Analysis

August 29, 2024

Final thoughts

Written by Michael Cowden

I want to say a huge ‘thank you’ from all of us at SMU to all of you (more than 1,500!) who attended Steel Summit this year.

We appreciate you taking time out of your busy schedules to join us – whether up on stage, submitting thoughtful questions, or catching up over a drink and bite to eat.

Also, a big shoutout to everyone at SMU and at CRU who made this event possible. It’s no understatement to say that we have a fantastic team. They kept everything running smoothly – from the registration booths and the AV to the FOAM-O coffee (iykyk).

If I have one regret, it’s that I’m so busy at Summit that I don’t have time to catch up with more of you personally. (Or not for long if I do.) But I look forward to continuing the conversation in the SMU newsletter, in our upcoming Community Chats webinars, and next year in Atlanta.

Speaking of next year, I wanted to draw your attention back to the results of the snap polls we conducted on Day 1 of Steel Summit. We asked folks to predict where hot-rolled (HR) coil prices and demand would be a year from now. We also asked about Nippon Steel’s roughly $15-billion acquisition of U.S. Steel and this year’s presidential election.

Snap poll: HR in August 2025

We’ve been writing for a lot of this year about how prices were falling (or not going up as much as expected), how inventories have been high, how there are concerns about demand, and how sentiment has been a little lackluster. So I was surprised, to be honest, at how bullish people were about 2025.

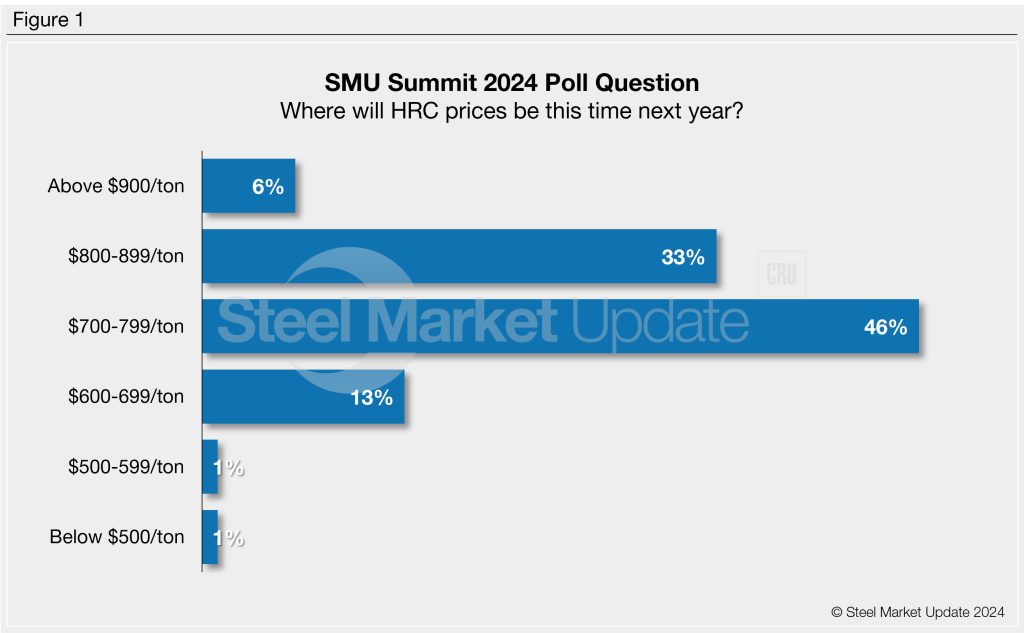

SMU’s hot-rolled (HR) coil price had been in the $600s per short ton (st) from mid-June until just before Steel Summit. But during a snap poll at the event, nearly half predicted that HR would be $700-799/st in August 2025.

Another 33% were even more bullish; they said prices would be $800-899/st this time next year. Very few said they would be below $600/st or above $900/st.

We haven’t really seen “mini-cycles” since the pandemic. Remember the “before times” – that distant galaxy called 2019. Perhaps we’ll see mini-cycles again but at a somewhat higher level?

