Government/Policy

August 30, 2024

Op-Ed: Mexican steel trade ‘myth’ - What US trade data really shows

Written by Salvador Quesada Salinas

In recent months, there has been loud, vocal commentary from the US against Mexico with respect to the steel trade between both countries, accusing Mexico of a huge surge in exports and of being a transshipment country for Chinese steel.

However, these intense alarm signals appear to be crafting a narrative that sharply contrasts with publicly available data, particularly from the US. Why is that? Maybe it is somehow politically convenient to believe in a tired old myth, or perhaps it’s just an innocent mistake. Regardless, let’s let the numbers speak for themselves because numbers don’t lie.

The numbers

Both Mexico and the US have increased their bilateral trade in steel. However, the US has done so to a greater extent. The monthly average of finished steel exports from the US to Mexico in 2024 increased by 19% compared to the baseline 2015-2017 volume, while Mexico’s exports to the US grew by 7% in the same period.

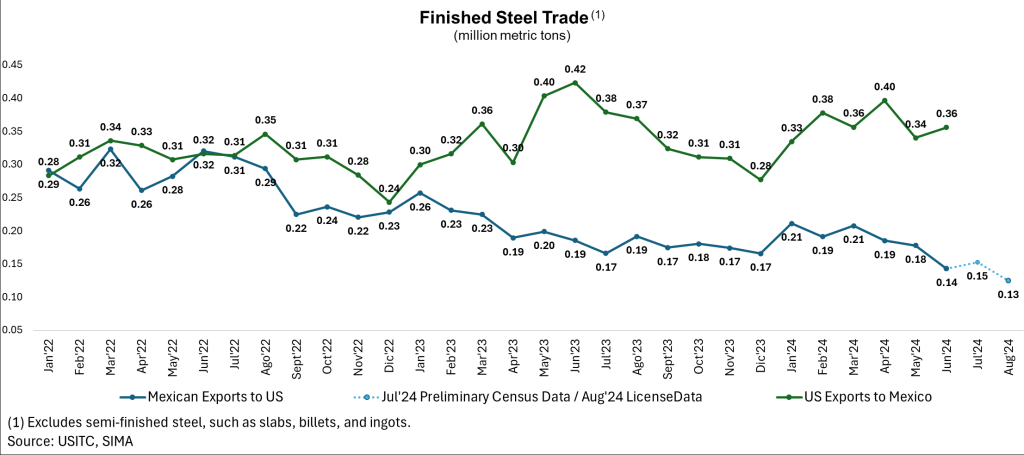

From January to June 2024, Mexico’s finished steel exports to the US decreased by 13% compared to the same period in 2023, while US shipments to Mexico increased by 3% during the same period. This increase is primarily due to higher exports of flat steel. These trends are consistent with those observed in 2023, when Mexico’s exports to the US fell by 28% compared to the previous year, whereas US exports increased by 11%.

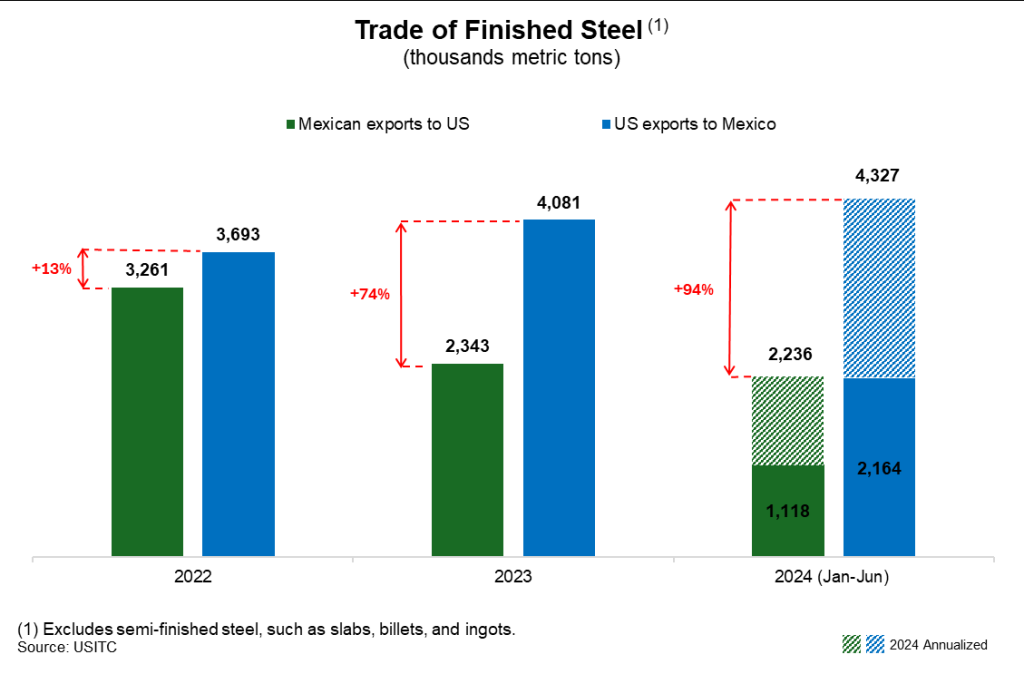

In addition to the above, it is important to highlight that the difference in the magnitude of the export volume of both countries has widened more and more each year. In 2022, US exports of finished steel were 13% higher than those of Mexico, but this difference increased to 74% in 2023, and if we annualize the January through June Census Data, the gap is on pace to grow to 94%. This illustrates that the US has benefited more from trade in finished steel than Mexico.

The downward trend in Mexican exports to the US will continue in the coming months, according to the most recent information from preliminary Census data and SIMA license data.

Let’s drill down into transshipments

The claims by some US mills that there is transshipment of Chinese steel through Mexico are incorrect.

In 2023, statistics from the US show that 144,000 metric tons (mt) of steel melted and poured in China entered the US via a third country. The top three origins were Thailand (52%), Oman (15%), and Canada (13%), while Mexico was 11th, exporting only 334 mt of Chinese melted steel.

From Mexico’s perspective, those 334 mt represented only 0.01% of Mexican finished steel exports in 2023.

Since implementing melted and poured tracking in October 2020, only 0.01% of the finished steel exported from Mexico to the US has been melted in China.

To conclude, what are the numbers telling us?

First, Mexico is not a backdoor for unfair trade from China but is a very important destination for US steel exports.

Second, there are strong bonds between both countries’ supply chains.

And third, there are still some trade inconsistencies that need attention.

To compete in a regionalized world, improve our economies, attract more investments, and fight against China’s unfair trade practices, our regional ties could and must be reinforced.

Engaging in a steel trade war based on myths and misconceptions is not a strategic decision; it won’t benefit the majority and will only diminish our region’s competitiveness.

Editor’s note

SMU welcomes opinions from across the steel industry. We’re happy to share the thoughts above from Salvador Quesada Salinas, general director of Mexico’s steel chamber, Canacero. If you have an opinion you’d like to express to the broader steel community, please contact us at info@steelmarketupdate.com.