Prices

November 7, 2024

HR Futures: Which way following election?

Written by Daniel Doderer & John Medich

Since June, The US hot-rolled coil (HRC) futures market has been in a rare period of prolonged price stability, closely mirroring the subdued volatility seen in the physical market. Over the past five months, futures have been rangebound, with prices oscillating between a floor near $680 and a ceiling around $800. This tight range, highlighted in the chart, underscores a cautious market environment. The chart below shows the rolling 3rd month CME HRC Future.

This behavior reflects trader psychology and broader market uncertainty. While spot prices have shown a steady recovery from lows earlier in the year, futures have yet to commit to a definitive direction. Over the above period, there has been a reluctance to sell below $700. Still, $800 has also proved a tough barrier, and the “middle of the curve” was sold down to around $700 less than a month ago on Oct. 18. This pattern is now likely going to be tested in the coming weeks as the January Future (currently the 3rd Month) sits just below that recent level of resistance.

For months, market observers have been pointing to election uncertainty as a primary headwind. Following the resolution of the US election, HRC futures have been slower to react compared to other markets. However, as of midday on Nov. 7, there has been a noticeable uptick in buying activity. This could indicate nervous shorts covering their positions, consumers locking in prices for 2025, or speculative longs positioning themselves for potential seasonal gains… probably some of all the above.

Shifts in Open Interest: Does the plumbing show signs of a market transition?

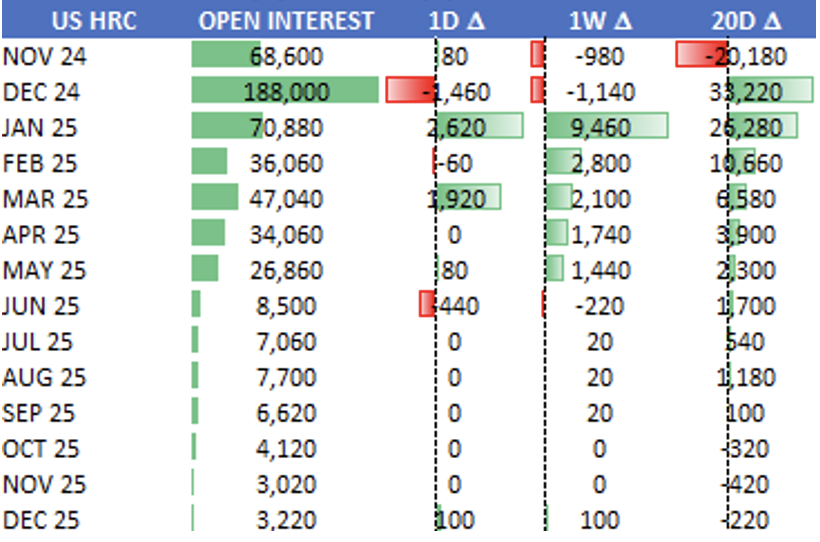

Another factor of note is how trading activity over the past few months, has been heavily concentrated in the December 2024 contract, which still accounts for approximately 37% of total open interest. While off its recent highs, December’s dominance reflects a focus on near-term hedging and speculation. However, the past few weeks have seen open interest begin to roll out of December and into the first half of 2025 contracts.

This shift has coincided with a widening spread between December 2024 and January 2025 contracts, pushing the curve into a steeper contango. The widening spread suggests market participants are increasingly pricing in weaker near-term fundamentals relative to an expected broad recovery in early 2025.

The bear case remains driven by persistent macroeconomic headwinds. Domestic demand is tepid, and while the Federal Reserve has begun cutting rates, the overall rate environment remains restrictive. Weakness in US and European manufacturing, combined with high steel output and lackluster demand in China, further dampens sentiment.

On the other hand, the bull case points to several supportive factors. Seasonal strength: robust Q4 price performance in eight out of the past 10 years, and strong raw material stocking ahead of winter. The ongoing trade cases on coated products could provide upward momentum. Additionally, election-driven optimism, including potential tariff changes, accelerated depreciation measures, border wall construction, and increasing energy infrastructure projects, adds to the bullish outlook.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Capital Markets should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.

Daniel Doderer

Read more from Daniel Doderer