Analysis

January 17, 2025

US rig counts fall to 2.5-year low, Canadian activity picks up

Written by Brett Linton

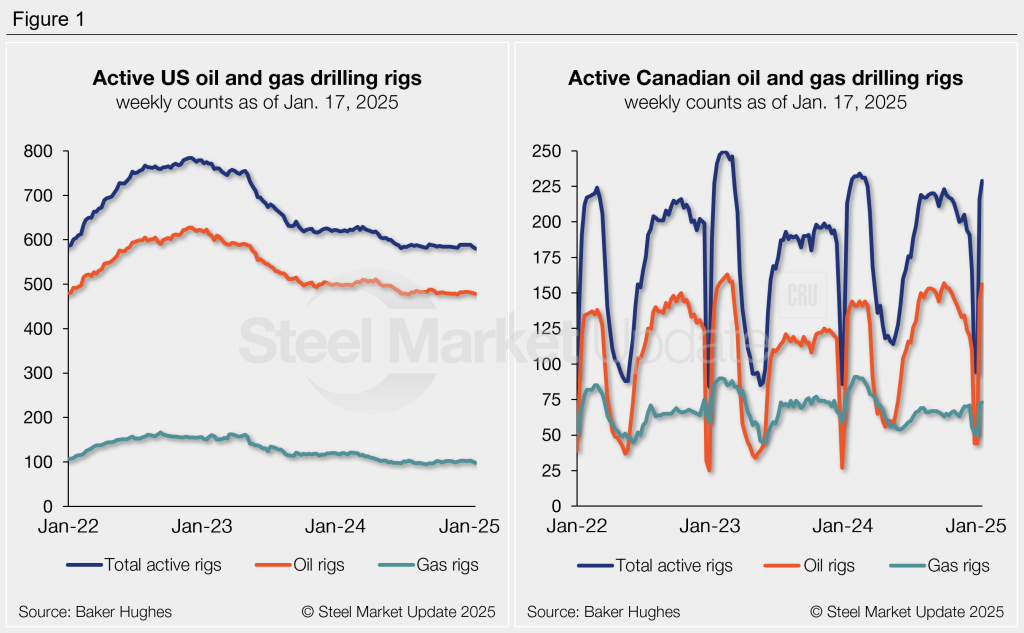

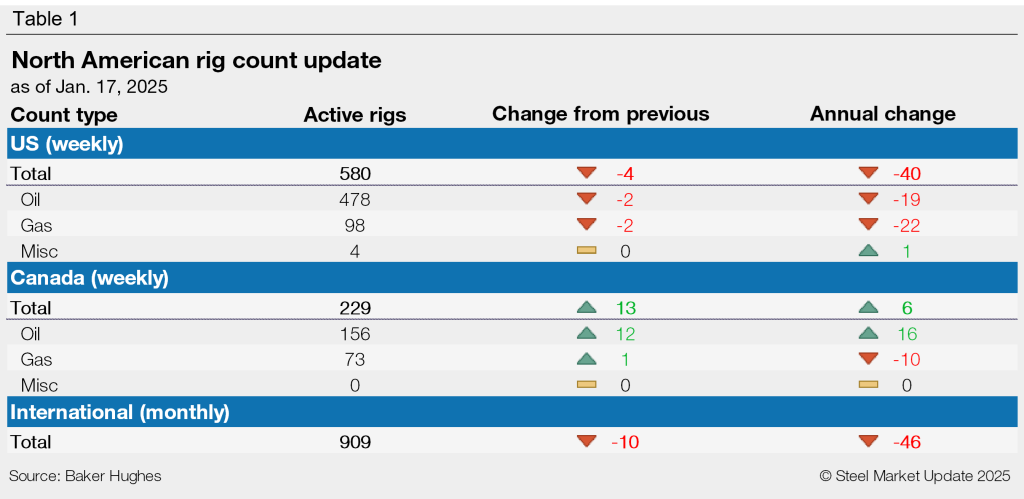

Active drilling rig activity in the US declined to a multi-year low this week, while Canadian counts marched higher, according to the latest data from Baker Hughes.

The latest US count of 580 rigs is the lowest weekly rate recorded since December 2021. US drilling activity has remained in this low ballpark since last June.

Canadian activity continues to rebound following the seasonal downturn seen at the turn of the calendar year. Canadian counts typically strengthen through February, then decline as warmer weather approaches and thawing ground conditions limit access to roads and drill sites.

The international rig count (updated monthly rather than weekly) decreased to 909 in December. This is 10 rigs fewer than the November count and 46 fewer than the same month one year prior.

The Baker Hughes rig count is important to the steel industry because it is a leading indicator of demand for oil country tubular goods (OCTG), a key end market for steel sheet. A rotary rig rotates the drill pipe from the surface to either drill a new well or sidetrack an existing one.

For a history of the US and Canadian rig counts, visit the rig count page on our website.