Market Data

May 14, 2024

Galvanized prices maintain big premium over HR

Written by Laura Miller

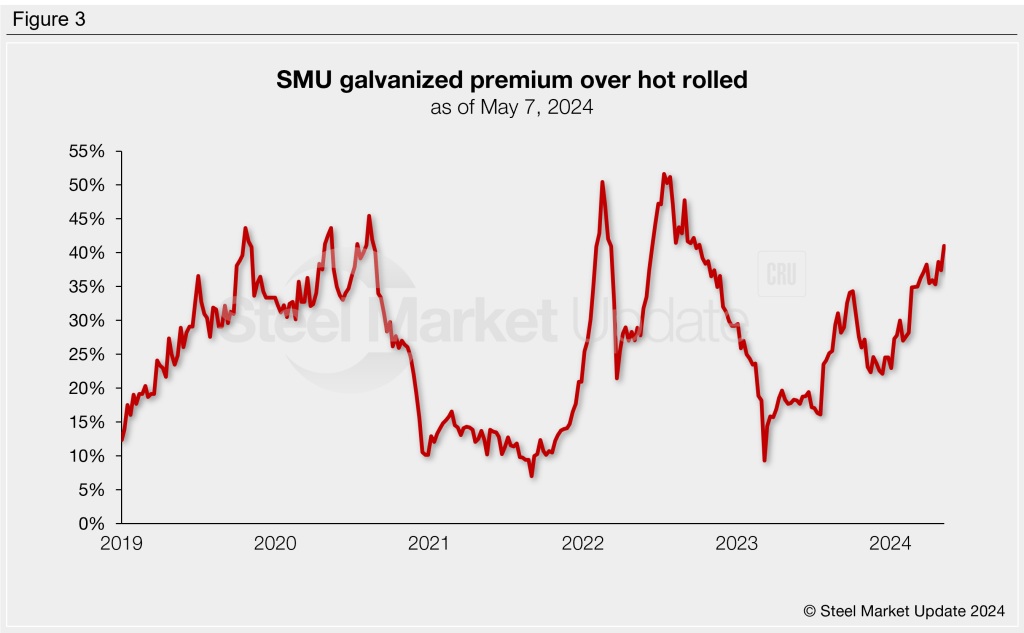

Prices for hot-rolled (HR) coil in recent weeks have been declining faster than those for galvanized sheet, resulting in a growing price spread between the two steel products.

HR prices, on average, have fallen 9% since mid-April to $735 per short ton (st), as of May 7. (Note this article was written before SMU prices were updated on Tuesday, May 14.) At the same time, average galvanized prices have declined by just 3% to $1,100/st.