Snap poll: 2025 Demand

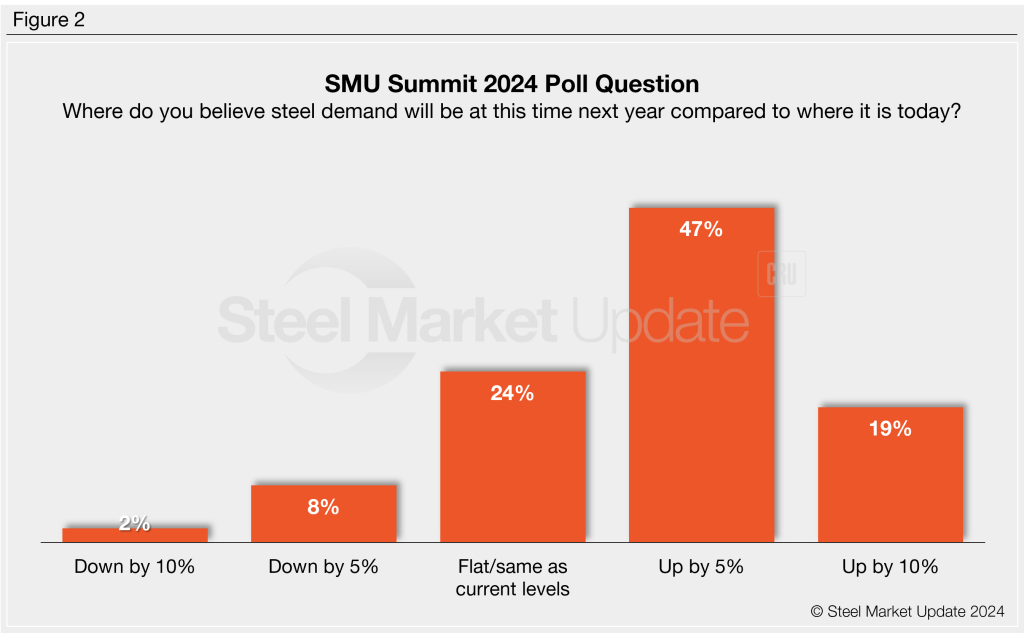

There was also a lot of optimism that demand would be better next year. Two-thirds of respondents said that demand would be better in August 2025. Only 10% thought demand would be lower.

Why might that be? Maybe this: There was a lot of talk at the conference about how we could see more restrictions on imports next year – whether from tariffs on downstream products, a carbon border tax of some sort, actions against transshipment, or AD/CVD cases.

Just a few examples: There was chatter at the conference about a potential trade action against coated sheet from Vietnam. On the long products side, there was talk of potential trade cases on rebar from Algeria and Egypt. And downstream, Barry Zekelman mentioned his frustrations with pipe from Oman and conduit from Mexico.

There was also some optimism that infrastructure spending and other federal stimulus could have more of an impact next year. Is it finally enough to move the needle on demand?

Snap poll: Nippon acquisition of U.S. Steel

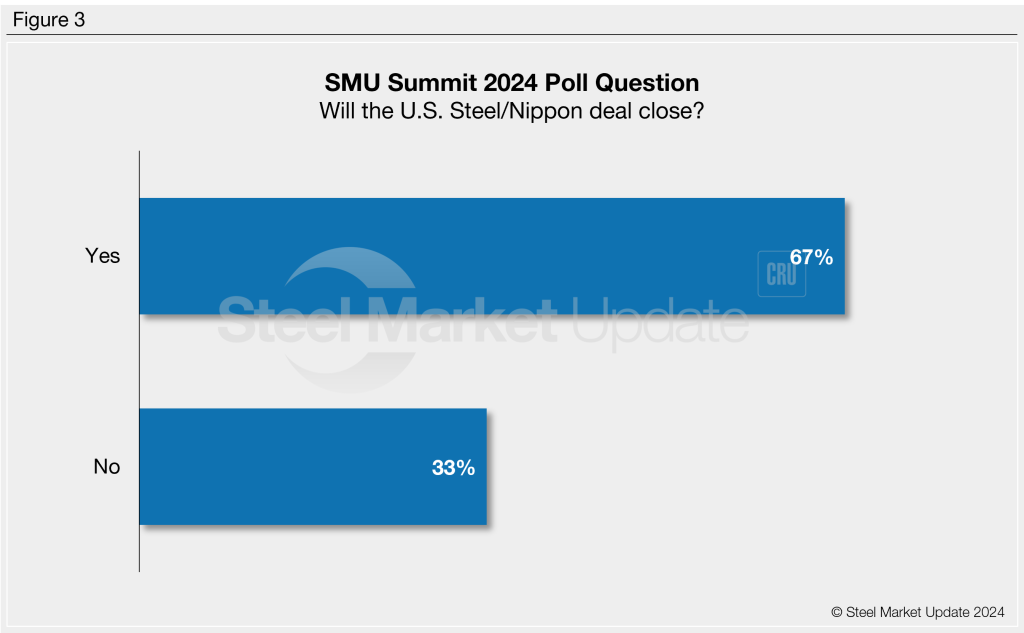

We, in addition, asked whether Nippon Steel’s $15-billion acquisition of U.S. Steel would close. Roughly two-thirds of you said that it would.

That’s a huge change from earlier this year when the deal became a political football with Cleveland-Cliffs and the United Steelworkers (USW) union vehemently opposed to the deal.

And keep in mind that we took our poll before Nippon Steel announced that it would invest “no less than $1 billion” in U.S. Steel’s Mon Valley Works near Pittsburgh and $500 million at its Gary Works in northwest Indiana. Both are represented by the United Steel Workers (USW) union.

That’s notable because you could make the case that a lot of the bad blood between U.S. Steel management and the USW stems from a decision in April 2021 to shift a planned $1-billion investment in Mon Valley to its non-union Big River Steel mill in Arkansas.

The USW still opposes the deal. And I think it’s risky to understate the union’s influence in an election year – especially when votes in western Pennsylvania, a swing area of a swing state, could make the difference between winning or losing the White House.

