Prices

August 1, 2024

HR futures: Trend reversal or bear market head fake?

Written by Dave Feldstein

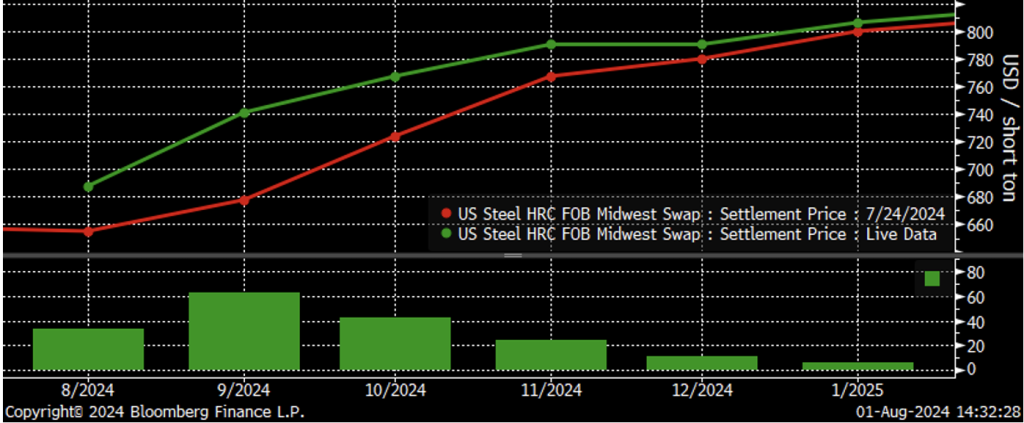

Cleveland-Cliffs and Nucor each raised their respective hot-rolled coil (HRC) prices this week. Since last Wednesday’s settlement, the Midwest HRC futures curve has rallied as much as $63 in the September future.

CME hot-rolled coil futures curve $/st

The futures curve was off today as the market took a breather to digest the sharp move higher. Is this another bear market head fake that should be sold into or the beginning stages of a new rally? Let’s get technical. This chart of the August CME HRC future illustrates a “double-bottom” trend reversal pattern with the June 24 low of $655 being tested on July 23 and 24 before finding support and rallying back to as high as $734 on Tuesday.

August CME hot-rolled coil future $/st

Zoom out and you will see the rolling 2nd month Midwest HRC future breaking above its downtrend that goes all of the way back to the Jan. 3 peak north of $1,100. The 2nd month future, now September, may have bottomed last Wednesday when it settled at $655, which is almost smack in the middle between November 2022’s low of $621 and September 2023’s low of $675. While it is too soon to say whether the bottom is in or if there is further to decline ahead, it is clear that the upside risk seen over the past 18 months cannot be ignored. Rallies of roughly $550, $200, $450 and $200 have left tire marks over the short-sellers they ran over. Thus, it is no surprise that the market is twitchy about any upside risk and quick to cover. Again, will this be a brief relief rally or another Glenn Frey “The Squeeze is On” kind of rally.

Rolling 2nd month CME HRC future $/st

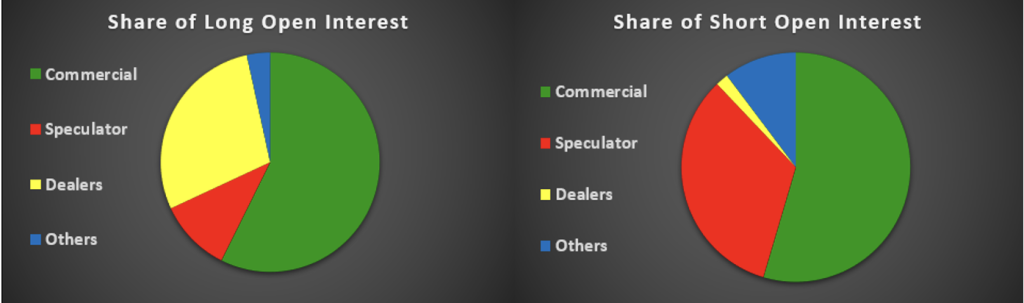

Empathy is a critical life and business skill to have. In my humble opinion, I wonder if commercial futures market participants appreciate, understand, or are even aware of the incentives and motives of the noncommercial market participants. These two pie charts show the share of long and short open interest by the different market participant categories of commercial, managed money (speculator), swap dealers, and others. Commercial participants, which include OEMs, service centers, scrapyards, importers and mills, hold the majority of open interest (57% and 55%, respectively). Swap dealers, aka market intermediaries or bank desks such as Goldman Sachs, JP Morgan, etc., hold around 28% of the long open interest. Managed money or speculators, think hedge funds and proprietary traders, are currently holding around 33% of the short open interest.

Each group contributes to the healthy functioning of the ferrous futures and options markets. Moreover, each group can be characterized by their different motives, incentives, and risk profiles. At the most basic level, commercial participants are mostly interested in managing the risk inherent in their business, managed money is seeking to profit or earn a return, while swap dealers are a component of a larger financial services institution driven to seek a return by charging fees to their customers.

For instance, a proprietary trader might be looking to “scalp” a quick trade. They buy on the rumor of a steel mill price increase announcement and then when the announcement comes, they sell their position at a profit. A hedge fund might be short HRC, but long iron ore, or they might be long the September HRC future and short the December HRC future holding a “calendar spread.”

These players have very different risk characteristics than say a service center that is short 3,000 tons per month of the fourth quarter trying to manage price risk on 30,000 tons of uncovered inventory. Moreover, the consequences of being on the wrong side of the futures are very different for the prop trader and hedge fund vs. the commercial service center. Most importantly, the prop trader and hedge fund trader are both overseen by a risk manager who might force them to liquidate a losing position. There are also speculators that trade momentum strategies. Those players are likely the ones that you see pushing on the bid to emphasize the declines on the way down and taking the offers to stress or “squeeze” the shorts during rallies. The bottom line is the futures can take on a life of its own as a result of these different market participants.

This is best explained by the Paul Newman quote:

“If you’re playing a poker game and you look around the table and can’t tell who the sucker is, it’s you.”

Or the master of military strategy Sun Tzu’s quote:

“Know thyself, know the enemy.”

And now a public service announcement from Rock Trading Advisors:

Folks, the CME busheling futures market has seen its open interest plummet to just above 50,000 tons. This is a critically important market for not only scrapyards, but also service centers, manufacturers, and steel mills. For just one trade a month, you can help save the busheling futures market from extinction. Call your broker now and help get the busheling futures market the support it needs to survive.

Rolling 2nd month CME BUS future $/lt & open interest (red) (22-day M.A. ylw)