Market Data

August 2, 2024

SMU survey: Current Sentiment Index erases gain, Future Sentiment slips

Written by Brett Linton

Following an uptick in mid-July, SMU’s Steel Buyers’ Sentiment Indices both eased this week. Current Buyers Sentiment has been seesawing for the past few months, now back down to one of the lowest readings recorded since August 2020. Future Buyers’ Sentiment remains higher, indicating buyers have positive outlooks for future business conditions.

Every other week, we poll steel buyers about their companies’ chances of success in today’s market, as well as business expectations three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, a measure we have been tracking since 2008.

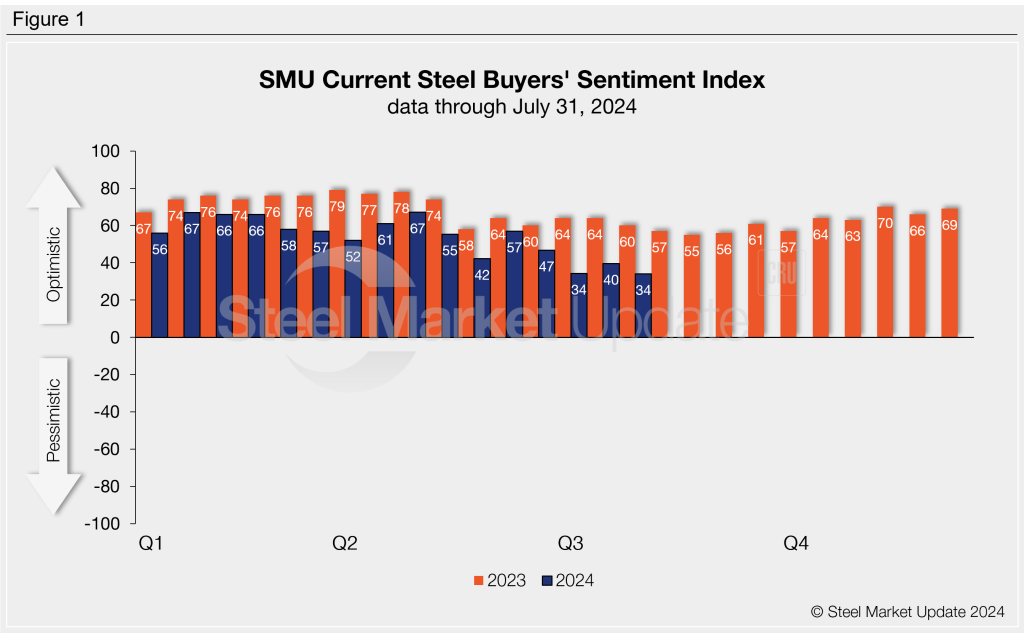

SMU’s Current Buyers’ Sentiment Index dipped to +34 this week, wiping out the six-point rebound seen two weeks ago (Figure 1). Current Sentiment is now tied with the early-July reading for the lowest measure recorded in the past four years. We have seen an average Current Sentiment reading of +54 across the first seven months of 2024; this time last year this metric was significantly higher at +71.

