Market Data

November 21, 2024

SMU Survey: Mill lead times remain stable and short

Written by Brett Linton

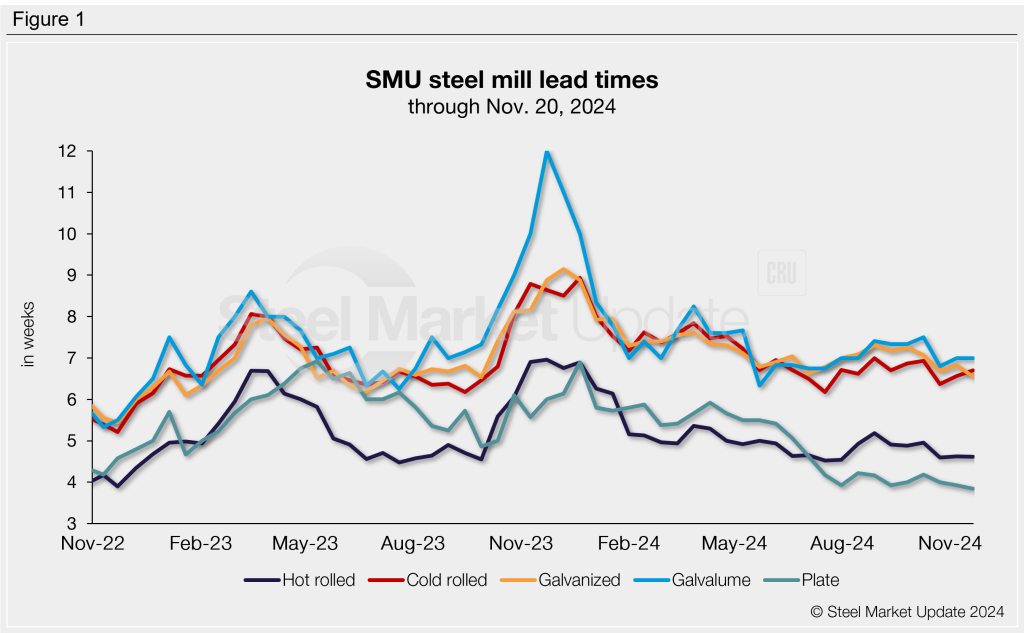

Steel buyers participating in our market survey this week reported stable mill lead times for both sheet and plate steel products. Production times are similar to those around the start of the month, though slightly shorter than levels witnessed three months ago.

Average lead times for hot-rolled steel generally remain in the mid-four-week range. Tandem product lead times are hovering around six and a half to seven weeks. Plate lead times average just under four weeks. Overall, lead times remain near some of the shortest levels seen this year.

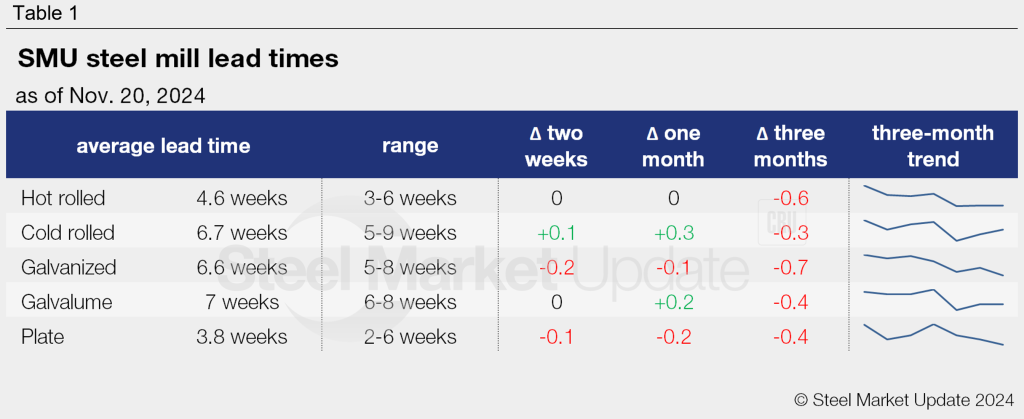

Table 1 below summarizes current lead times and recent trends.

