Sheet

December 8, 2024

Final Thoughts

Written by David Schollaert

As my colleague Ethan Bernard noted in our most recent Final Thoughts, I don’t think many of us thought uncertainty would be mounting four weeks out from 2025. If anything, the general theme post-Steel Summit and into Q4 was that election night would be the turning point. And whatever had been keeping the steel market from building would finally get the jump-start it needed.

While that hasn’t happened, and uncertainty continues, many are quite optimistic about a second Trump term.

Business when the clock strikes 2025

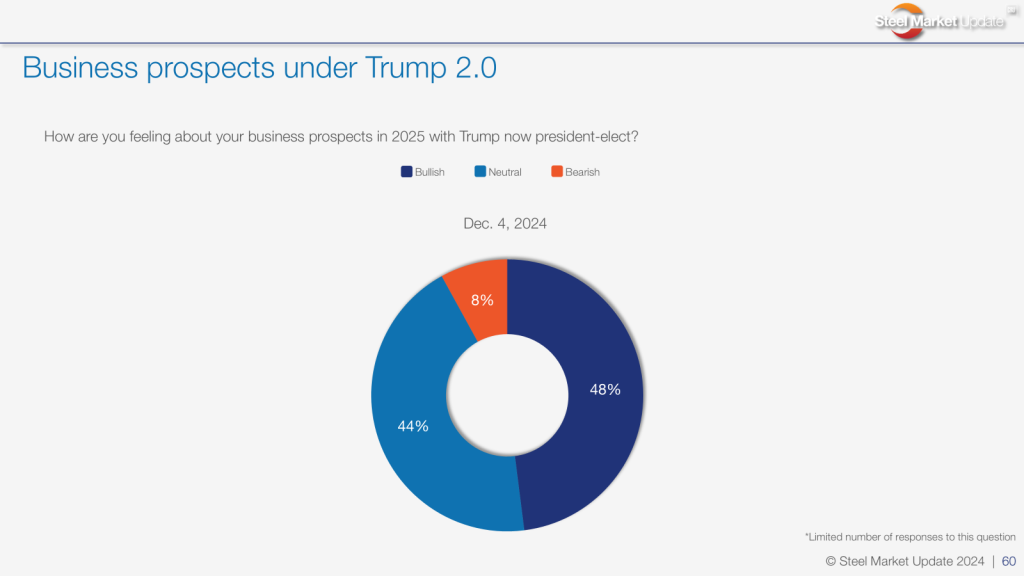

In our most recent survey, we asked respondents how they felt about their business prospects in 2025 under Trump 2.0. Nearly half of the surveyed respondents are bullish on what another Trump presidency might mean for their business. Still, just under 10% are less than thrilled about what next year will bring under the president-elect.

And where’s what some of you had to say about it:

“During 2016-19 we did very well, hope he repeats the same.”

“Business-friendly and pro-growth policies.”

“I think the America First agenda will kick things into high gear.”

“I don’t care for the man, but he is good for our industry.”

“He will have a plan to improve production in the USA.”

“Somewhere between neutral and bullish.”

But it wasn’t all roses.

“Terrible for world stability and democracy.”

“I believe his policies will be harmful to manufacturing mid- to longer-term.”

“Crazy things will happen.”

And not surprising, some of the anxiety is tied to uncertainty around tariffs.

“Tariffs on foreign steel and products may/should encourage domestic steel and product production.”

“Tariffs are not good for demand. They only help a small amount of businesses. The global economy is in for tough times the next few years.”

“Will be interested to see how tariffs will impact demand.”

“Tariff effects.”

“Tariffs will have both a good and negative impact on the market. It will create some artificial increases but restrict supply.”

“Tariffs could hurt the economy based on threats from the new administration.”

And as intriguing as that is, here are some other notable results from this week’s survey.

