Analysis

January 17, 2024

November exports hit lowest point of 2023

Written by Laura Miller

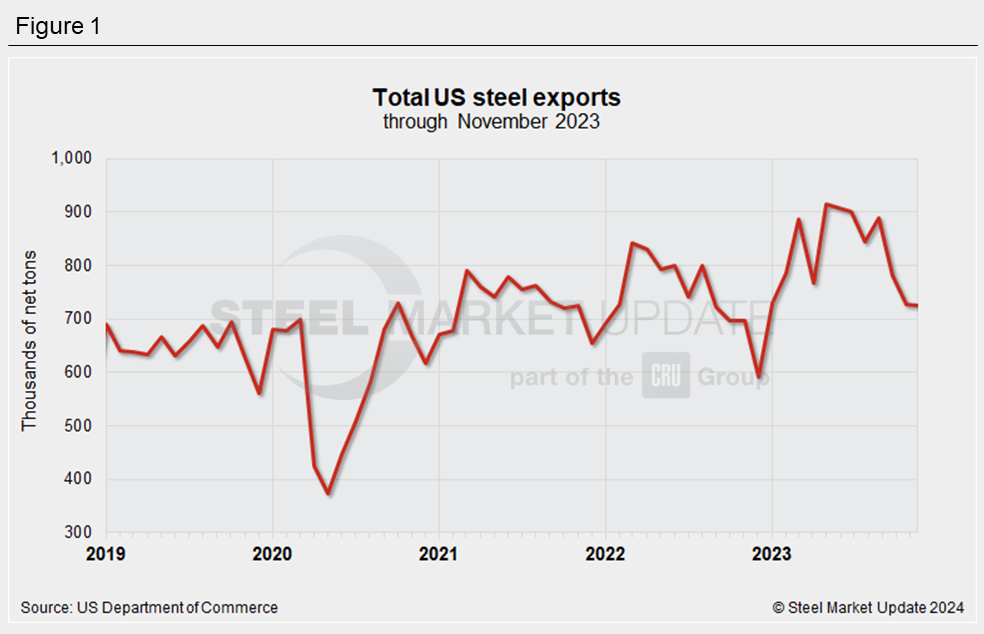

US steel exports were flat from October to November, but November took the prize for the fewest monthly exports year to date in 2023.

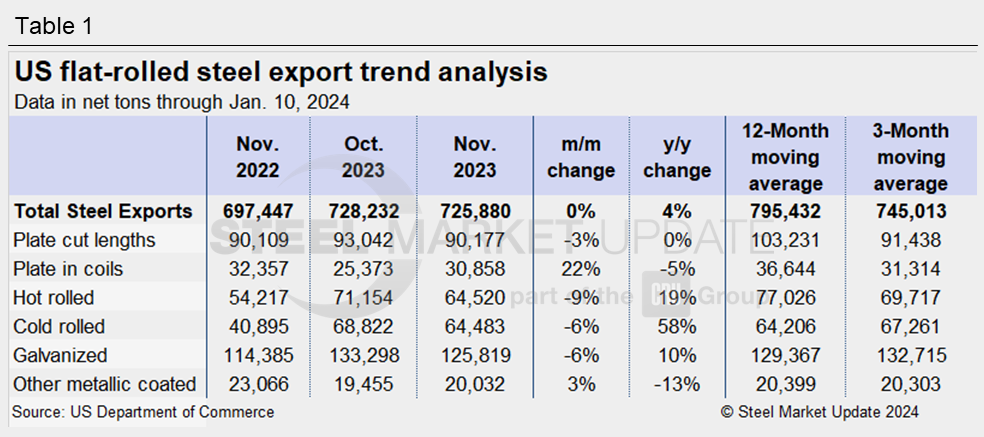

The US exported 725,880 net tons of steel products in November, according to the latest data available from the US Department of Commerce. While flat from 728,232 tons in the prior month, November’s shipments out of the country were 4% higher than November 2022.

