Market Data

May 10, 2024

SMU Steel Demand Index falls to an eight-month low

Written by David Schollaert

Steel Market Update’s Steel Demand Index fell eight points, and back into contraction territory, an indication demand might be slipping as prices have trended lower, according to our latest survey data.

SMU’s Steel Demand Index now stands at 44, down eight points from a reading of 52 at the end of April. The decline brought the index to its lowest measure since mid-September.

Methodology

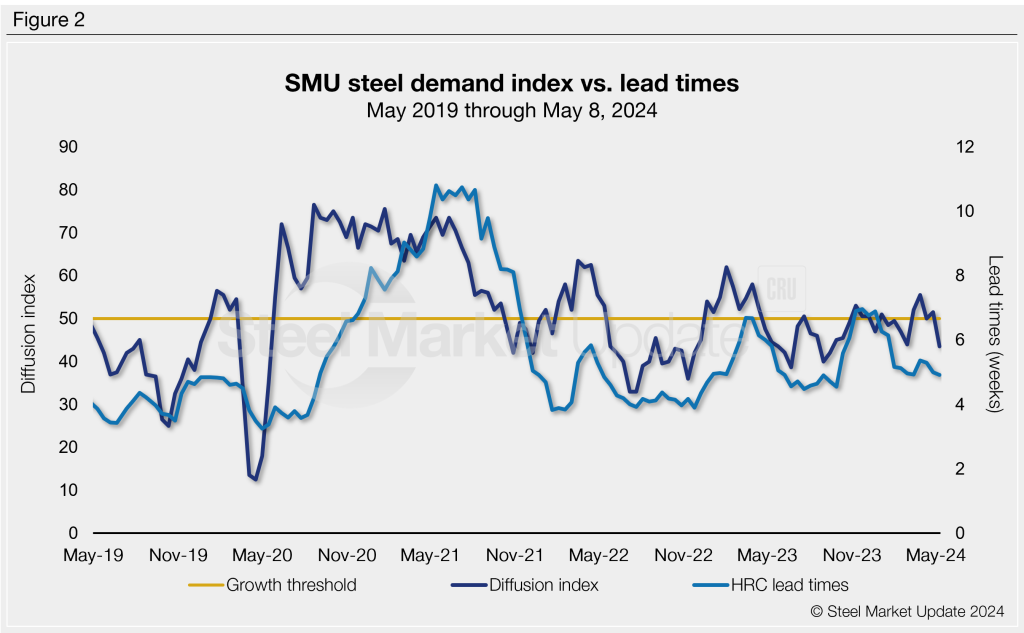

The index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves.

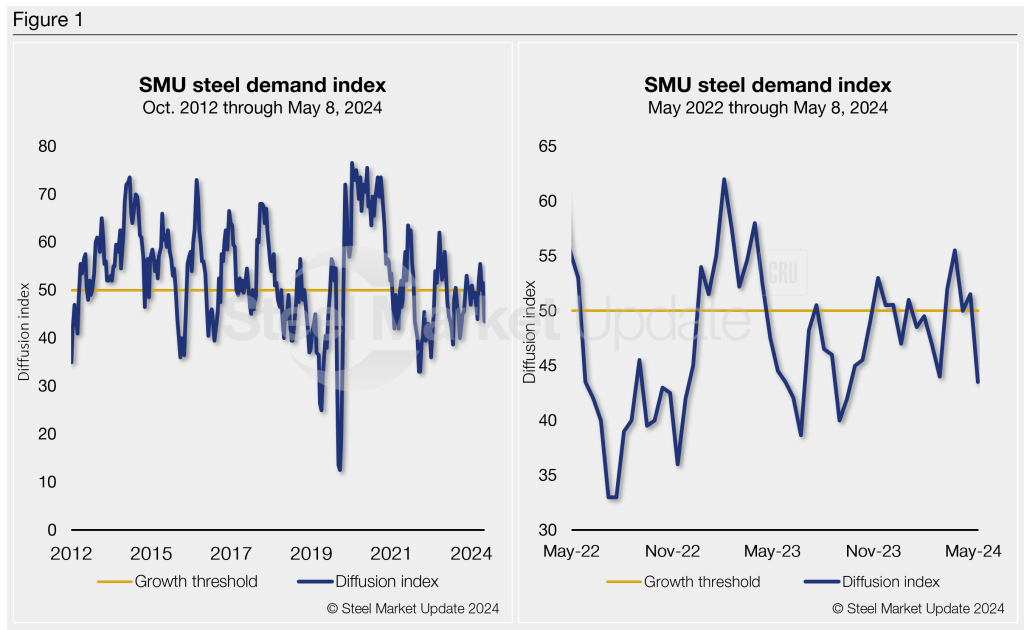

An index score above 50 indicates rising demand and a score below 50 suggests declining demand. Detailed side by side in Figure 1 are both the historical views and the latest Steel Demand Index trend.

