Analysis

January 14, 2025

Shipments of HVAC equipment slip through November

Written by Brett Linton

Monthly shipments of heating and cooling equipment decreased from October to November, according to the latest data released from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI).

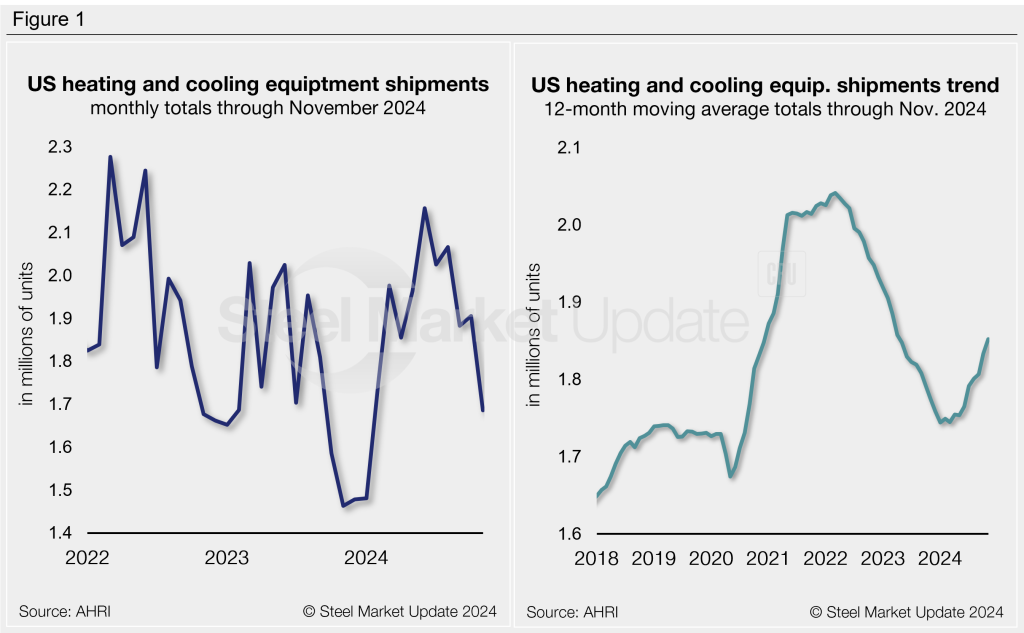

November shipments fell 12% month on month (m/m) to 1.69 million units (Figure 1, left). This follows typical seasonal declines, as the monthly decrease from October to November has averaged -11% over the last six years.

While lower, November 2024 shipments were the second-highest for any November in our 16-year history, just below November 2021’s 1.78 million units.

Trends

To smooth out seasonal fluctuations, monthly shipment data can be recalculated on a 12-month moving average (12MMA) basis to better highlight trends. On this annualized basis, total shipments have trended upward since the start of 2024. The 12MMA through November has risen to a 19-month high of 1.85 million units (Figure 1, right). This surge follows a significant decline occurring from mid-2022 to the end of 2023, which followed the post-Covid surge.

Shipments by product

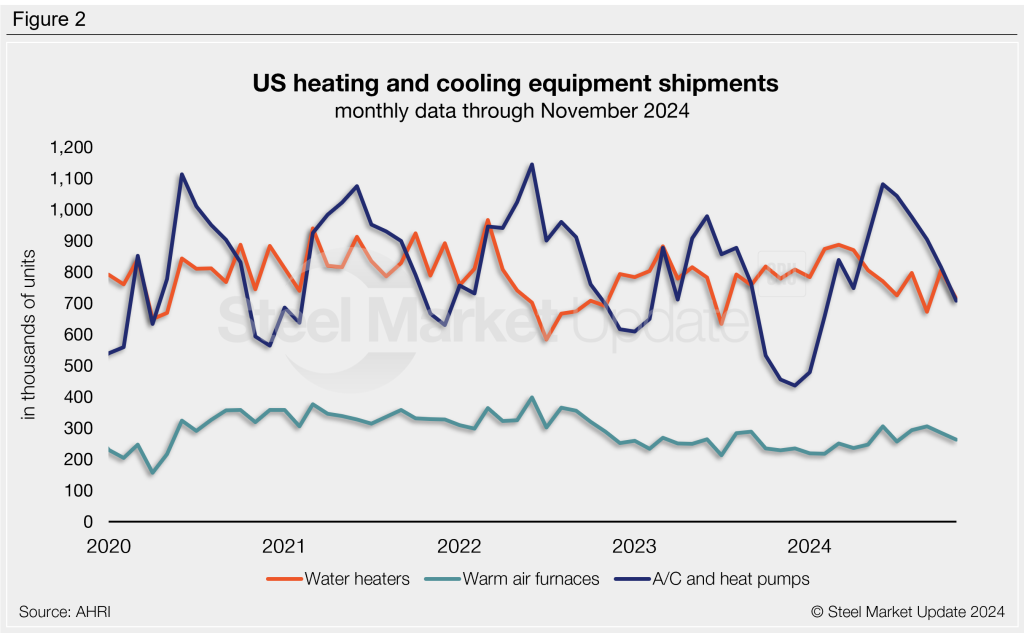

- Water heaters: Shipments decreased 11% month over month (m/m) in November to 715,000 units, 8% lower than levels seen one year prior. Recall the two-year high of 887,000 units recorded back in March.

- Warm air furnaces: Following September’s 23-month high, shipments declined again in November, falling 8% m/m to 285,000 units. Compared to the same month last year, November shipments were 15% higher this year.

- Air conditioners and heat pumps: Shipments fell in November for the fifth consecutive month, down 13% m/m to 707,000 units. While down, shipments were 55% higher than the same month last year. Note that air conditioner/heat pump shipments are very seasonal, with slowdowns experienced throughout the winter months as evident in Figure 2.

The full press release of this data is available here on the AHRI website.

An interactive history of heating and cooling equipment shipment data is available here on our website. If you need assistance logging in to or navigating the website, please contact us at info@steelmarketupdate.com.