Canada

May 9, 2024

Stelco reports solid Q1, plans to up value-added output

Written by Laura Miller

Stelco reported a positive start to 2024 in its first-quarter earnings report on Thursday. And with steady demand and a stable market, the Canadian flat-rolled steelmaker is optimistic for the remainder of the year.

First-quarter results

| First quarter ended March 31 | 2024 | 2023 | % Change |

|---|---|---|---|

| Net sales | $746 | $687 | 9% |

| Net earnings (loss) | $63 | $(11) | 673% |

| Per diluted share | $1.14 | $(0.20) | 670% |

From a loss in last year’s Q1, Stelco swung to a profit in Q1’24, posting net income of CA$63 million (US$46 million).

Average selling prices 18-20% higher than Q1’23 and Q4’23 pushed sales 9% and 22% higher, respectively, to CA$746 million in Q1.

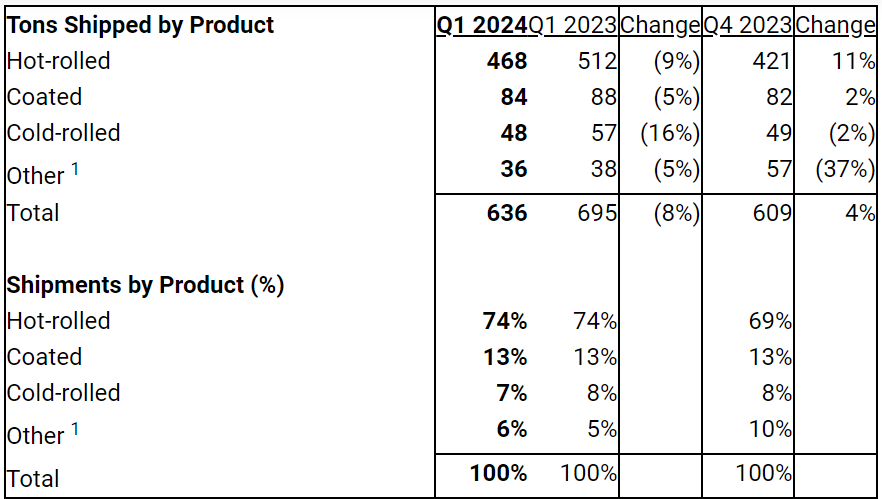

Shipping volumes, meanwhile, were down 8.5% year over year (y/y) but rose 4.4% sequentially to 636,000 short tons. Shipments of all product categories were down on-year, but hot rolled and coated shipments showed quarter-on-quarter increases. The table below shows Stelco’s shipments in short tons.

In the current quarter, Stelco is expecting shipments to be in the range of 625,000 to 650,000 st.

Increasing value-added output

Stelco’s CEO and chairman Alan Kestenbaum said on an earnings call on Thursday that Stelco has already begun executing an initiative he alluded to in a prior earnings call.

By incrementally increasing its utilization of unused downstream value-added capacity at its mill in Hamilton, Ontario, the company is taking advantage of what is “essentially a capex-free opportunity.”

The CEO said the company expects “on an annualized basis to see an increase in that part of the business by over 15% as we get through this year,” with hopes to double that in 2025.

He said that Stelco has an ambitious three-phase plan that will be rolled out over the next two years.

“Keep in mind … we’ve got about 50% capacity utilization available in that part of the business,” he said.

“This is a dramatic, major, and important shift in this company,” he added.

Continued focus on M&A

Kestenbaum has made no secret that he is looking at various ways to grow Stelco. On Thursday’s call, he echoed his previous comments, noting his continued focus on M&A opportunities.

“M&A is something that’s unpredictable. It’s opportunistic,” he told analysts and shareholders on the call. “We’re not like Starbucks. We’re not gonna go and build 200 stores this year … this is a company that lives by being able to exploit opportunities.”

And with CA$645 million in cash and no borrowing on its revolving credit facilities as of the end of Q1, the company has “a very, very flexible balance sheet to enable us to do that,” he added.

Decarb announcement forthcoming

Kestenbaum said the company will in June make an announcement regarding decarbonization initiatives with support from the Canadian government.

“We’ve had major, major advancements on all fronts, both in terms of technology and government support,” he said on the call in response to a question about the opportunities for potential government support on decarb projects.

“I’m not at liberty to give you precise programs that have been awarded to us, but that will come out in June,” he said, noting that “everything we planned on, we alluded to … is happening.”

On steel prices

Kestenbaum said steel buyers’ behavior and the effect on pricing has become somewhat predictable. “We do see the same cycle happening again. History has been repeating itself consistently since 2021,” he commented.

It’s too early to tell how Nucor’s new weekly pricing mechanism will affect the market, but the impact should be clearer three-to-six months down the road, he said.

Some of the recent softness in steel prices “may impact some of our competition” but “should have less of an impact on us,” he noted.

On demand

Stelco’s order book is into the latter part of June, Kestenbaum said.

As for demand, nonresidential construction, residential construction, automotive, oil and gas, “Really across the board we’re seeing demand steady,” he noted. Any “ebbs and flows” are seen as “pricing related.”

There has been a lot of growth in Canada from government spending, including “big infrastructure projects that definitely consume a lot of steel, and we’re right at the forefront” of that, he pointed out.

He also referred to “an acute housing shortage” in Canada that’s driving construction despite higher interest rates.

“The Canadian environment is very, very positive,” he stated, noting that more than 80% of Stelco’s shipments stay in Canada.

“While the impact of pricing is very much related to what goes on in the US, the local demand in Canada is excellent,” he added.