Demand still hanging back

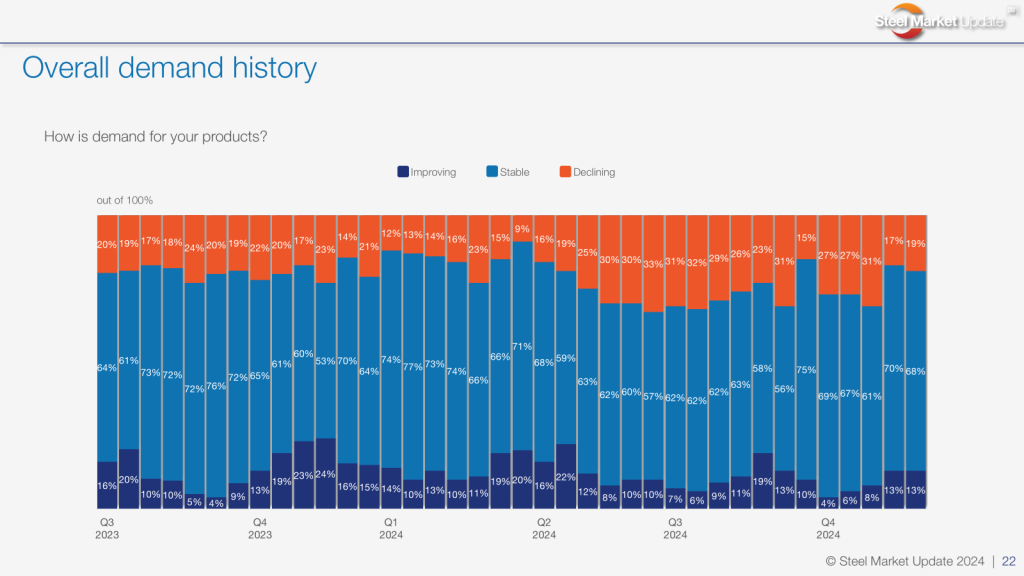

From our latest survey results, 19% of respondents still note that demand is declining, though 68% continue to say that demand is stable, and 13% are seeing demand on the rise. But is this relative stability a result of a calm market during the holidays with better demand on the horizon, or is it more of the same – slow but steady?

Here’s what some of you had to say:

“Very weak to non-existent.”

“Consumers hesitant to buy our steel systems owing to high interest rates for the overall finished project.”

“A few big sales have really boosted demand, otherwise it’s very quiet.”

“Down year over year.”

“Seasonality declines – we feel good about 2025.”

But that’s not all, there are still a few more sticking points.

Forecasts are still problematic for many

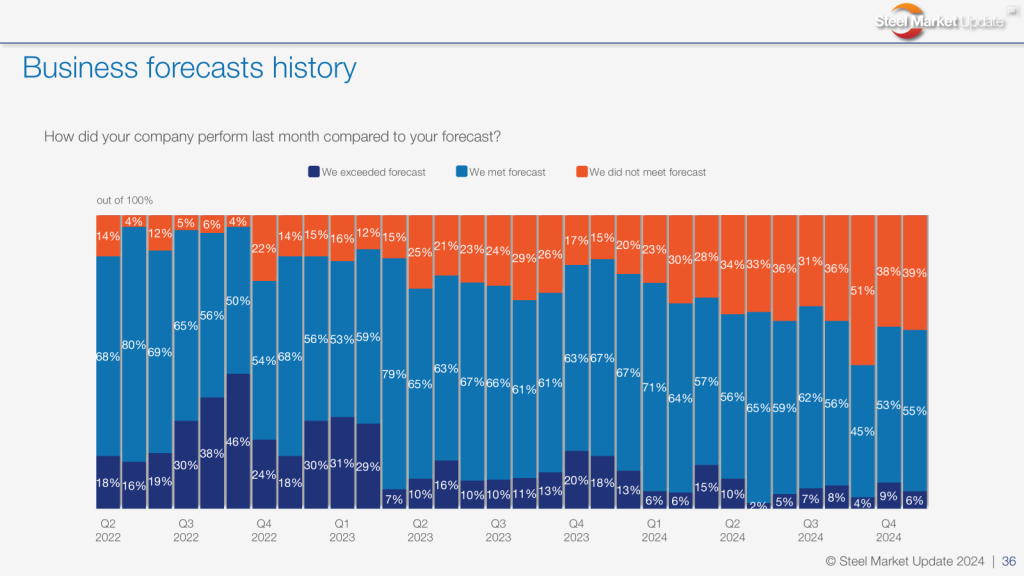

More than one-third of respondents didn’t meet forecast in November, a trend we’ve seen since the beginning of Q2. But still, more than half of the respondents met forecast last month.

“No one is buying much of anything these days.”

“Have remained conservative.”

“Demand remains softer than anticipated.”

“Didn’t have great expectations.”

“Demand is too soft.”

“For the first time in literally forever, we missed forecast in November. Very disappointing.”

“Slower but steady growth.”

“Very surprised we exceeded forecast in November – especially with short shipping month.”

Mills firm stance on price paying off?

