Market Data

April 12, 2024

SMU survey: Buyers' sentiment increases

Written by Ethan Bernard

SMU’s Steel Buyers’ Sentiment Indices both rose this week.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index. (We have historical data dating to 2008. You can find that here.)

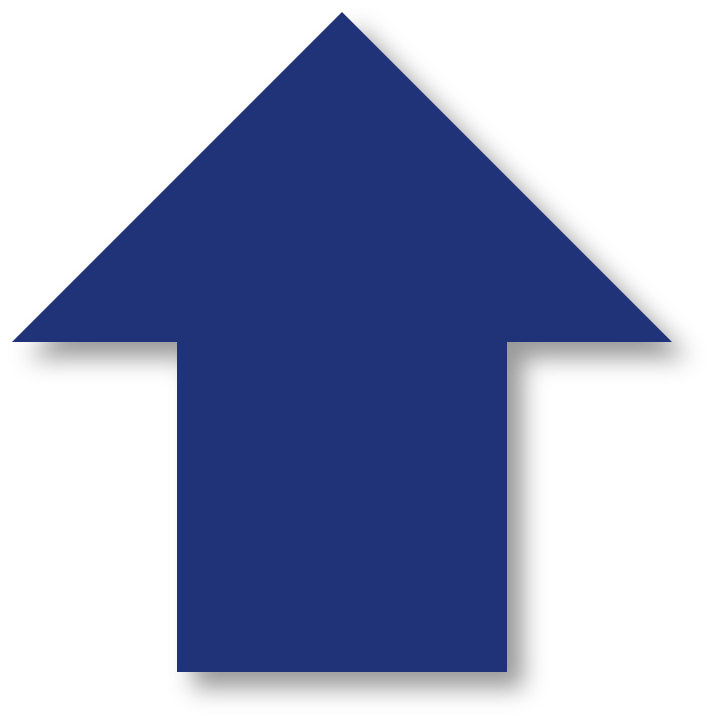

SMU’s Current Buyers’ Sentiment Index stands at +61 this week, up nine points from two weeks earlier (Figure 1). This is the first time it’s broken 60 since the middle of February.

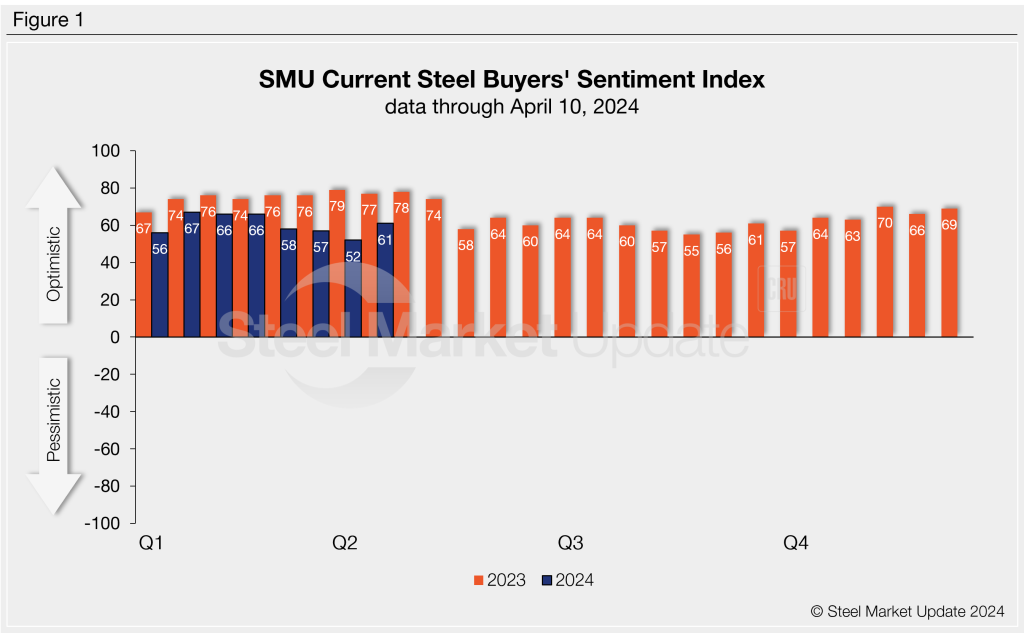

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. The index increased three points this week to +66 (Figure 2). Future Sentiment has only fallen below +60 once so far in 2024, in the middle of February.

