Analysis

October 13, 2024

Final Thoughts

Written by David Schollaert & Ethan Bernard

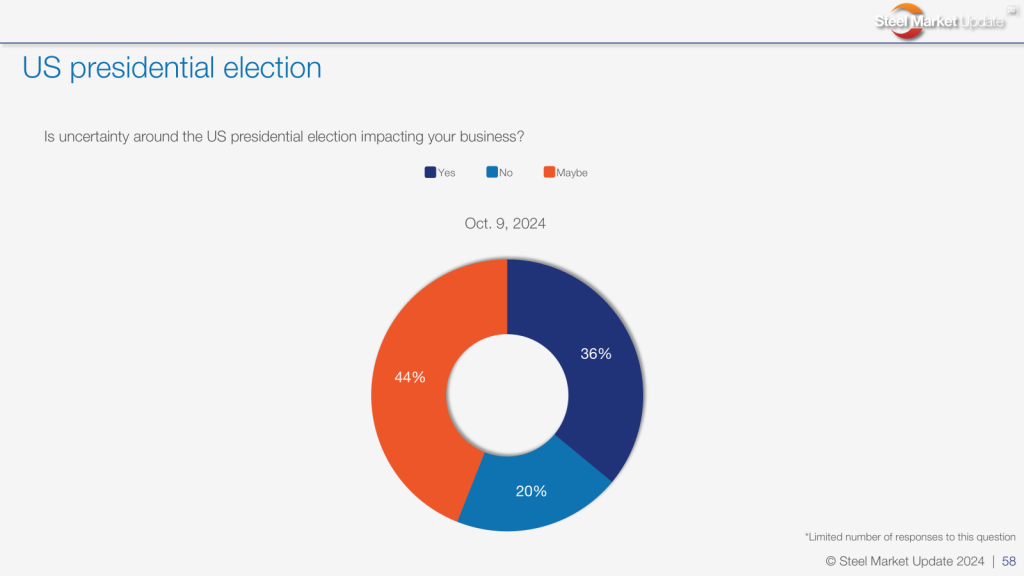

Everybody has an opinion about politics these days. More importantly for our readers, though, every business has a bottom line. A popular question in our most recent steel buyers survey asked how uncertainty around the upcoming US presidential election could affect that line.

It turns out that many of our survey respondents had opinions to share on that (see slide 58 below). I would characterize those responses, not so scientifically, as stretching from ‘Nah’ to ‘Heck, yes.’

Based on the number of comments we received, it’s a subject on most of our readers’ minds. One of our service center respondents even said this election is making buyers plain “dumb.” Of course, we couldn’t agree.

