Market Data

June 21, 2024

SMU survey: Current Buyers' Sentiment Index falls off, Future Index inches up

Written by Ethan Bernard

SMU’s Current Steel Buyers’ Sentiment Index tumbled this week, while Future Sentiment ticked up slightly, according to our most recent survey data.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and Future Sentiment Index. (We have historical data dating to 2008. You can find that here.)

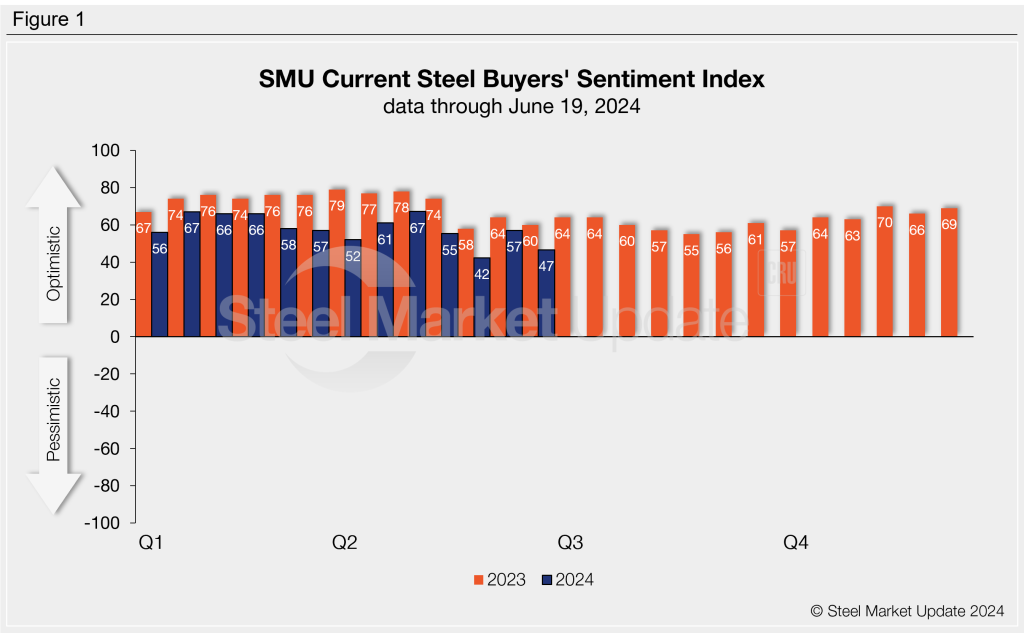

SMU’s Current Buyers’ Sentiment Index was +47 this week, diving 10 points from two weeks earlier. (Figure 1). Other than the +42 reading from a month ago, this is the lowest reading since the end of July 2022. We’ll have to see if the index keeps seesawing, or if it finds more equilibrium.

