Analysis

December 20, 2024

Steady architecture billings signal improving conditions

Written by Brett Linton

Architecture firms reported a slight reduction in billings through November but were essentially flat from October, according to the latest Architecture Billings Index (ABI) released by the American Institute of Architects (AIA) and Deltek.

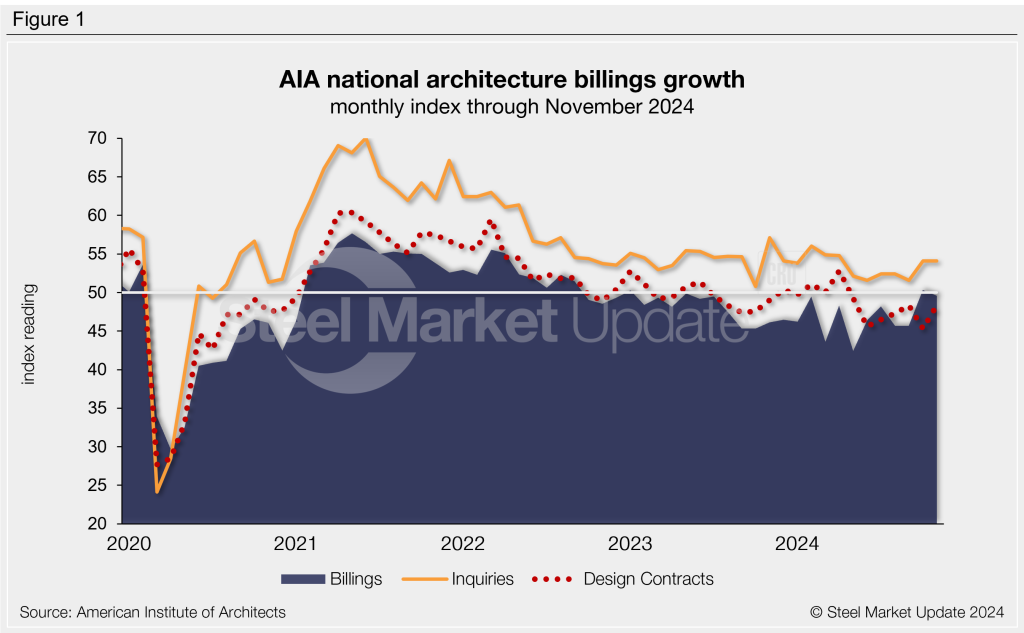

The November ABI decreased 0.7 points month over month (m/m) to 49.6, the third-highest reading in the past two years (Figure 1). Note that, prior to October, the index indicated declining business conditions for 20 consecutive months.

The AIA/Deltek report explained that the index “remains close enough to that [50] threshold to indicate that the share of firms that reported declining billings was essentially the same as the share that reported increasing billings.” It noted that, while the past two months have been steady, it was encouraging to see business conditions improving following such a long period of decline.

“Given the extended weakness in business conditions at architecture firms, increasing firm profitability remains the top concern for 2025, with one-third of firm leaders selecting it as a major issue – the highest since 2017,” said AIA Chief Economist Kermit Baker.

The ABI is a leading indicator for near-term nonresidential construction activity. It is said to project business conditions approximately 9-12 months into the future (the typical lead time between architecture billings and construction spending). Any index reading above 50 indicates an increase in architecture billings, while a score below that indicates a decrease.

Participant comments

- “Things seem to be staying in a positive direction, but no significant changes in conditions.” – 74-person firm in the Midwest, institutional specialization

- “New multifamily residential and mixed-use projects are increasing, but our hospitality work is still slow.” – 12-person firm in the West, commercial/industrial specialization

- “Project starts and schedules have slipped in the last two months of 2024, but projections for 2025 remain very strong.” – 17-person firm in the South, mixed specialization

- “Lots of renovation projects ahead in our market.” – 26-person firm in the Northeast, institutional specialization

Sub-indices

The new project inquiries index remained optimistic in November, unchanged m/m at 54.1. The design contracts index recovered three points from October’s four-plus-year low to 48.3 but remains weak for the seventh month in a row.

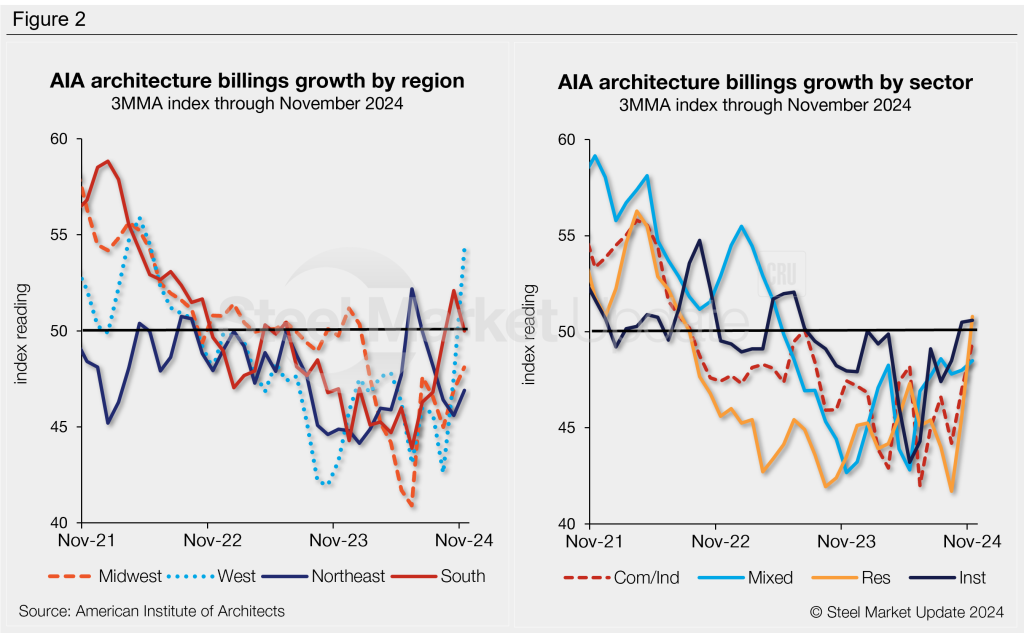

Three of the four regional indices improved from October to November, though only two indices are at or above the 50 threshold (Figure 2, left). The Western and Southern regions indicated an increase in billings, while the Midwestern and Northeastern indices continue to signal declines.

Each of the sub-sector indices improved from October to November, but only the institutional and multifamily residential indices showed improving billings (Figure 2, right). The commercial/industrial and mixed practice indices remained in contraction territory.

An interactive history of the November Architecture Billings Index is available here on our website.