CRU

August 16, 2024

CRU: Chinese steel export prices plunge as confidence collapses

Written by Anton Perevezentev & Linda Lin & Puneet Paliwal

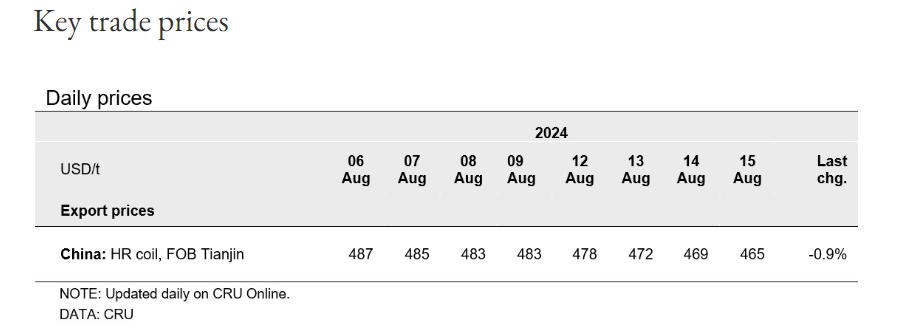

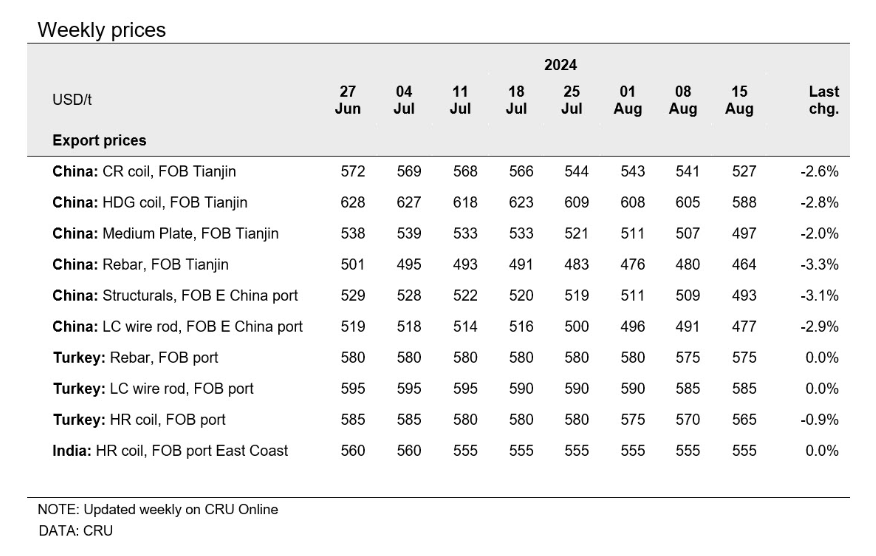

Chinese steel export prices decreased for the eleventh week in a row, with all steel products recording losses of 2-3.7% compared to the previous week.

While uncertainties about new rebar national standards kept weighing on the market, overall local steel consumption remained depressed in the summer lull.

The Chinese National Bureau of Statistics (NBS) announced that July automobile production and sales both fell m/m and y/y, reflecting generally sluggish local demand. As a result, HR coil spot prices hit a seven-year low in the week. In China’s domestic market, for the first time, all major Chinese mills surveyed by CRU reported lower local sales this week.

The local market’s poor performance prompted Chinese exporters to cut HR coil offers by up to $30 from last week. However, this only scared away most overseas buyers, who bid at extremely low levels or simply remained on the sidelines this week.

In the face of bleeding bottom lines, some mills started production cuts this week, but the effect has not been observed yet as the oversupply in China’s steel market is likely to persist and depress steel prices in the near term.

Turkey HR coil prices downtrend persists

HR coil export prices remained unchanged for the fifth consecutive week at $555 per metric ton (mt) FOB. This is because Indian suppliers continued to halt export offers in response to the recent sharp decline in Asian prices. Market sources suggest that some traders tested the market by reducing price offers for Indian-origin HR coil by $30/mt w/w, but there was no acceptance as these prices were still much higher than the latest offers from China. CRU contacts on the supply side expect export activity to resume in late August when European buyers return after the summer holidays.

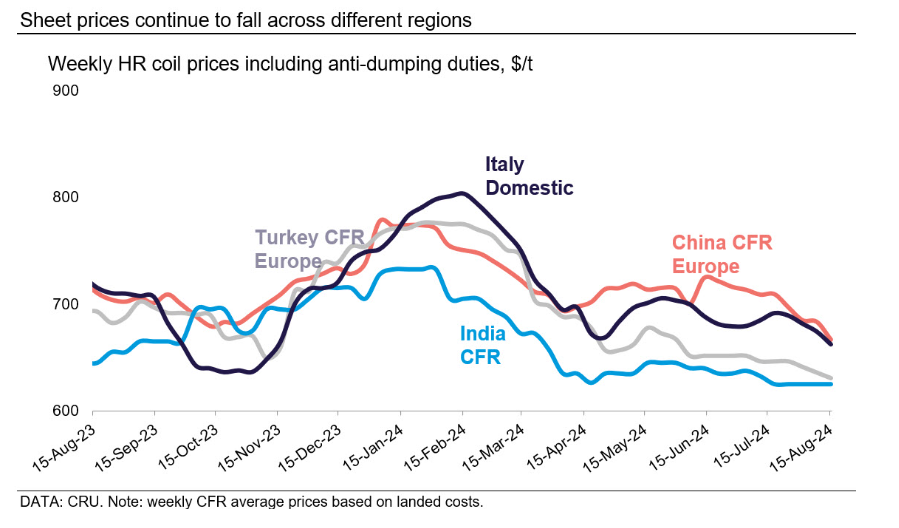

The downtrend in the Turkish sheet market persisted, resulting in a $5/mt w/w fall in HR coil export quotes. Turkish sellers have come under pressure from the overall price weakness observed in export markets. In Asia, markets have been impacted as Chinese mills continued to drop prices amid a lack of domestic demand. HR coil offers from China were heard at $510-520/mt CFR in Turkey.

The discount of Turkish HR coils in Southern Europe fell to $30/mt, duties included. Buying interest in Europe remained weak due to the holiday season, while local prices trended downwards.

Turkish longs prices remained stable w/w, with rebar and wire rod being at $575/mt and $585/mt, respectively. Buying activity from Central and Western Europe remained seasonally weak. Meanwhile, heavily discounted long products from China have limited interest from the Middle East.

This article was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.