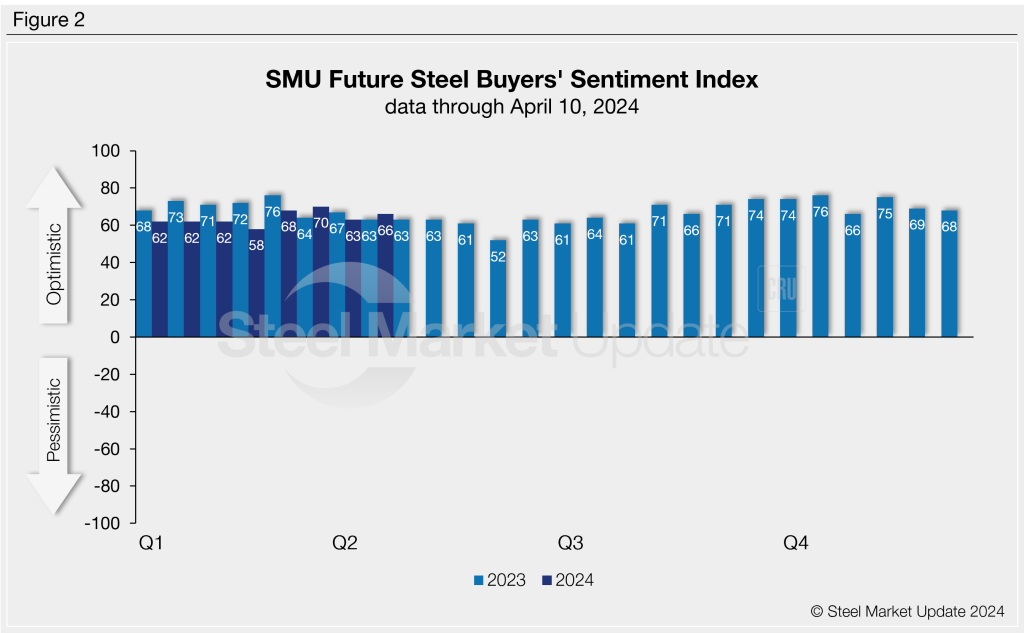

Measured as a three-month moving average, the Current Sentiment 3MMA fell one point to +60.00 (Figure 3).

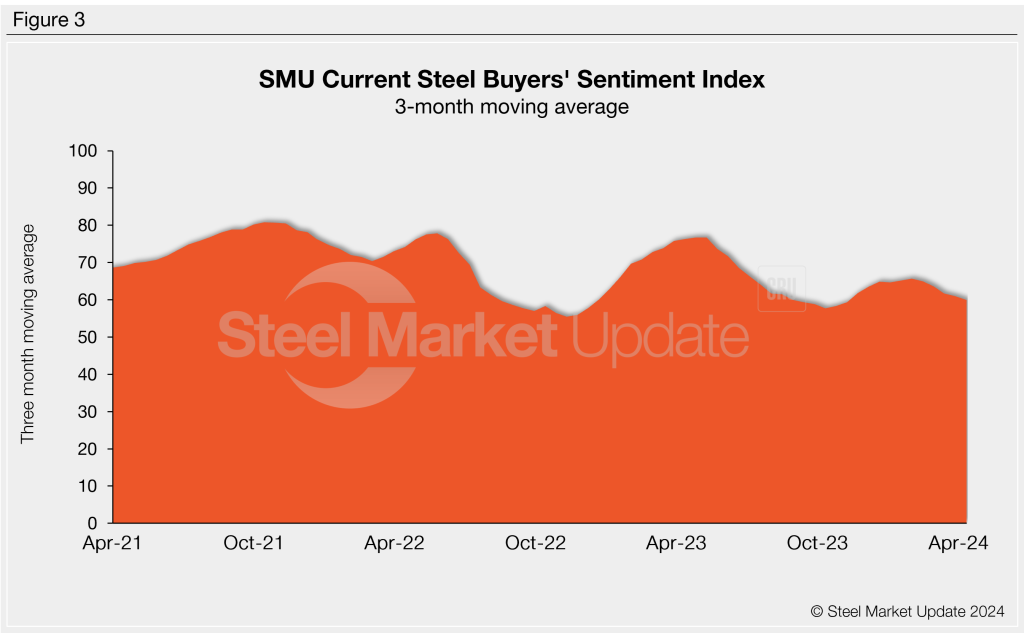

This week’s Future Sentiment 3MMA increased to +64.50 vs. +63.83 at the last market check. (Figure 4).

What SMU survey respondents had to say:

“H2’24 might be interesting if the market doesn’t stabilize. I predict extreme volatility will continue, contrary to HR futures.”

“We are still working through high-cost steel received in January/February.”

“Labor is an issue.”

“So hard to predict where the market will be in six months since mills have been driving price movement, not demand.”

“Labor is biggest constraint”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.