From our last market check two weeks ago, the lead time range changed for one of our products: The top end of cold rolled’s lead time range rose from eight to nine weeks.

Figure 1 tracks lead times for each product over the past two years.

Survey results

Over half of the buyers we polled this week believe lead times will be flat two months from now (54%), with almost as many anticipating that production times will extend (44%). This has been the general consensus in most of our recent surveys. The number believing lead times will pull back further continues to dwindle.

We also asked buyers to assess the current state of mill production times. The majority continue to report that lead times are shorter than normal, while just over a third said they are within typical levels. A small portion of respondents think lead times today are slightly longer than usual.

Here’s what respondents are saying:

“Waaaayyyy too much mill capacity. Folks are talking about it, but not as much as they should be – especially with this poor of demand. That is a bad combo, even for The Donald.”

“Demand could be up, so lead times should extend.

“Lead times will extend slightly as the economy goes up after Trump takes office.”

“We are predicting both stable demand and lead times in the next two months.”

“Lead times are at a recent history low and with the mill adjustments in play, some modest extensions could be expected.”

“I don’t see lead times impacting steel prices anytime soon.”

“As prices rise, there will be a run on mill buys, which will push lead times. Also, we will see less foreign steel imported.”

“Q1 will pick up activity in plate.”

3MMA lead times

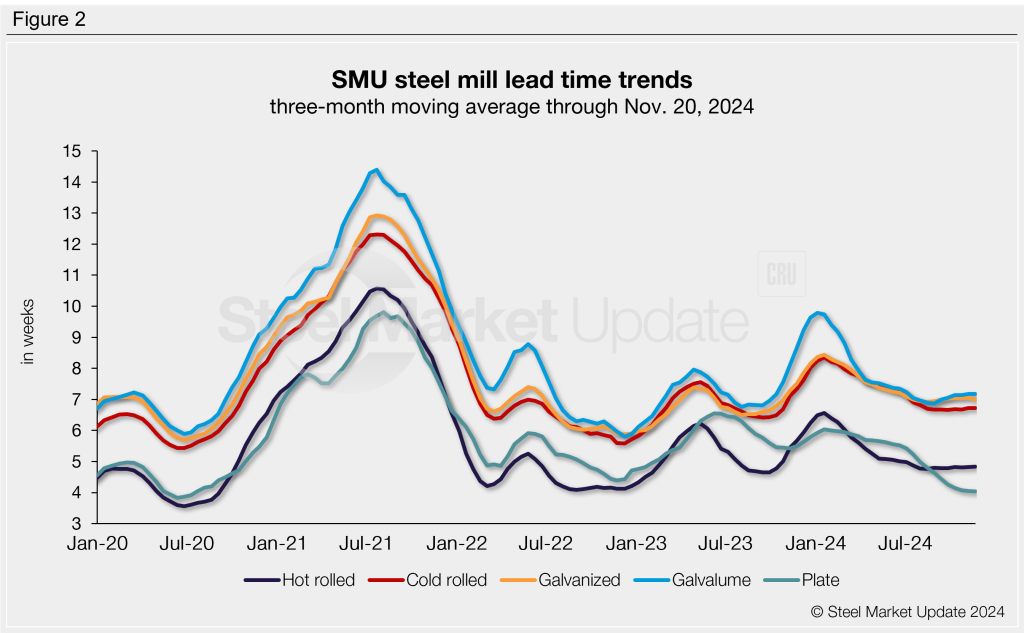

To better capture trends and smooth out variability in our biweekly data, we present lead time data on a three-month moving average (3MMA) basis. As of this week, 3MMA lead times on both sheet and plate have only changed slightly since early November. Overall, 3MMA lead times have been trending downward since the start of the year, leveling out in recent months near one-year lows.

The hot rolled 3MMA is now at 4.84 weeks, cold rolled at 6.72 weeks, galvanized at 6.99 weeks, Galvalume at 7.17 weeks, and plate at 4.03 weeks.

Figure 2 highlights lead time movements since the start of 2020.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.