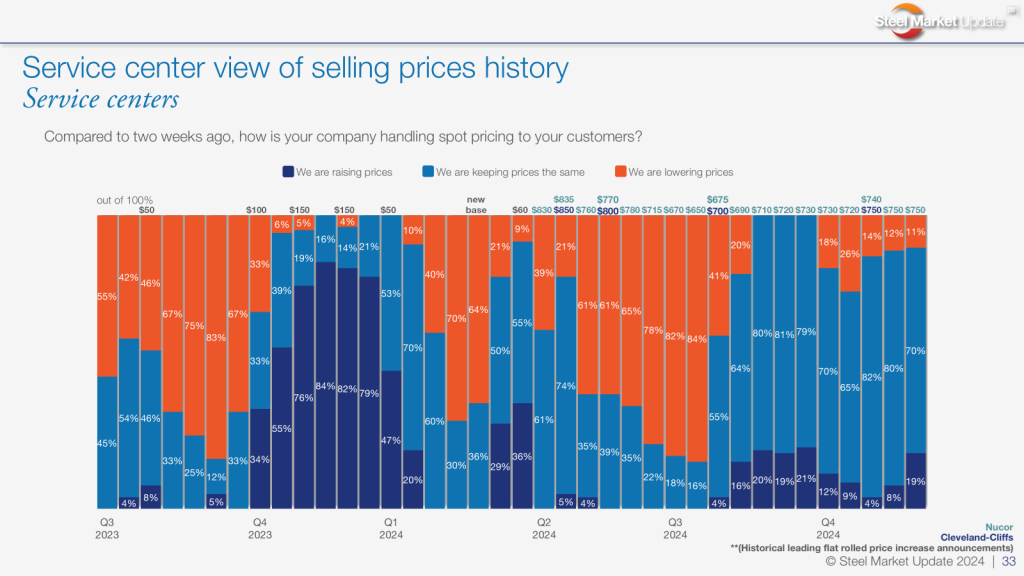

Surprisingly, mills haven’t been very successful in finding willing buyers at higher levels, but a recent shift was more service center survey respondents noting they are increasing prices. The move is interesting, given that negotiation rates went up – meaning mills willing to talk price increased in our latest survey. Could the shift be an anticipation of what’s ahead in 2025?

But keep in mind, according to our data, mills have not been able to yield their “pricing power” since midway through Q3. But could the recent mill pricing stability – holding flat at $750 per short ton (st) over the past four weeks – be paying off?

Buying patterns remain cautious

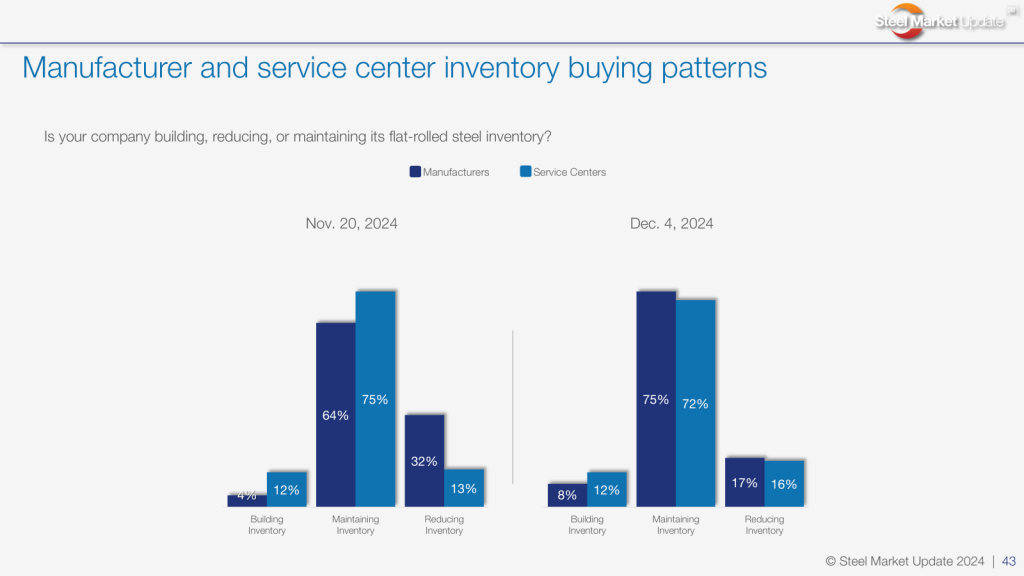

The common thread between service center and manufacturer (OEM) buying, is that most are strictly focused on maintaining inventories, to the tune of 72% to 75%. What stands out, though, is that manufacturers remain less interested in building inventory.

That’s just some of the interesting data in our latest survey results, so do ensure you look through them all. In the meantime, there is still time for some twists and turns as we say goodbye to 2024. But don’t worry… we’ll be sure to report exactly what steel buyers are seeing.

Tampa Steel Conference

Registrations are pouring in for the 36th annual edition of Tampa Steel Conference. The timing of the event is a great opportunity to get a true health check of the steel industry as the new year gets underway. Trump will be inaugurated on Jan. 20. And we’ll be gathering for in Tampa just two weeks later on Feb. 2.

The agenda will deliver six fireside chats and 20-plus expert speakers addressing critical industry topics, including Trump, trade, and tariffs. You can learn more about the event and register here.

Steel 101 Workshop

Since 2025 will be here before we know it, I’d be remiss if I didn’t also draw your attention to our next Steel 101 workshop set for Spring 2025 in Charleston, S.C.

We will once again converge on Hyatt Place Mount Pleasant Towne Centre, with the date set for March 11-12, 2025. The workshop includes a guided mill tour of Nucor Steel Berkeley. You can get more info and register here.

As always, all of us here at Steel Market Update truly appreciate your business.