Latest developments

The negative move comes after the index had swung to growth in early March on the heels of Q2 buying and rising prices. The latest change comes as tags and lead times have been ticking down, while sheet buyers continue to find mills are willing to talk price.

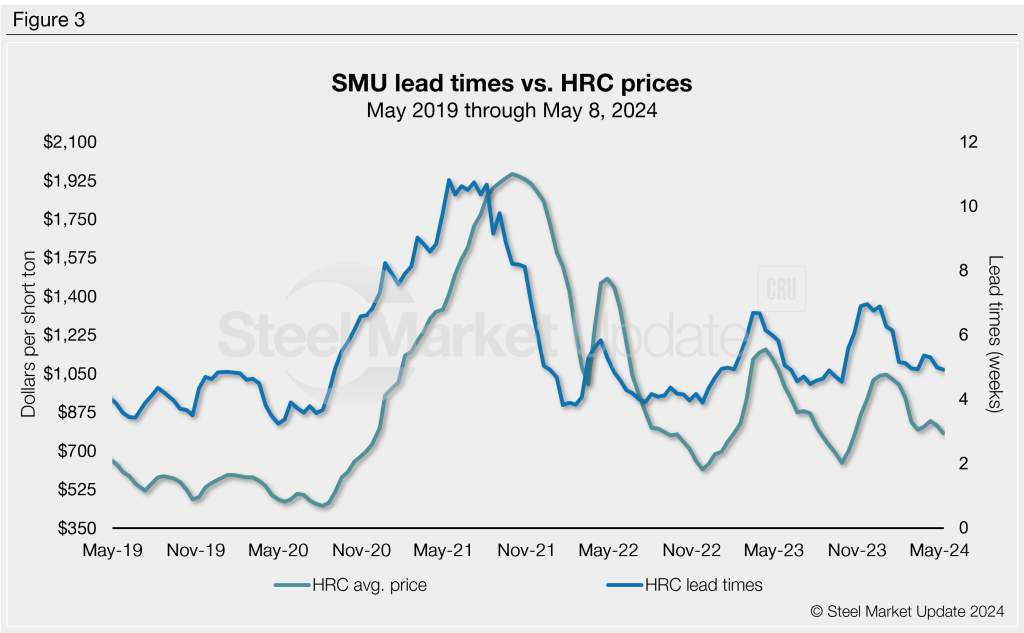

Lead times ticked down to 4.92 weeks on average – its lowest reading since early October – while hot-rolled (HR) coil fell below $800 per short ton (st) for only the second time year to date. HR prices now stand at an average of $780/st FOB mill, east of the Rockies. That’s down $35/st week on week, according to SMU’s latest check of the market on Tuesday, May 7.

It’s not all bad news. Despite the lower reading, nearly two-thirds of survey respondents report stable or improving demand. However, 25% are reporting declining demand, a jump from just 9% less than two months ago.

Recall the only time the index has moved into growth territory since late-April 2023 has been for short-lived bumps when the market responded to mill price hikes in mid-June, late September, November, and mid-March.

Apart from short-lived rallies, SMU’s Steel Demand Index has trended downwards and in contraction territory for significant clips over the past year.

It’s important to note that SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times (Figure 2), and SMU’s lead times have also been a leading indicator for flat-rolled steel prices, particularly HRC (Figure 3).

What SMU survey respondents had to say

“Demand seems off.”

“Construction season start-up will help demand.”

“Competing with stock on the ground in some product groups.”

“Better but not on the same trajectory as one month ago.”

“Stable on contract sales, declining on transactional since we don’t price off replacement cost. We don’t want to eat losses.”

“With prices sliding, demand is moving down, and the summer auto slowdown is upcoming.”

“Slightly better; spot market buyers likely to emerge again for June HRC in the coming one to two weeks.”

Note: Demand, lead times, and prices are based on the average data from manufacturers and steel service centers that participate in SMU’s market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.