Market Data

September 13, 2024

SMU survey: Steel Buyers' Sentiment Indices decline again

Written by Brett Linton

Following significant recoveries in late August, SMU’s Steel Buyers’ Sentiment Indices tumbled this week. We have seen volatility in our Current Steel Buyers’ Sentiment Index since June, but only recently in our Future Sentiment Index. While down, both of our Sentiment Indices remain in positive territory and continue to indicate optimism among steel buyers.

Every other week, we poll hundreds of steel buyers about their companies’ chances of success in today’s market, as well as business expectations three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, a measure SMU has been tracking since 2008.

Highlights

Through our latest market survey, the Current Buyers’ Sentiment Index fell seven points from late August, now nearing lows last seen in July and early August. Future Steel Buyers Sentiment dropped 12 points from two weeks prior, previously at a nine-month high.

In our late-August Sentiment analysis, we warned that the uptick in the Indices may have been attributed the increased optimism following our annual SMU Steel Summit Conference. Historically, our Steel Buyers’ Sentiment Indices have shown moderate gains in the weeks after each Summit, with upticks in market enthusiasm observed in seven of the past 10 years following the event.

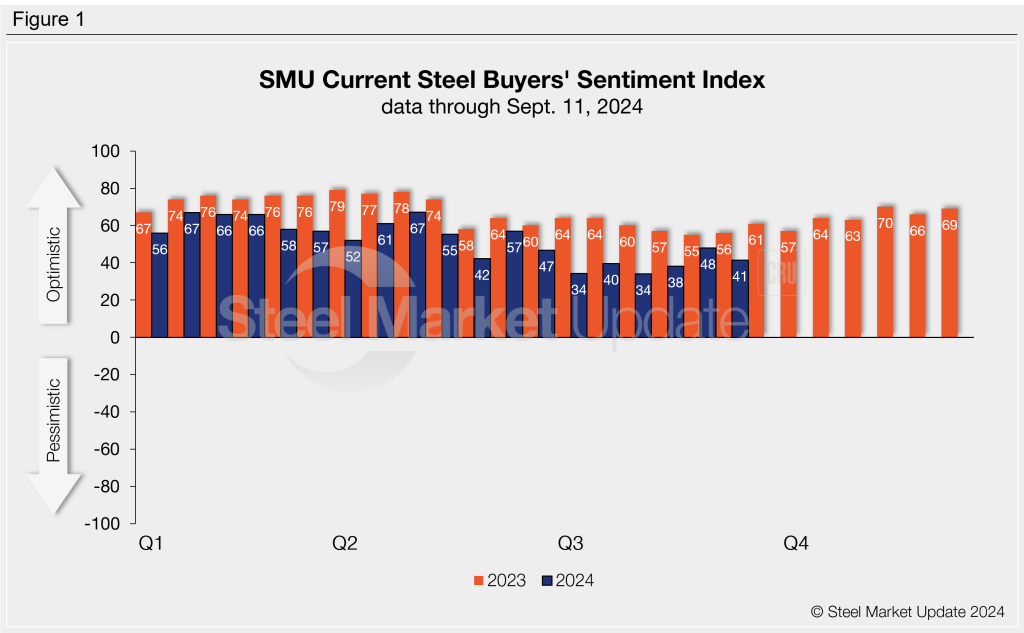

Current Sentiment

SMU’s Current Buyers’ Sentiment Index declined to +41 this week (Figure 1). Recall that Current Sentiment had fallen to +34 in both the first and last week of July, which were the lowest readings recorded since August 2020. Year to date (YTD), Current Sentiment has averaged +52 across 2024, significantly lower than the 2023 YTD average of +68. Current Sentiment was +56 this same week one year ago.

