Market Data

June 19, 2024

SMU survey: Most sheet buyers find mills more flexible on price, plate less

Written by Ethan Bernard

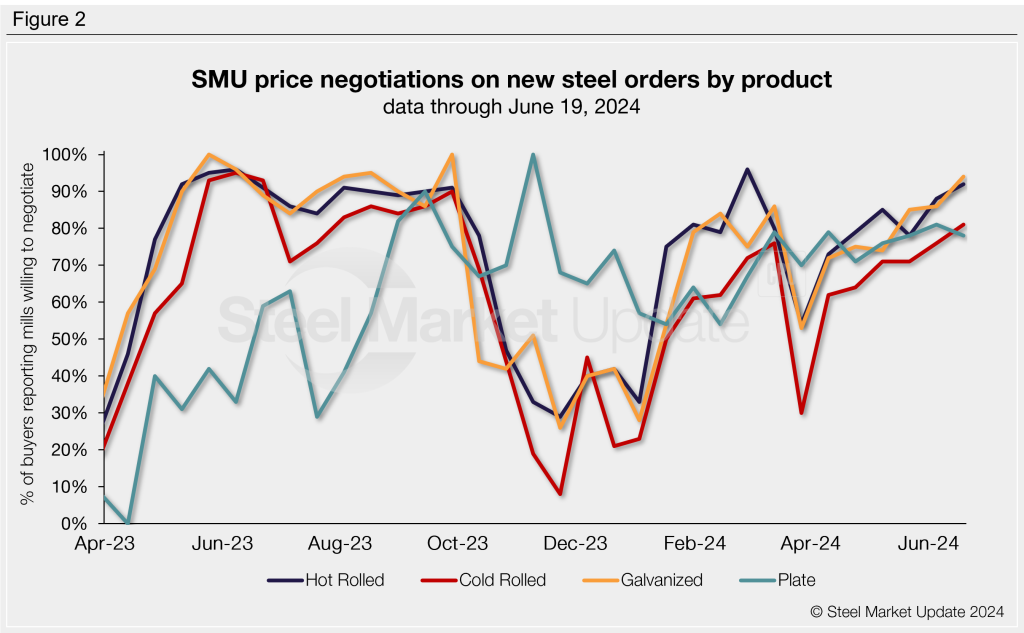

Steel buyers of hot-rolled, cold-rolled, and galvanized products found mills more willing to negotiate spot pricing this week, according to our most recent survey data. However, buyers of plate products said mills were less willing to talk price.

For buyers of HRC, 92% of respondents said mills were more flexible on price, up four percentage points from two weeks earlier. Meanwhile, plate’s rate ticked down three percentage points to 78%, in the same comparison.

Every other week, SMU polls steel buyers, asking if domestic mills are willing to negotiate lower spot pricing on new orders.

This week, the rate remained flat overall, with 83% of participants surveyed by SMU reporting mills were more willing to negotiate prices for new spot orders. The steady reading keeps the rate around the highest territory this year except for mid-March’s 84% (Figure 1).

Figure 2 below shows negotiation rates by product. The rate for cold-rolled coil stands at 81% this week, a five-percentage point rise from the previous market check, and the rate for galvanized increased eight percentage points to 94%.

Here’s what some survey respondents had to say:

“Depending on the mill (for hot rolled), pricing can be negotiated now.”

“Big tons are getting much lower numbers (on hot rolled).”

“Yes (on cold rolled), but really trying to maintain a $250+ spread to help cover the tight HR band margins.”

“Seemingly willing to deal (on galvanized). Perhaps the increased zinc adders are adding in some margin?”

“Getting aggressive offers for 1,000 tons (on galvanized).”

“Mills seem to be dealing around $700-720 and sub-$700 for larger volume (on hot rolled).”

Note: SMU surveys active steel buyers every two weeks to gauge their steel suppliers’ willingness to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our steel mill negotiations data, visit our website. Additionally, negotiation rates for all products, including Galvalume, are available to premium subscribers on our website here: https://www.steelmarketupdate.com/data-tools/mill-spot-price-negotiations/