But as several speakers at Summit said, politics aside, the transaction just makes sense. It’s the kind of knowledge and information transfer that the US should support – in this case, from Japan, one of our closest allies, to the States.

Snap poll: Trump vs. Harris

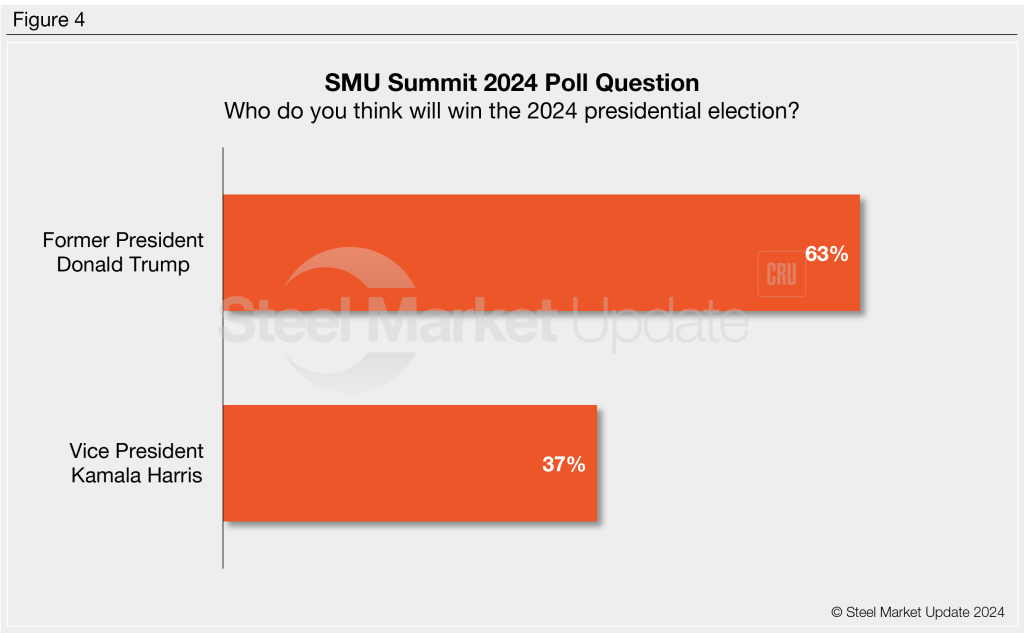

I was a little concerned ahead of Summit that things would get heated this year over politics, especially with a very close (according to current polls) election between former President Donald Trump and current Vice President Kamala Harris.

Most folks who attended the Summit think Trump will win.

Michael Smerconish did a good job of setting the tone for the conference in his keynote address. He encouraged everyone to get out of their bubbles, especially the social media ones. And to consider other points respectfully – which I think we mostly did. (Ha, maybe to the chagrin of some who were hoping for more sparks.)

While the election matters greatly on a lot of issues, one theme that came across again and again was that one of the few subjects on which both parties agree is trade policy, especially as it relates to steel.

Trade experts and other speakers also noted that both parties, along with much of the rest of the world, has woken up to the problem of excess capacity in China – with Canada recently joining those ranks.

Analysts and policy experts also pointed out that both the US and Europe want to account for imports coming in from countries whose steelmakers emit more carbon. Even if they’re still pretty far apart on the details of how to do that.

If there are differences among Republicans and Democrats, the consensus seemed to be that a second Trump administration might take a harder line on allies like Europe and Mexico. But, as several speakers noted, former President Obama first cracked down on steel imports with a wave of AD/CVD cases while he was in office.

President Trump more or less continued that effort, albeit through Section 232. It was perhaps not the tool designed for the job, but one that got it done. (Sort of like hammering a nail with a shovel.) And President Biden has largely continued Trump’s policies. The assumption seems to be that a Harris administration would mostly follow in Biden’s steps as it relates to steel.

Steel might be lucky in that regard. Our panel on electric vehicles (EVs) noted that the election was almost an existential issue for that sector. Whether you drive (or aspire to drive) EVs or not, they said, is a pretty good proxy for party affiliation.

I was surprised to hear that. But then again, I was surprised when Smerconish talked about a Whole Foods/Cracker Barrel divide. I didn’t realize that existed, which is apparently proof that I’m from a swing state. (Here we go, Steelers!)

Into the woods

Frankly, it’s hard to pull just a few key themes from such a big event spanning three days with nearly 40 speakers. And if you’re having trouble sorting it all out, just remember Zekelman’s words of wisdom at the end of his fireside chat: “We’re all morons.”

True, that. It’s important to be humble – whether that’s in assessing markets or in life. And with that, my friends, I’m signing off for a long weekend of camping/glamping with family and friends.

PS – We will keep our website humming on Friday. But there will be no Sunday newsletter this week in observance of Labor Day. I and the rest of the SMU team look forward to catching up with yinz again on Tuesday, when we’ll send our next newsletter.

Steel Summit 2025

Some of you have asked me when the next SMU Steel Summit will be. Mark your calendars for Mon-Weds, Aug. 25-27, 2025. It’s sure to be another informative and entertaining event.