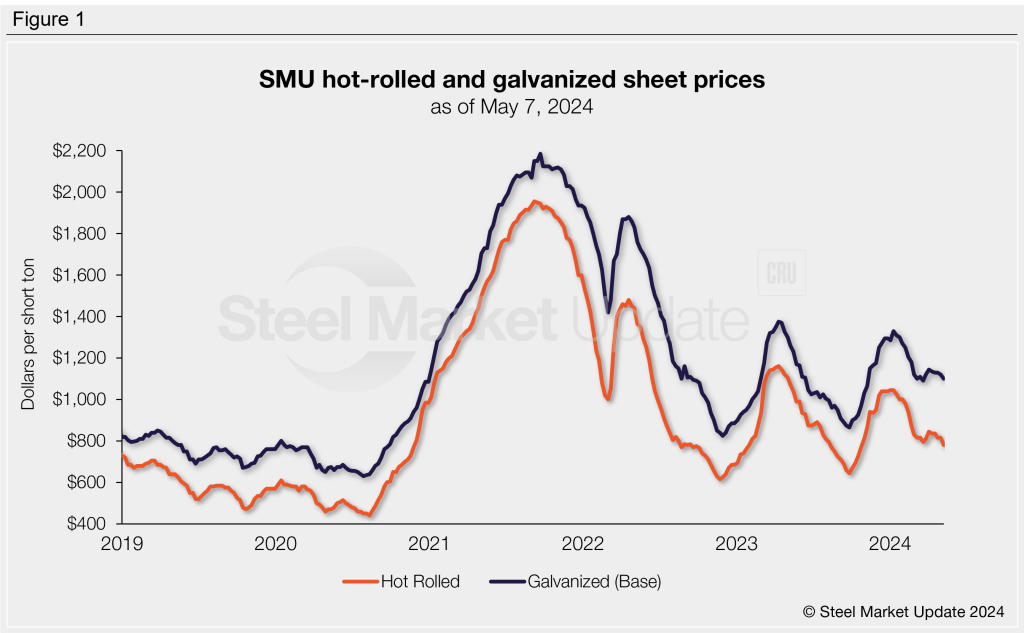

The result is a growing price spread between the two products. Let’s consider the difference in dollars per (short) ton.

Like could be said of many other things, the spread has been more erratic post-pandemic. From 2014 to 2018, the spread averaged $148/st, and in 2019 it was $164/st. It rose further in 2020 to $177/st and $209/st in 2021 before spiking to an average of $367/st in 2022. Last year brought a decline in the spread to an average of $195/st.

The spread fell to a recent low of $100/st for just one week in early March 2023. But for nine months now, since August 2023, the spread has remained signficant, not falling below $200/st. As of May 7, galvanized sheet held a $320/st premium over HR. That’s the highest the premium has been since September 2022.

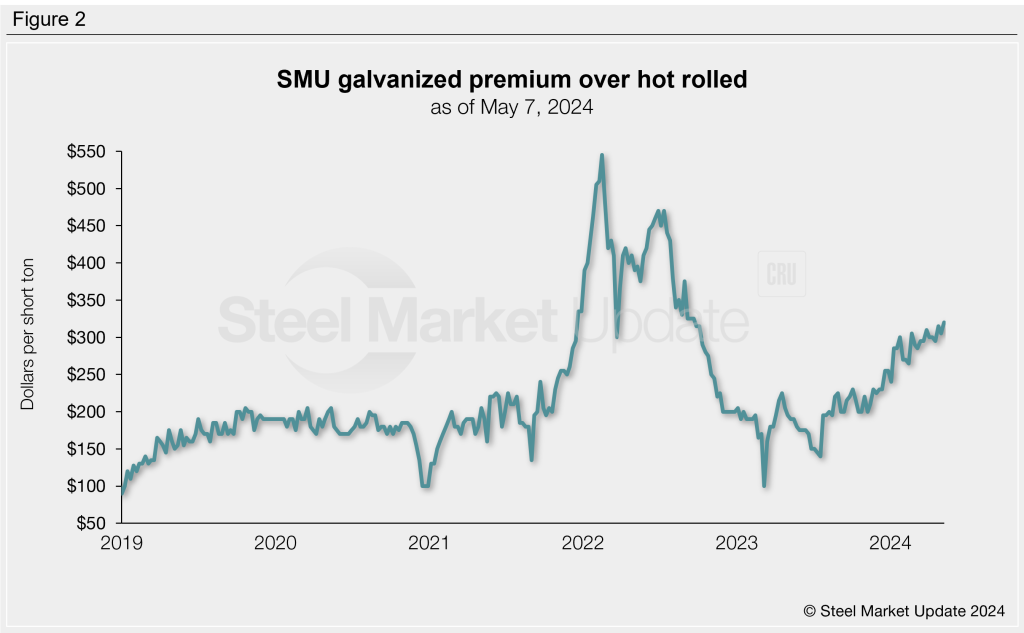

When we look at the spread as a percentage, the rise in galv’s premium over HR across the past year looks even more significant.

Last week, the spread rose four percentage points from the previous week to 41%. That’s a notable increase from 19% at this time last year. As a percentage, the spread is at its largest point since October 2022.