Market Data

August 1, 2024

SMU survey: Sheet lead times tick up, plate shrinks, all remain short overall

Written by Brett Linton

Buyers continue to report very short mill lead times on sheet and plate products, according to our latest market canvass of steel service center and manufacturer executives. Sheet lead times were flat to slightly higher this week, while plate lead times shortened to lows not seen since August 2020. Production times remain near historical lows for all products we track.

Table 1 below summarizes current lead times and recent trends.

Survey results

Nearly two thirds of the companies we surveyed this week categorized current mill production times as shorter than normal. The remaining 36% responded they were within typical levels.

We polled buyers on where they believe lead times to be two months from now. A third of this week’s respondents believe lead times will be longer at that time (vs. 32% from our mid-July survey). Sixty-two percent forecast production times will remain stable (unchanged from two weeks prior), while 5% think they could shrink further (vs. 6% previously).

Here’s what respondents are saying:

“Likely will see a bump in lead times as end users come off the sidelines and start buying.”

“They’ll be ‘flat’ but flat at very short times- this is a major concern of ours heading into the second half of the year.”

“I think the mills will shut down some furnaces to cause a demand.”

“Mills will take out tons to tighten supply.”

“Year-end construction and automotive demand will be down due to very high inflation and high interest rates.”

“Extending just a little bit, and I say that because it seems we are pretty near the absolute minimum, right?”

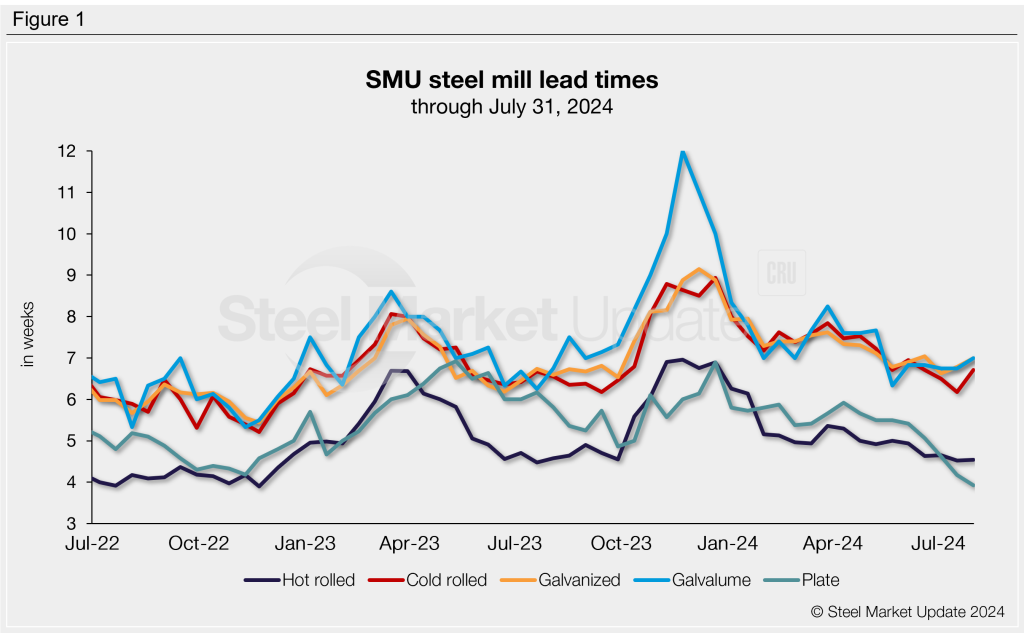

Figure 1 below tracks lead times for each product over the past two years.

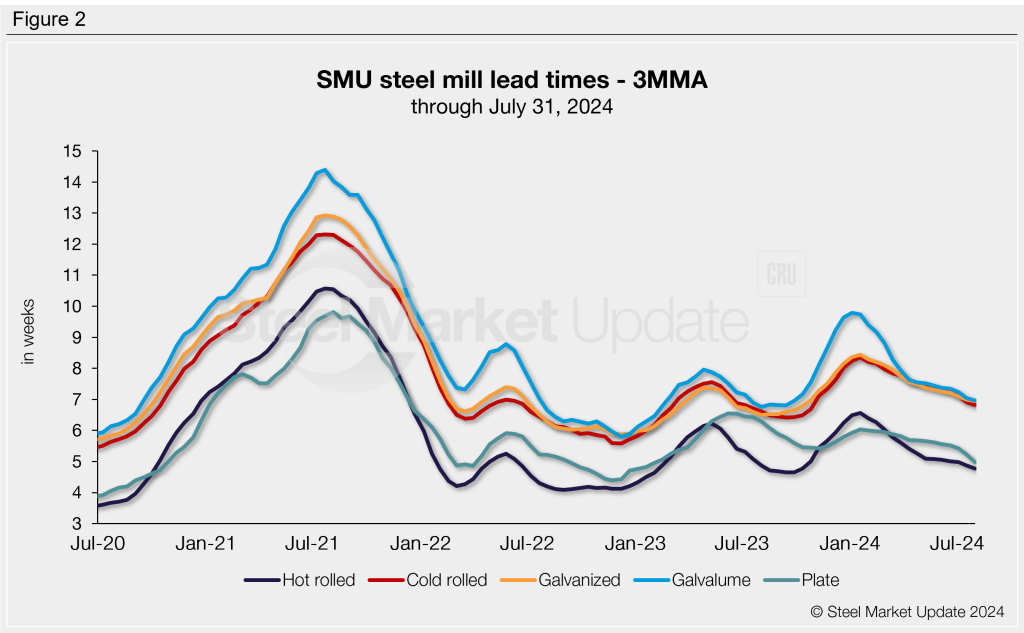

3MMA lead times

We can better spotlight lead time trends by viewing the data on a three-month moving average (3MMA) basis, which smooths out the variability seen in our biweekly readings. When viewed on this basis, 3MMA lead times continued to ease on all products this week, a trend we have consistently seen month across the last six months. Through this week, 3MMA lead times are down to some of the lowest levels recorded since late 2023.

The hot rolled 3MMA is now down to 4.78 weeks, cold rolled at 6.82 weeks, galvanized at 6.95 weeks, Galvalume at 6.97 weeks, and plate at 4.98 weeks.

Figure 2 highlights lead time movements across the past four years.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.