Market Data

September 3, 2024

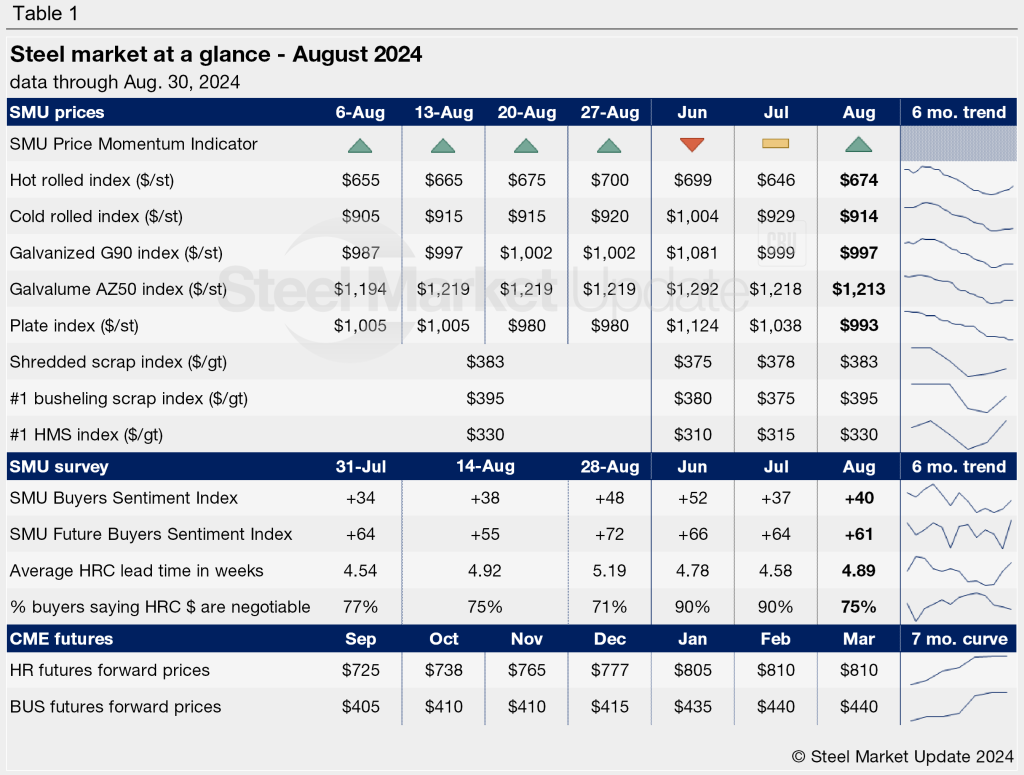

SMU's August at a glance

Written by Brett Linton

SMU’s Monthly Review provides a summary of important steel market metrics for the previous month. Our latest report includes data updated through Aug. 30.

Following the low seen in mid-July, sheet prices gradually increased throughout August, supported by upcoming maintenance outages and mill price increases. Meanwhile, plate prices ticked lower across the month, a trend seen since late last year.

The SMU Price Momentum Indicator on sheet was adjusted from Neutral to Higher in the first week of August. The Price Momentum Indicator for plate remains at Lower, where it has been for four months.

Scrap prices were mostly sideways from July to August, ticking up $5-20 per gross ton. Buyers were mixed on what prices could do in September, with some expecting a decline and others foreseeing further recovery.

We saw an improvement in Steel Buyers Sentiment as we neared the end of August. Current Sentiment jumped to a two-month high last week, while Future Sentiment rose to a nine-month high.

Steel mill lead times edged higher across August but are not far from the multi-month lows seen in July. The percentage of buyers reporting that mills were willing to negotiate on new orders slightly declined from July to August, but remains at a relatively strong rate.

See the chart below for other key metrics for August.