Analysis

August 13, 2024

Final thoughts

Written by David Schollaert

The countdown is on! In less than two weeks, we’ll kick off the 2024 SMU Steel Summit.

This year is poised to be the best attended yet. More than 1,350 delegates have already registered – so we’re within sight of last year’s record number of nearly 1,450.

I’m looking forward to learning from executives across the supply chain – from steel mills and service centers to OEMs, analysts, and more.

One tradition that I’m also looking forward to: Gauging the mood of the room when we do our annual poll questions. As we’ve done for at least the past four years, we’ll seek to measure how those in attendance see the steel market developing over the next year.

We’ll of course ask people where they think hot-rolled (HR) coil prices will be this time next year. We’ll probably ask about demand. We might even ask a question or two about the upcoming presidential election.

It’s not a scientific discovery process for forecasting purposes. And our collective track record is average at best, let’s be honest. But the polls do serve as a good indication of industry sentiment.

A quick look in the review mirror

In 2020 and 2021, our predictions were pretty terrible. A black swan here (pandemic) or there (Russia invades Ukraine) will do that. But we saw solid improvement in 2022 and again in 2023.

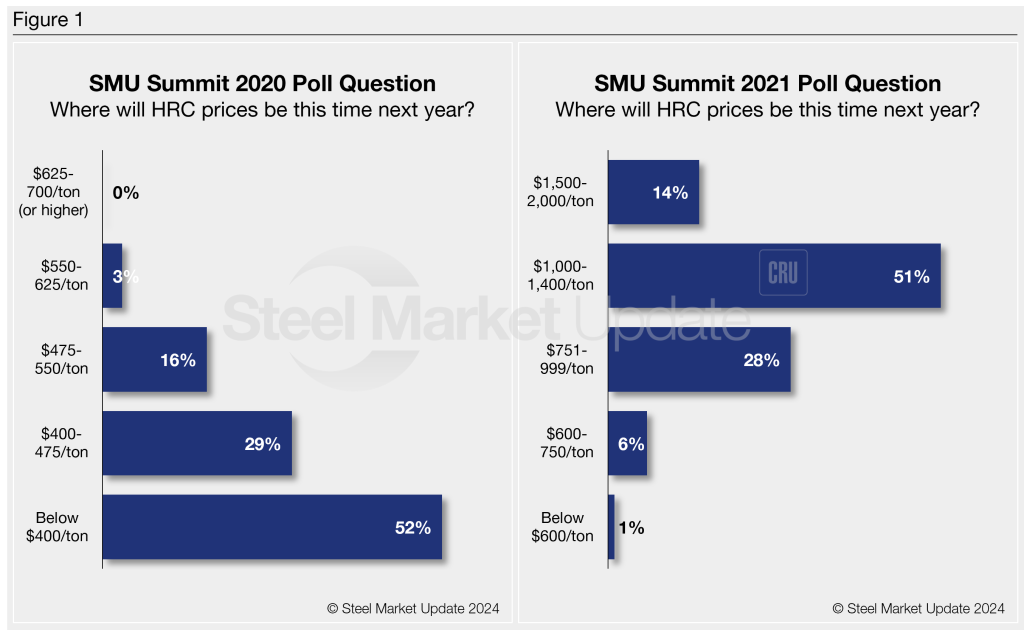

Steel Summits in 2020 and 2021 were polar opposites. If 2020 marked peak bearishness, 2021 was peak bullishness (see Figure 1).

In August 2020, HR prices averaged $485 per short ton (st) when we held a virtual Summit because of Covid. The consensus was that prices would be at or below $400/st come 2021. We might have rivaled some of Miss Cleo’s best fortune-telling skills with that one… or not. We were just $1,500/st or so off the mark.

In August 2021, HR tags were $1,915/st during Summit. And 51% of Summit delegates predicted prices would moderate at a new normal of around $1,200/st on average. Twelve months later, HR was at $770/st. We got a lot better. We were only off by about $400/st!

