Analysis

September 26, 2024

Final thoughts

Written by Michael Cowden

Thanks to everyone who attended our Steel Hedging 101 workshop in Chicago on Wednesday. I learned a lot from StoneX Group’s Spencer Johnson, who instructs the course, and from your good questions.

One thing that Spencer said sticks with me as I write this column. Namely, that momentum drives steel prices more than other commodity markets. If you watch steel futures, you’ll see up days and down days. But it’s rare to see the momentum shifting back and forth within any given day.

And yet despite that history of volatility in the US, we’ve had a period of remarkable stability over the last 2-3 months when it comes to both prices and lead times. We saw hot-rolled (HR) coil prices climb from as low as $600 per short ton (st) in July to $700/st by the end of August. Over the last month, prices have hovered around $700 per short ton, give or take a few bucks.

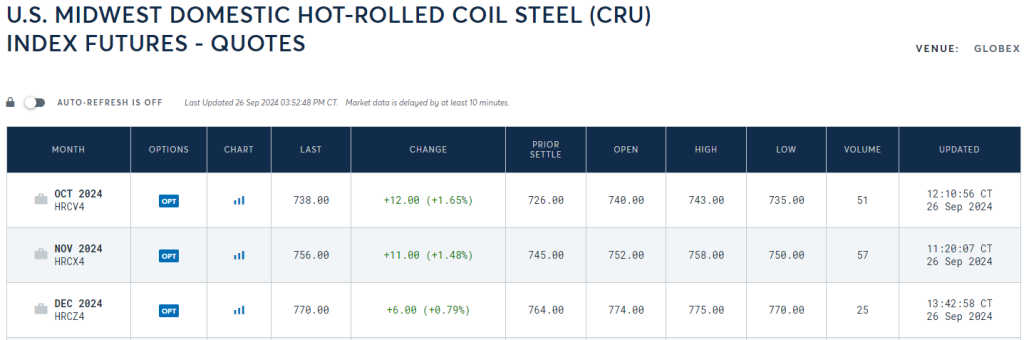

And yet in exchanges with some of you lately, there is less consensus than I’d expected on whether it’s an up day or a down day. There seems to be a sense that prices should go up based on current events. That appeared to be reflected in futures markets on Thursday:

Yet some of you in the physical market don’t see the same bullishness. You remain skeptical that numbers can hold in the $700s/st for HR and in the $900s/st for coated (base).

Trade issues to power another move up?

As I’ve noted before, I could see prices moving upward from here. US mills have been trying to nudge them in that direction. Those efforts could gain steam now that the Commerce Department has officially initiated a sweeping trade case against imports of coated sheet from 10 nations.

The impact of that case is already being felt. I’m told that some customers are canceling, or trying to cancel, material from Vietnam. Some are also attempting to shift orders to established mills in areas seen as lower risk (e.g., Taiwan) or are not targeted by the case (e.g., South Korea and Japan). I’m also told some companies are seeking out potential alternative suppliers in places perhaps less familiar to US buyers – Indonesia and Pakistan, for example.

I’ve been around long enough to remember when China was knocked out of the coated market. That happened during a round of trade cases in 2015-16. In the ensuing years, Vietnam helped fill the void left by China. Do any of the nations mentioned above have the potential to do the same if Vietnam is knocked out?

It will also be interesting to see whether the public timelines of the case shift. Will preliminary anti-dumping (AD) margins really be issued as soon as Feb. 12, 2025, and final AD orders as soon as June 12, 2025? And will preliminary countervailing duty (CVD) margins come as soon as Nov. 29, 2024, and final CVDs orders as soon as April 7, 2025? Or will those deadlines be extended given the scale and complexity of the case? (All of this assumes the International Trade Commission allows it to proceed next month.)

Also on the trade front, what happens if the “sleeping giant” of a ports strike along both the Atlantic and Gulf coasts roars on Tuesday? That could further squeeze supplies of foreign steel. (And as Laura Miller reported, the strike deadline is not the only wild card on the water. There is also Hurricane Helene.)

Or does weak demand offset all that?

That’s not the only way to interpret a potential strike. Could supply chain snarls resulting from a labor action disrupt manufacturing and thus demand for steel? In other words, what happens if imports of both steel and auto parts are hit?

So let’s circle back to momentum. Because while some of you tell me prices have nowhere to go but up, others think we’ll be back into the $600s/st for HR before the end of the year – even if mills are holding the line in the $700s/st for smaller spot orders now.

Those folks might note that several mills – North Star BlueScope, for example – have more tons to sell now because of capacity expansions. (New capacity isn’t coming only from new mills.) And it might be harder to place those tons with demand flat to down.

And then there are prices abroad. US prices have notched modest gains since mid/late July in what we’ve dubbed a “mini-rally.” The same can’t be said of prices in the rest of the world. Prices in Germany, Europe’s manufacturing powerhouse, have slipped over that same period as icons like Volkswagen consider massive layoffs and plant closures.

Steel prices have also moved lower in China. Yes, Beijing announced stimulus measures earlier this week. Maybe those policies will work. But stimulus measures aren’t typically needed when times are good.

I’m not saying that prices in the US track with prices in the rest of the world. Last fall, US prices soared from the $600s/st to more than $1,000/st by the end of the year, according to SMU’s pricing records. There was nothing remotely equivalent to that surge abroad.

As Johnson noted yesterday, developments like that shouldn’t come as a huge surprise. Policies such as Section 232 in the US and safeguard measures in the EU – combined with national security concerns – have created three regional markets, broadly speaking: North America, Europe, and Asia. And they don’t move in tandem like they used to.

Survey says

Bringing it back to SMU’s data, I was surprised to see that most buyers we surveyed continued to report that mills were willing to negotiate lower prices.

There might be some noise in lead time data now because of pending or upcoming maintenance outages. So the negotiation rate might be a better read than usual on the pulse of the market.

And if that data is a good indication, then the pulse of the market is not as strong as I thought it would be. At least not yet. Our current data is based on what people thought this week. What will they be thinking when we do our next full survey on Oct. 7-9?

In the meantime, thanks again to all of you for your continued support of all us at SMU. We really do appreciate it. And if you’re interested in participating in our survey, let us know at info@steelmarketupdate.com.