Market Data

October 8, 2024

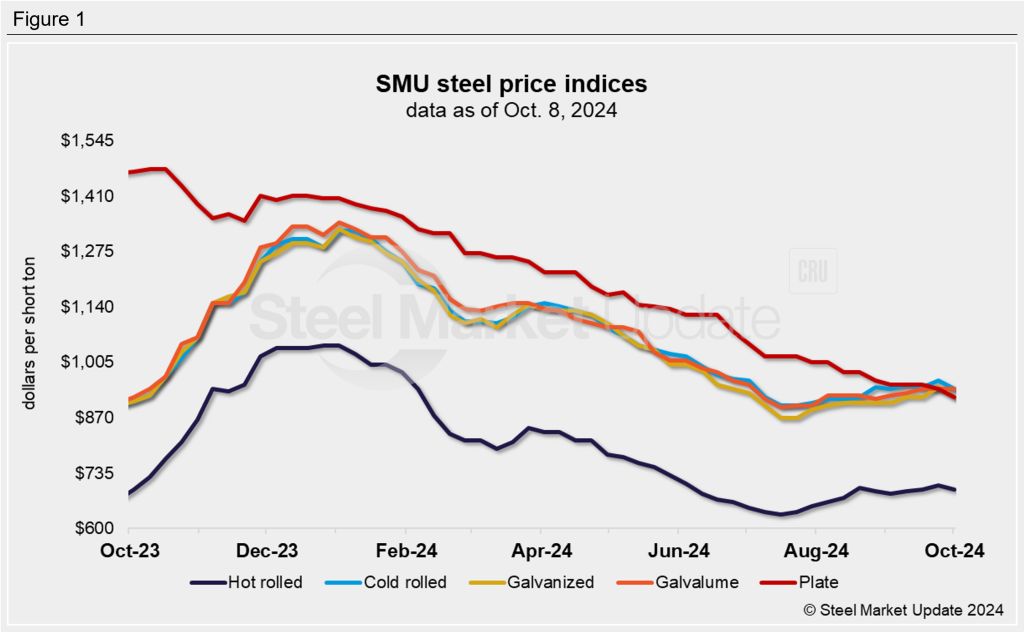

SMU price ranges: Sheet slips, plate falls to 45-month low

Written by Laura Miller & Michael Cowden

Steel sheet and plate prices moved lower this week as efforts by some mills to hold the line on tags ran up against continued concerns about demand.

SMU’s hot-rolled coil price now stands at $695 per short ton (st) on average. That’s down $10 from last week but still within the narrow range of average prices ($685-705 st) we’ve seen since late August, according to SMU’s interactive pricing tool.

How did we arrive at that number?

Certain larger mills are trying to stick to numbers around Nucor’s published price of $730/st. And some of those mills sport lead times into mid-November or even early December once you factor in Thanksgiving, market participants said.

But some smaller mills, as well as certain northern mills, remain willing to sell in the mid/high $600s/st given a more competitive market. And certain larger buyers speculated that they could get prices in the low $600s/st should they return to the market.

It was a similar story across cold-rolled (CR) and coated products. SMU’s CR price fell $20/st to $940/st on average. Galvanized base prices dropped $25/st to $920/st on average. And Galvalume prices were unchanged at $940/st.

Despite the week-over-week declines in CR and galv, both remained within the $900-960/st range they’ve been in since mid-August.

Market sentiment was decidedly weaker on plate, where SMU’s average price fell $20/st to $920/st on average. We haven’t seen plate prices that low since early January 2021. And several buyer sources said major plate mills were selling well below $900/st despite list prices as high as $1,075/st.

SMU’s price momentum indicator remains neutral for sheet products until a clear trend emerges. And our plate momentum indicator continues to point lower.

Hot-rolled coil

The SMU price range is $660-730/st, averaging $695/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is unchanged. Our overall average is down $10/st. Our price momentum indicator for hot-rolled steel remains at neutral until the market establishes a clear direction.

Hot rolled lead times range from 3-6 weeks, averaging 4.9 weeks as of our Sept. 25 market survey. We will update lead times this Thursday.

Cold-rolled coil

The SMU price range is $900–980/st, averaging $940/st FOB mill, east of the Rockies. The low and high ends of our range are both down by $20/st w/w, as is our overall average. Our price momentum indicator for cold-rolled steel will remain at neutral until the market establishes a clear direction.

Cold rolled lead times range from 5-9 weeks, averaging 6.9 weeks through our Sept. 25 survey.

Galvanized coil

The SMU price range is $880–960/st, averaging $920/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, and the top end is down $30/st. Our overall average is down $25/st from last week. Our price momentum indicator for galvanized steel remains at neutral until the market establishes a clear direction.

Galvanized .060” G90 benchmark: SMU price range is $977–1,057/st, averaging $1,017/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-9 weeks, averaging 7.3 weeks through our last survey.

Galvalume coil

The SMU price range is unchanged for a third week at $900–980/st, averaging $940/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,194–1,274/st, averaging $1,234/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-9 weeks, averaging 7.3 weeks through our latest survey.

Plate

The SMU price range is $860–980/st, averaging $920/st FOB mill. The lower end of our range is down $40/st w/w, while the top end is unchanged. Our overall average is down $20/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 4.0 weeks through our latest survey. Look for updated lead times on Thursday.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Laura Miller

Read more from Laura Miller