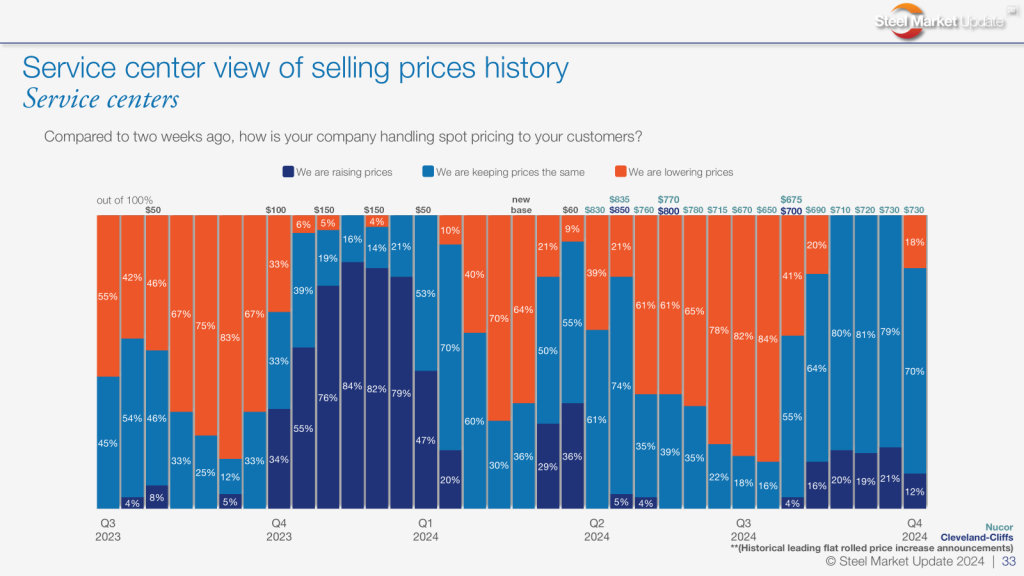

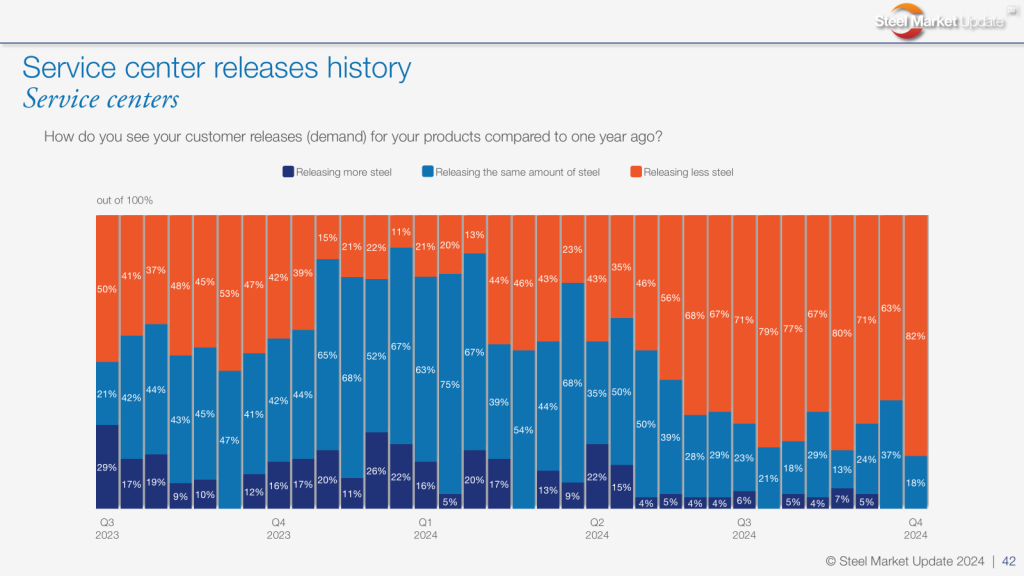

Turning to service centers, we see that 18% of service center respondents said they are lowering spot prices to customers (slide 33). That’s a new development. And on our service center releases history slide (slide 42), we see that 82% of respondents said that they are releasing less steel, up from 63% two weeks earlier. Lower prices and demand, will the trend continue?

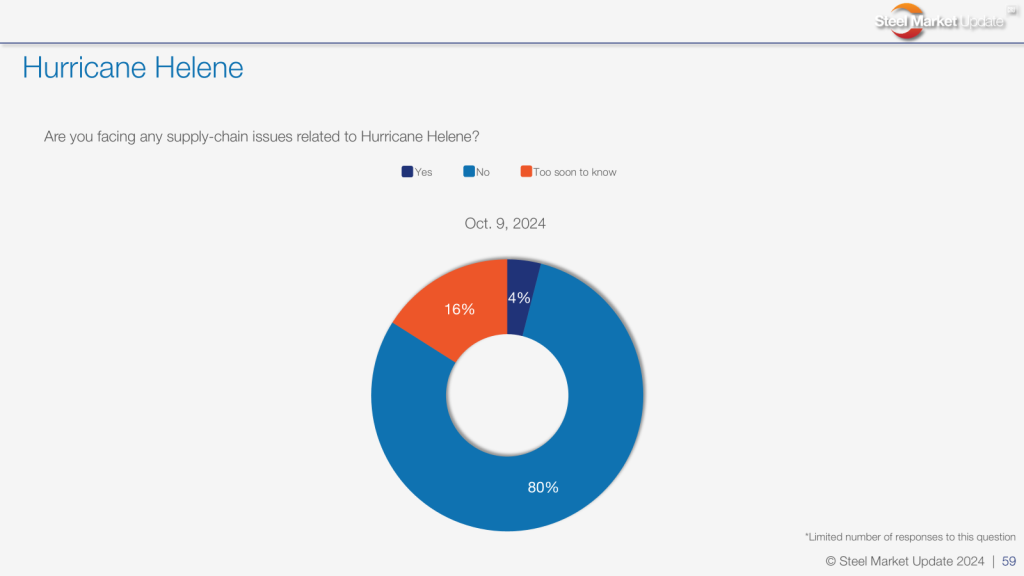

A less contentious subject than politics or prices is the weather. Well, the weather has been very much in the news as of late. We asked our survey participants if they were seeing any fallout to the supply chain from Hurricane Helene (slide 59). This was before Milton entered the picture. While the majority responded no, the comments give a more nuanced picture. Especially as hurricane season traditionally runs through Nov. 30, we hope we won’t have to add too many more weather questions to the mix.

So, for those of you in the business of perusing charts, crunching numbers, deciphering comments, and drawing conclusions, have at it. And if you’d like to share what you gleaned, feel free to tell us at info@steelmarketupdate.com. Below, you can find the survey slides with respondents’ comments below.

Slide 58: Is uncertainty around the US presidential election impacting your business? Why or why not?

“Our business is hooked to energy – we are either going to be ‘drill, baby, drill’ or green… .”

“Very much so. People are waiting, and each candidate has very different plans, and each could help spur business but in different ways.”

“Buyer hesitancy.”

“Indecision about the direction of the economy and spending.”

“People are still ordering and are planning for the future.”

“Money is held usually during these times so projects are put on hold.”

“Everyone is driving down their inventory and waiting; not even sure some buyers understand what they are waiting for.”

“‘Maybe’ to ‘No’ here. It won’t really impact our business, or steel pricing for that matter – short of a potential Section 232 2.0.”

“Much more affected by interest rates. Never bought into the presidential effect.”

Slide 33: Compared to two weeks ago, how is your company handling spot pricing to your customers?

“Mill prices are stable, but buyers assume because their business is soft, prices should be sliding, not the case.”

“Lowering when and where needed.”

“We are adjusting according to the inquiry.”

Slide 42: How do you see your customer releases (demand) for your products compared to one year ago?

“We still have some strong markets in construction.”

“We typically see a slowdown headed into the holidays. But this year, with the election, buyers are just dumb.”

Slide 59: Are you facing any supply-chain issues related to Hurricane Helene? (And if yes, how so?)

“The hurricane(s) are absolutely likely to have ripple effects across various industries, potentially leading to shortages, increased prices, and longer lead times for affected products and materials. The full extent of the impact may take time to fully manifest as businesses and communities work to recover from the hurricane’s devastation.”

“We aren’t. I had some concerns about a double whammy with that and the work stoppage at the ports, but that never truly materialized. All good.”

“While there may be knock-on effects, fortunately our supply base is not in the directly affected areas.”

“Transportation is an issue and will be around for a while during these events.”

Stay safe out there, and, as always, thank you for your continued interest in Steel Market Update.

David Schollaert

Read more from David Schollaert