Analysis

January 25, 2024

Global steel production dipped in December, 2023 output down

Written by David Schollaert

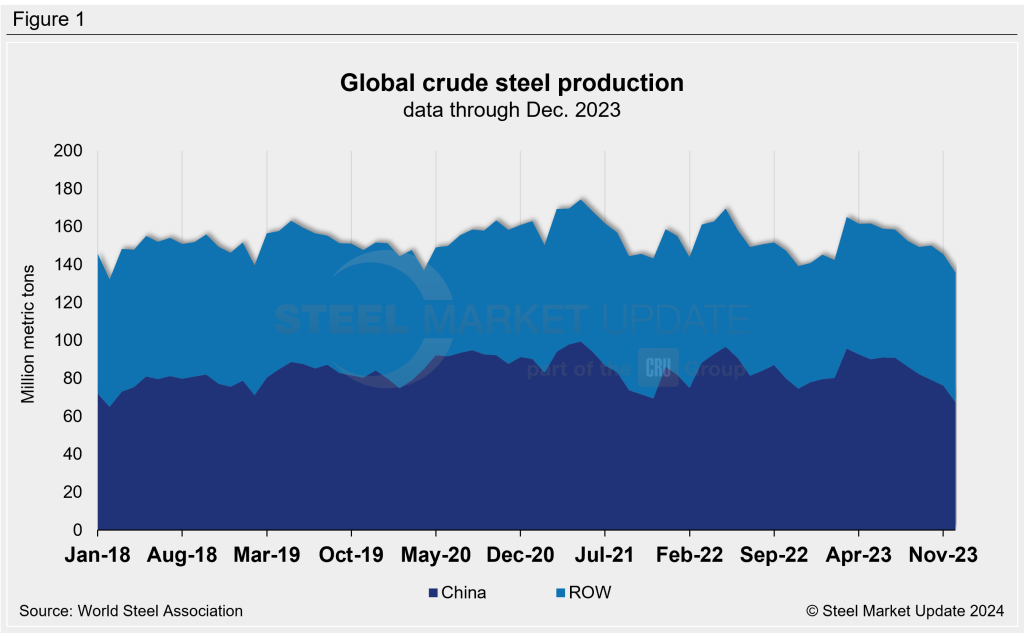

Global steel output fell in December, led by cuts in China, the World Steel Association (worldsteel) said in its latest monthly report. Annual totals in 2023 saw a similar trend.

Producers around the world produced 135.7 million metric tons (mt) of steel in December. This was 3.1% below the 145.5 million mt produced the month before and was a 5.3% year-on-year (y/y) decline, worldsteel said.

All told, despite the month-on-month (m/m) decline in global crude steel production last month, output totaled 1.89 billion mt in 2023. The results were largely identical vs. 2022, the report said.

Regional breakdown

China, the world’s top steel producer, saw a 14.9% m/m decline in output to 67.4 million mt in December. China’s production was unchanged y/y, however. December marked the lowest month for Chinese steel production since February 2018.

Meanwhile, steel output in the rest of the world (RoW) declined by 1.6% m/m but was nearly 9% higher y/y to 68.3 million mt in December. For the year, output in the RoW totaled 815.2 million mt in 2023, down 0.5% vs. 2022 when production reached 819.3 million mt.

Regionally, Europe, Other, saw the highest y/y rise in output, increasing by 19.4% y/y to 3.9 million mt. Africa’s production rose by 17.7%; Russia, other CIS, and Ukraine’s by 11.8%; the Middle East’s by 9.6%; and the EU’s was up by 2.7%.

North America’s steel output was up 5.3% y/y in December at 9.3 million mt, but down 1.7% in 2023 vs. the year prior, according to worldsteel’s figures.

Regions with lower on-year production included Asia and Oceania (-9.7% to 96.4 million mt – severely impacted by China’s lower output) and South America (-3.2% to 3.2 million mt).