Market Data

November 21, 2024

Architecture billings flat in October after months of contraction

Written by Brett Linton

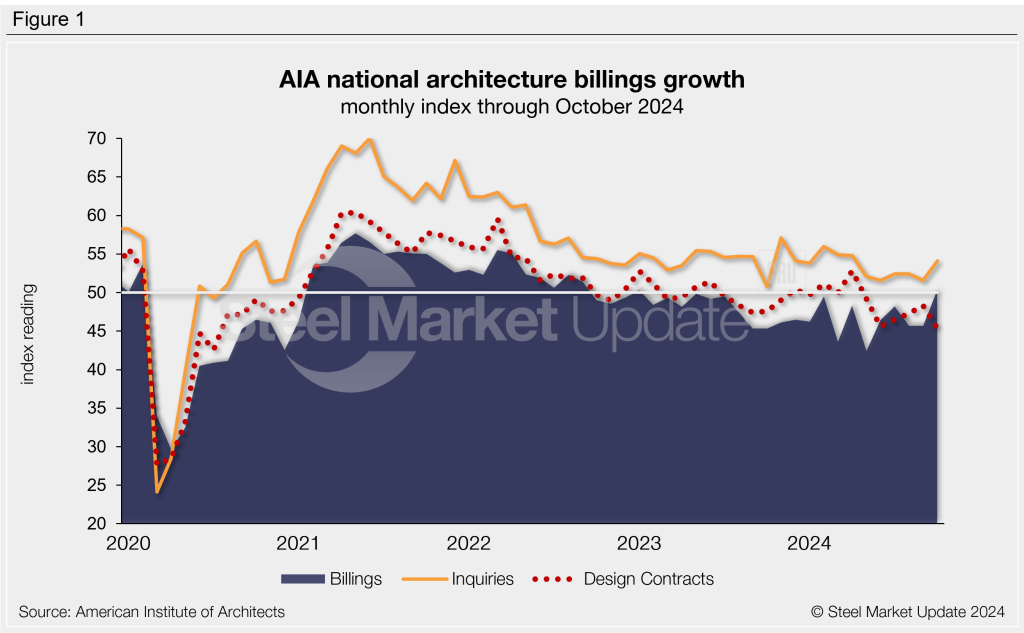

Architecture firms reported stable billings in October, according to the latest Architecture Billings Index (ABI) released by the American Institute of Architects (AIA) and Deltek. This follows 20 months of contracting business conditions.

The October ABI increased 4.6 points from September to 50.3, now tied with January 2023 for the highest measure seen in the last two years (Figure 1). It was this same month two years prior when architecture billings began to soften, slipping to 49.0 in October 2022 following 20 months of growth.

The ABI is a leading indicator for near-term nonresidential construction activity. It is said to project business conditions approximately 9-12 months in the future (the typical lead time between architecture billings and construction spending). Any index reading above 50 indicates an increase in architecture billings, while a score below that indicates a decrease.

AIA/Deltek highlights

“Billings finally stabilized this month, and firms are feeling more optimistic about revenue projections for 2025,” said AIA chief economist Kermit Baker. He commented that almost half of responding firms expect their net revenue to grow from 2024-25, with about a third expecting 5-9% annual growth rates.

The latest release remarked that “despite declining interest rates and softening inflation, clients remain hesitant to start new projects.” It noted that many clients are waiting to see how the election outcomes impact them before making major business decisions.

Participant comments

- “There is still a lot of ‘wait and see,’ but there is a lot more positive conversation than negative, and we feel poised to have a strong 2025.” — 45-person firm in the South, commercial/industrial specialization

- “Bonds for affordable housing have not been passing, so there’s a lot of concern about the viability of nonprofit housing developers remaining in business due to lack of funding for projects.” —12-person firm in the West, residential specialization

- “Business is generally good, but projects are very slow to start after award.” — 48-person firm in the Northeast, institutional specialization

- “We had one large project stall, but we have multiple new potential projects.” —15-person firm in the Midwest, commercial/industrial specialization

Sub-indices

The index for new project inquiries remained optimistic in October at a six-month high of 54.1. The design contracts index remained weak for the sixth month in a row, slipping to a four-plus-year low of 45.3.

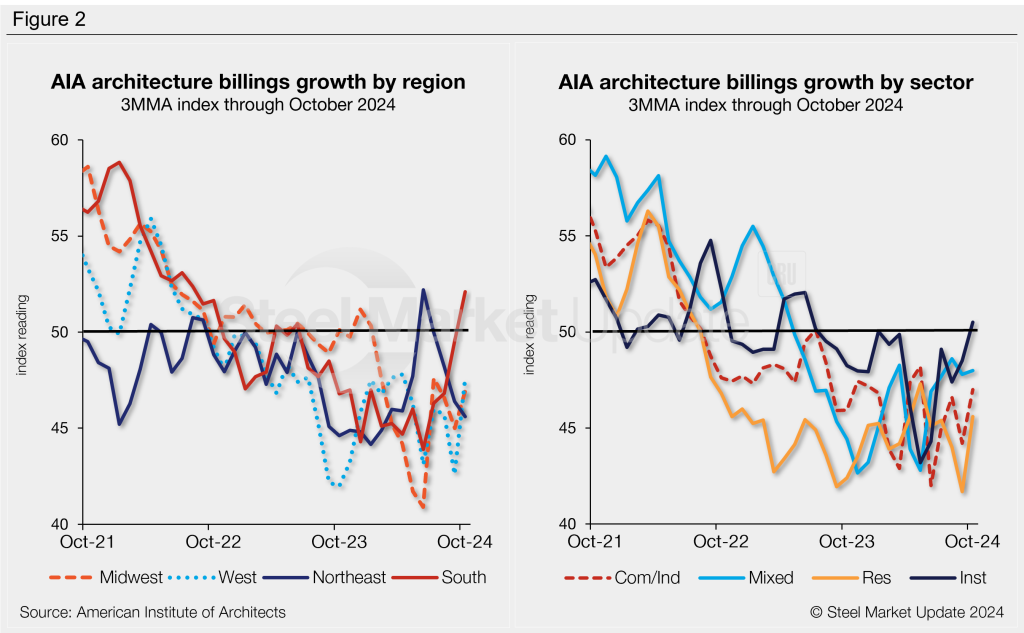

Three of the four regional indices indicated declining billings in October (Figure 2, left). The Southern region was the only regional index to indicate an increase in billings, rising to a two-year high. The Midwestern and Western indices each inched higher from September, while the Northeastern region declined further.

Each of the sub-sector indices improved from September to October, but only the institutional index improved enough to indicate an increase in billings (Figure 2, right). The commercial/industrial, multifamily residential, and mixed practice indices all remain in contraction territory, with residential being the most dismal.

An interactive history of the October Architecture Billings Index is available here on our website.