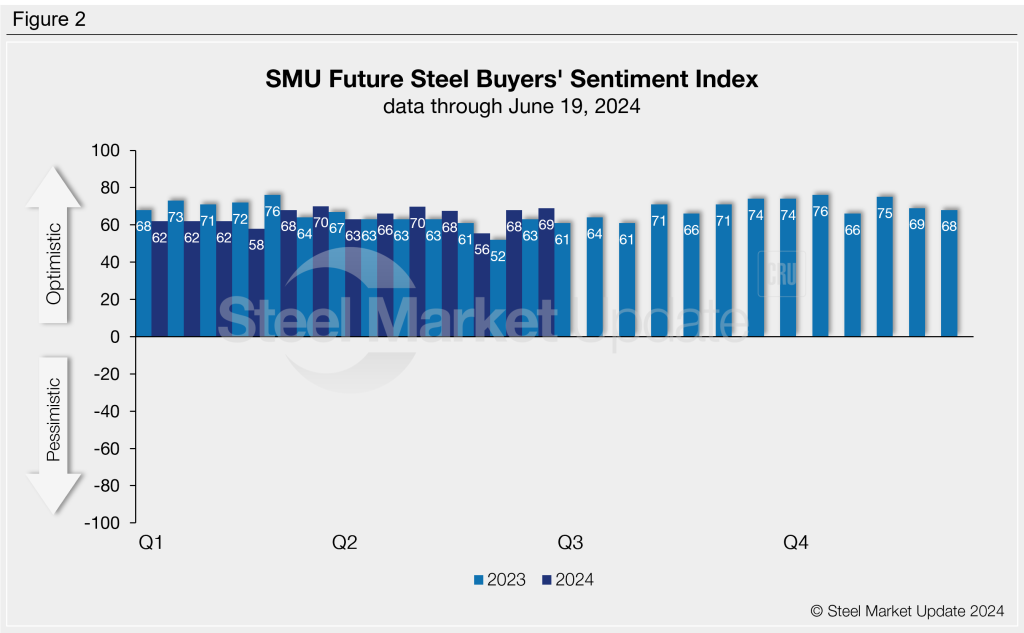

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. This index stands at +69 this week, up one point from our previous market check. (Figure 2). This is in line with the readings we’ve see most of this year.

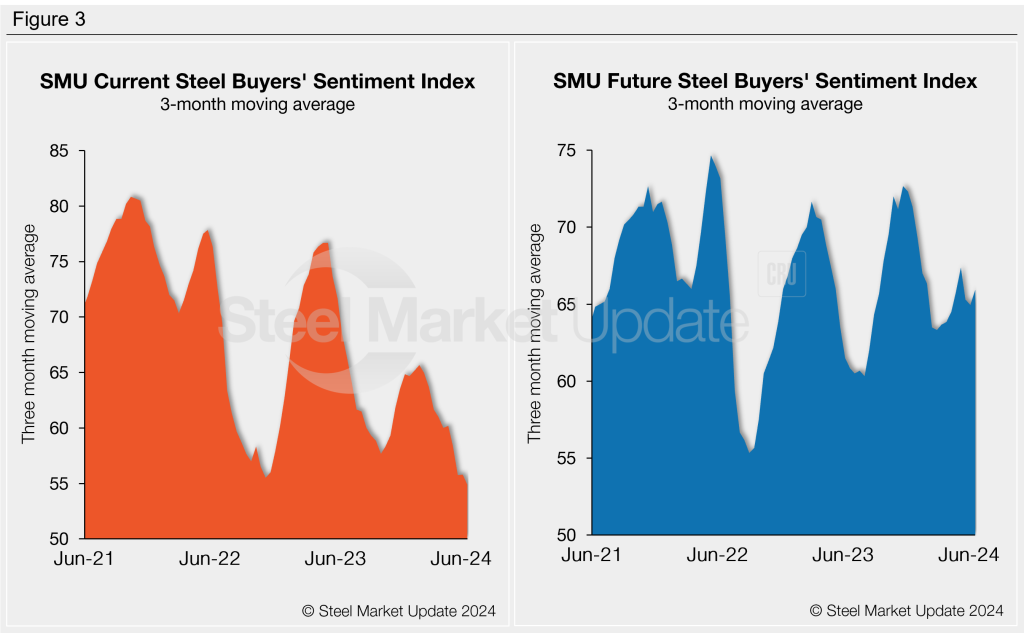

Measured as a three-month moving average, the Current Sentiment 3MMA slipped to +54.89 from +55.78 two weeks earlier.

Meanwhile, this week’s Future Sentiment 3MMA rose to +65.94 from +64.96 at the last market check (Figure 3).

What SMU survey respondents had to say:

“Margins are slim, so have to time buys correctly and closely monitor overhead.”

“With so much of our business being as an OEM, we don’t hate falling prices!”

“Well-timed buys in the next month or so should set us up for a better second half.”

“We’ll do well if prices rebound at all.”

“We will run lean and mean, but only placing summer mill orders if we have a customer PO in hand.”

“Hopefully we see some sort of stability established with a bottom, maybe a slight increase in demand.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.