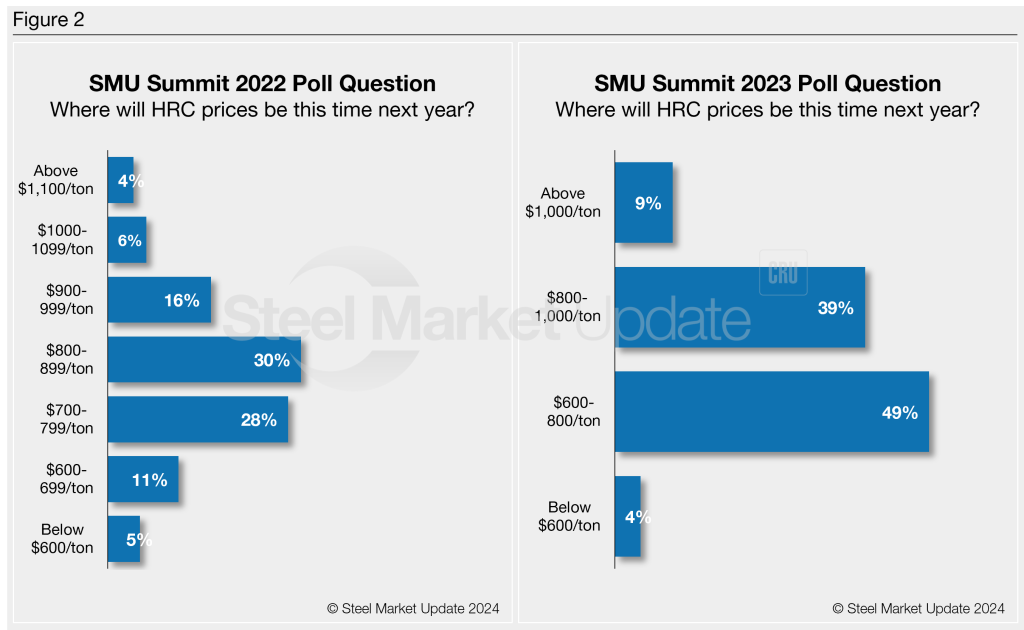

And we were pretty dang close to right in 2022 and again in 2023. Most predicted in August 2022 that HR prices would average in $700-900/ton in August 2023. HR prices stood at $750/st during last year’s Summit.

At last year’s Summit, with a nearly 50% response rate from the 1,438 registered attendees, 49% predicted that HR prices would be $600-800/st come August 2024. (See Figure 2). SMU’s HR price stands at $665/st on average as of today, within consensus poll results from a year ago.

If there is one constant over the last four years, it’s that we’ve speculated that future prices will be more or less like current prices. That what we’re seeing today we’ll see 12 months from now – unless life (or geopolitics) throws us a curveball. Will this year be any different?

What’s in store for Summit ’24

It appears we’re getting better at this prediction game the further we move away from recent black swan events. And it will be fun to see the results trickle in when we ask the room this year where HR prices will be in August 2025. Don’t hesitate to chime in. You can’t do much worse than we all did in 2020 and 2021.

Also, we have a jam-packed agenda for our three-day Summit. That includes our highly anticipated Fireside Chats. It also includes panels that will cover the latest developments in automotive, trade policy, and decarbonization. You can find full details here.

Steel Summit 2024 app

If you’re attending Steel Summit this year, make sure to download the Steel Summit 2024 app from the Apple or Android app stores.

You will use it for networking, receiving agenda updates, and participating in polls as well as Q&A sessions. You can also use the app to live stream and replay the proceedings of any sessions you might miss.

Steel Summit of course starts on Monday, Aug. 26., and runs through Wednesday, Aug. 28 at the Georgia International Convention Center (GICC) in Atlanta. If you haven’t signed up yet, you can register here.

And, most importantly, from all of us at SMU, we thank you for your continued support.