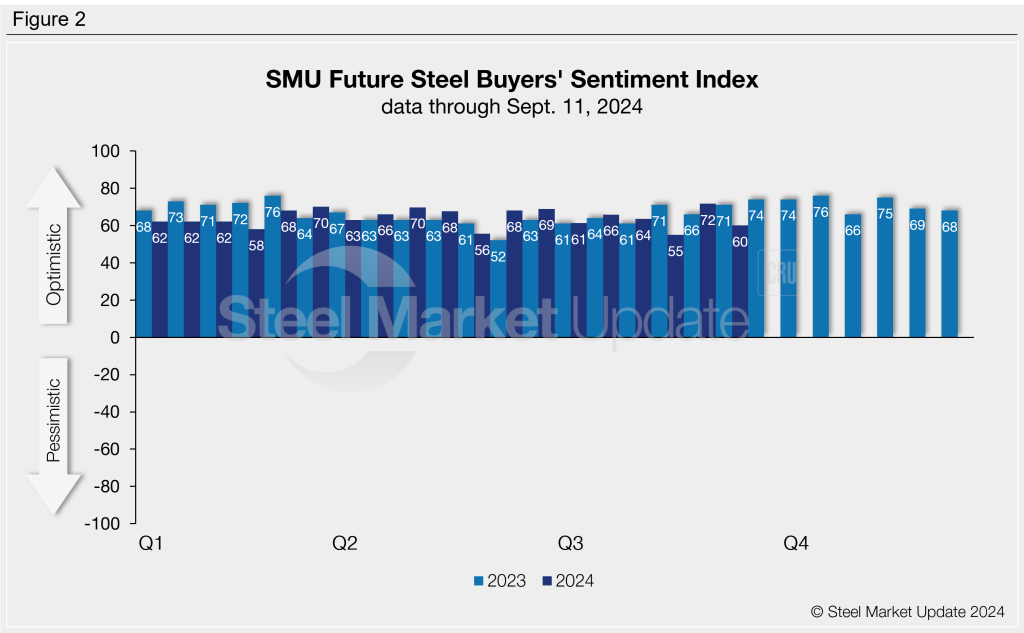

Future Sentiment

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months down the road. This index fell to +60 this week. Recall that in mid-August it reached +55, the lowest reading seen in over a year (Figure 2). Future Sentiment has averaged +64 since the beginning of 2024, down just two points from the same period of 2023. This time last year Future Sentiment was +71.

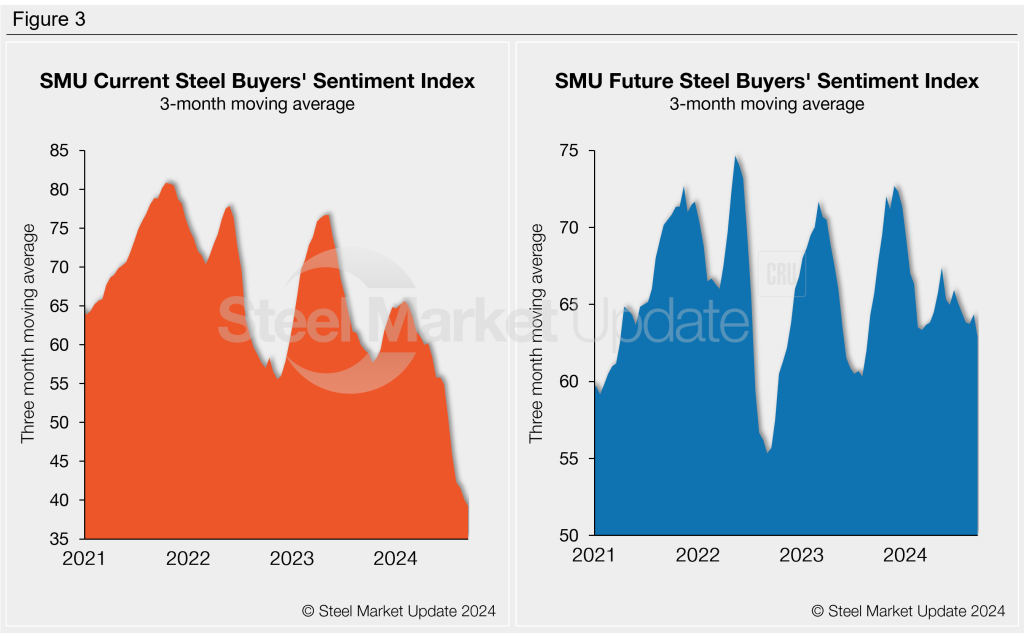

Moving averages

Measured as a three-month moving average, Buyers Sentiment declined across the board this week. The Current Sentiment 3MMA eased to a four-year low of +39.20, while the Future Sentiment 3MMA edged down to a one-year low of +62.86 (Figure 3).

What SMU survey respondents had to say:

“As we ship the trough-priced tons sold, we will do OK, but it will take some time to improve beyond fair.”

“Once the election is over, the market will open up.”

“I see things picking up from current lows and improving after some additional clarity coming from the presidential election being decided.”

“Spot price recovery will help improve things.”

“Future outlook is better.”

“We are always adapting to market pressures.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.