Analysis

February 8, 2024

Dodge: January gain thanks to institutional planning

Written by David Schollaert

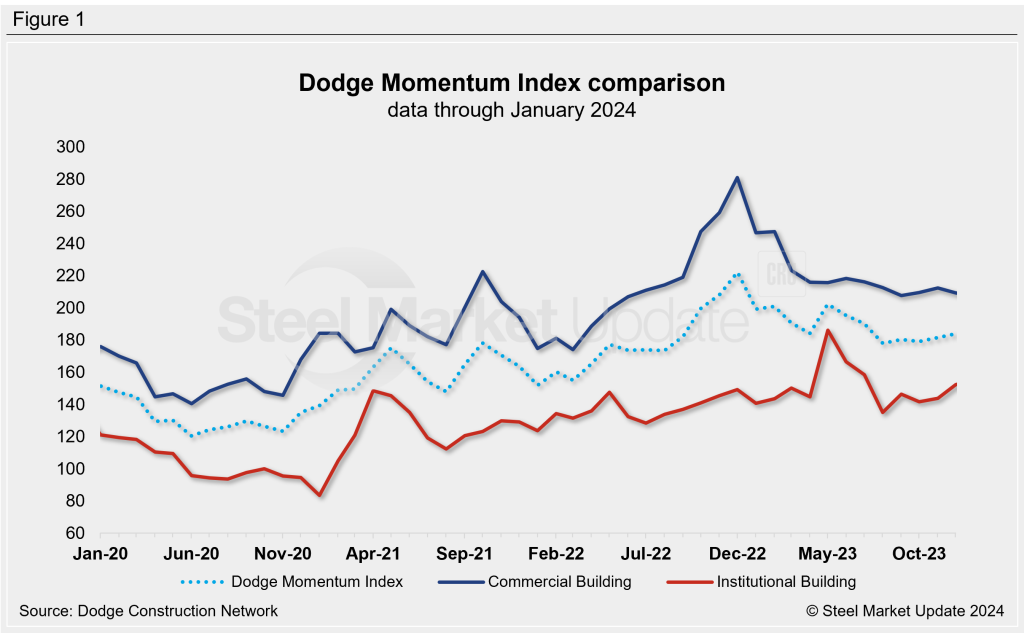

The Dodge Momentum Index (DMI) was largely unchanged in January, moving up marginally due to improved institutional conditions, according to the latest Dodge Construction Network (DCN) data.

The DMI increased in January to 184.1 from a revised December reading of 183.9, DCN said on Thursday, Feb. 8. That’s just a 0.1% increase vs. the prior month, but 3% below January 2023’s reading.

“Divergent trends between commercial and institutional planning continued in January, nullifying any growth on the overall Momentum Index,” Sarah Martin, associate director of forecasting for DCN, said in a statement.

“Nevertheless, lending standards began to loosen in January and the Fed is expected to begin cutting rates in the back half of the year. With this in mind, momentum should resume in commercial activity throughout 2024 as owners and developers gain confidence in market conditions for 2025,” Martin added.

Education and healthcare planning supported growth in institutional planning, while slower growth in warehouse planning pulled down the commercial side of the Index in January, reported DCN.

The commercial segment saw a 12% decline from year-ago levels, while the institutional segment was up 15% over the same period.

Overall, 15 projects valued at $100 million and up entered planning in January. Three of those projects have a $200 million value or higher, DCN said.

Dodge is the leading index for commercial real estate, using the data of planned nonresidential building projects to track spending in the important steel-consuming sector for the next 12 months. An interactive history of the DMI is available on our website.