Market Data

October 24, 2024

Architecture Billings Index remains dismal in September

Written by Brett Linton

Architecture firms continued to experience soft business conditions through September, according to the latest Architecture Billings Index (ABI) release by the American Institute of Architects (AIA) and Deltek.

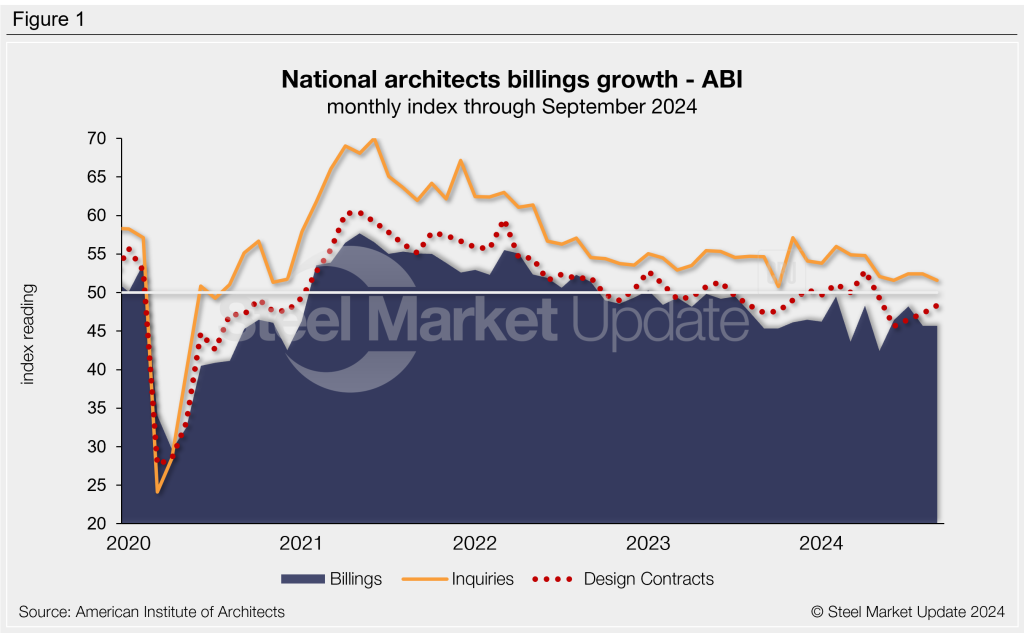

The September ABI held stable at 45.7, down 2.5 points from July and tied with August for the third-lowest level seen so far this year (Figure 1). The Index has shown contracting business conditions for 20 consecutive months. Last September, the index was in contraction at 45.3, whereas two years prior it was in expansion at 51.4.

The ABI is a leading economic indicator for near-term nonresidential construction activity. It is said to project business conditions approximately 9-12 months in the future, the typical lead time between architecture billings and construction spending. An index reading above 50 indicates an increase in architecture billings, while a reading below that indicates a decrease.

“Despite recent rate cuts by the Federal Reserve, many clients remain on the sidelines with regard to proceeding on planned projects,” AIA Chief Economist Kermit Baker said in a statement. “And while new project opportunities also emerge, clients are cautious about which to pursue.”

He noted that work backlogs remain above pre-pandemic levels, indicating that there is still active work in the pipeline.

As it has since mid-2020, the Project Inquiries Index remained in optimistic territory in September at 51.6. This index has trended lower after peaking late last year. The Design Contracts Index continues to recover from the June low but remains weak at 48.3.

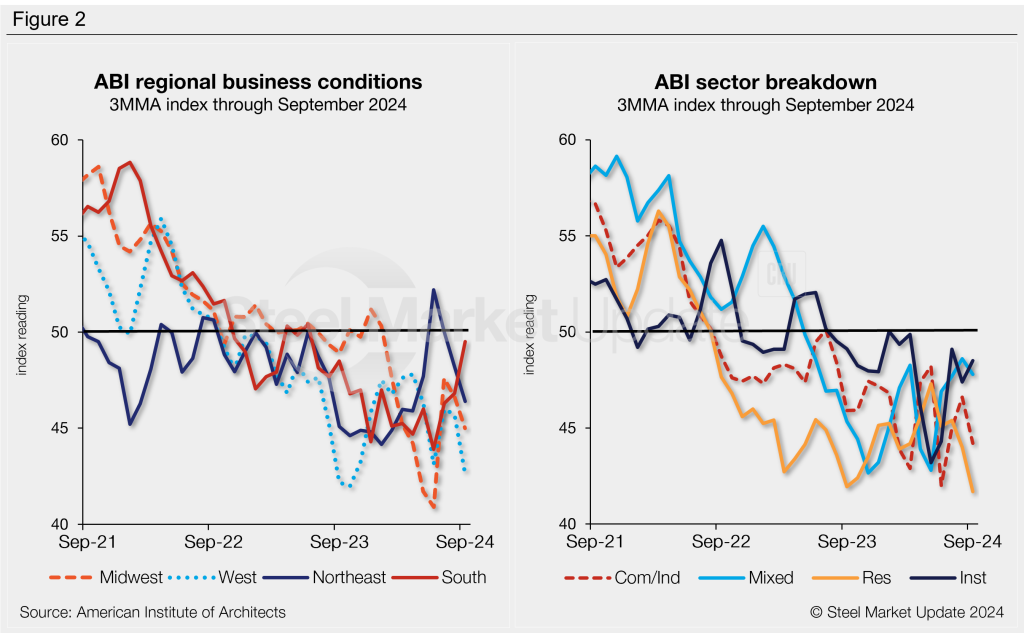

All four regional indices indicated declining billings in September (Figure 2, left). The Southern region was the only regional index to move higher from August to September, it’s third monthly increase. The Northeastern, Midwestern, and Western Indices all declined for the second consecutive month, with indices ranging from 42.6-46.4.

Each of the sub-sector indices also indicated continually declining billings in September (Figure 2, right). The Institutional Index saw slight growth compared to the month prior, while commercial/industrial, multifamily residential, and mixed practice indices all declined further.

An interactive history of the September Architecture Billings Index is available here on our website.