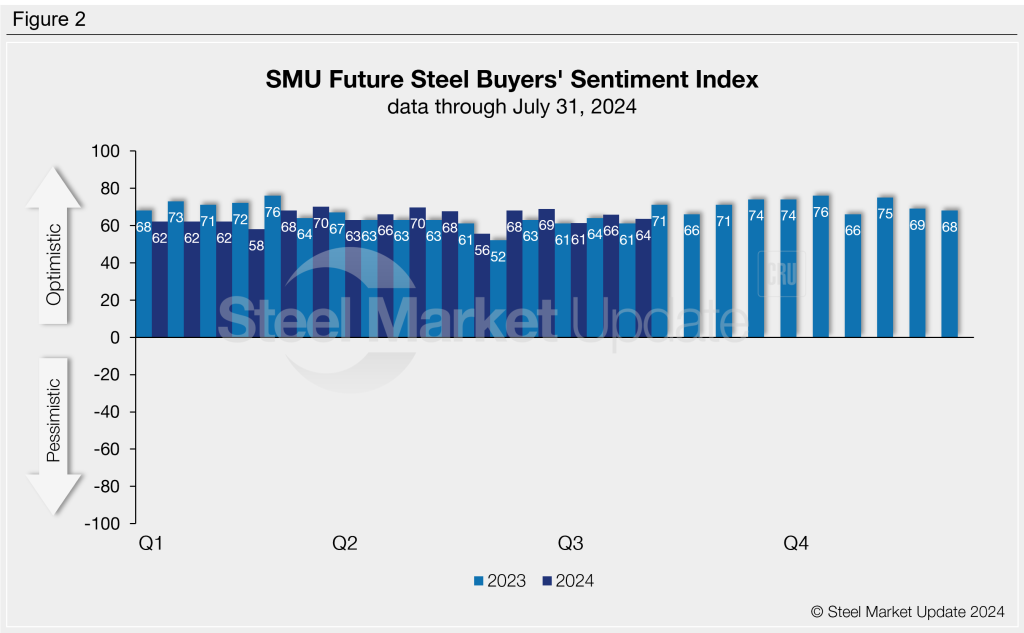

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months down the road. This index decreased two points this week to +64, right in line with the average readings of 2024 (Figure 2). Future Sentiment is just slightly higher than it was this time last year.

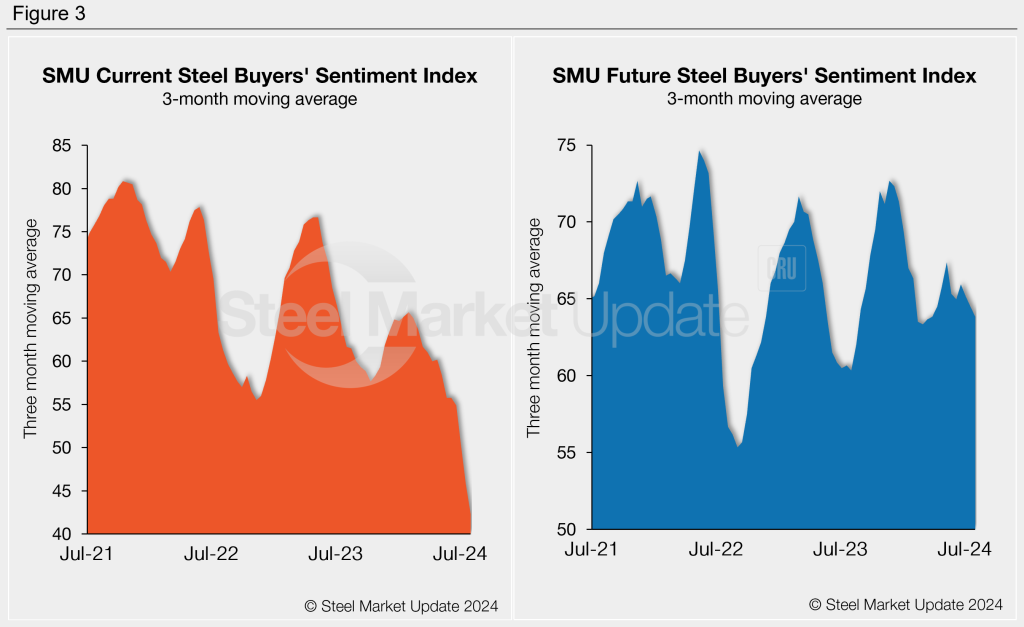

Measured as a three-month moving average, Buyers’ Sentiment ticked lower again this week. The Current Sentiment 3MMA slipped to +42.29, now the lowest reading recorded since August 2020. The Future Sentiment 3MMA fell half a point this week, now at a four-month low of +63.84 (Figure 3).

What SMU survey respondents had to say:

“I think we’ll see a bit more confidence/stability once the presidential election is decided.”

“I feel the business will soon come back to our market.”

“We need more building to start.”

“The overall decline in market pricing does not allow for elevated margins.”

“Anticipating favorable year-over-year performance.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.