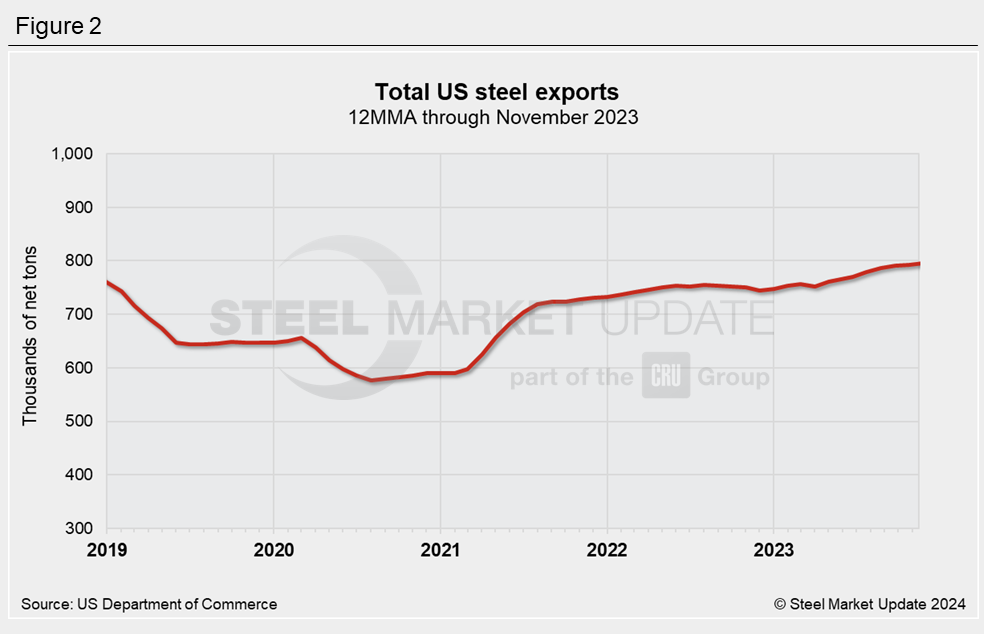

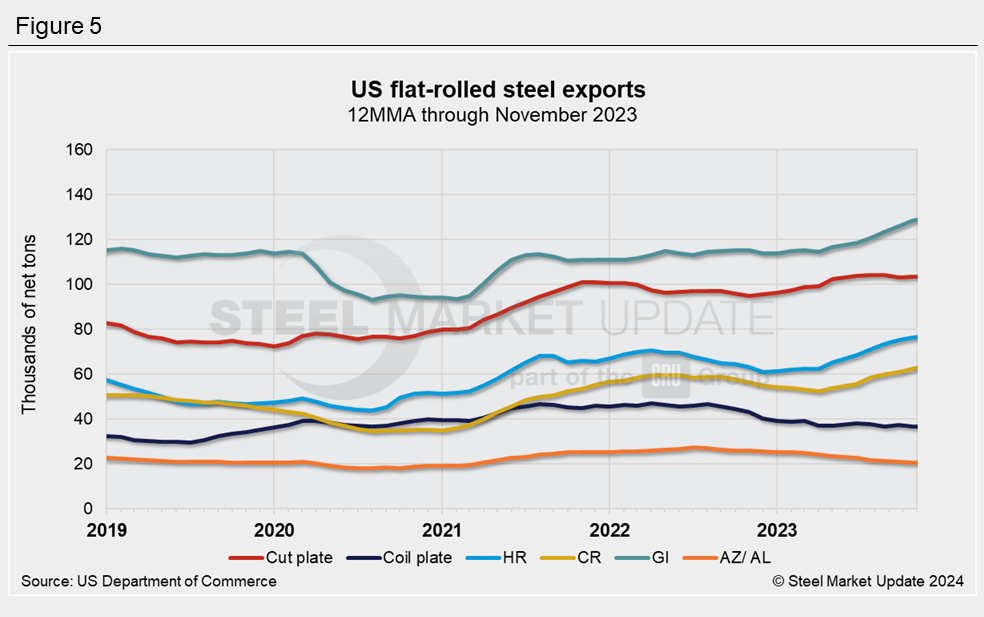

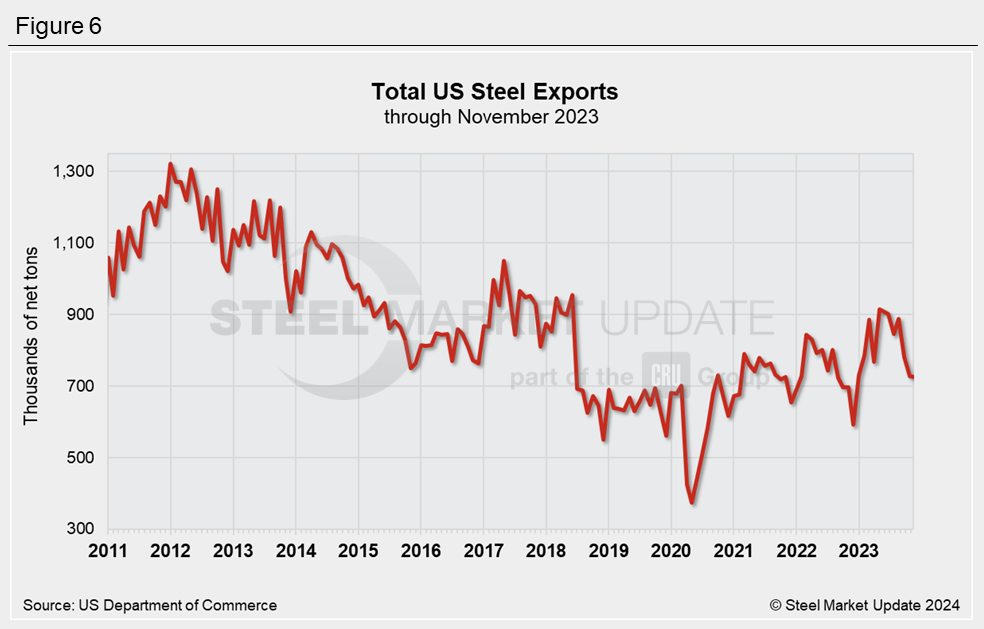

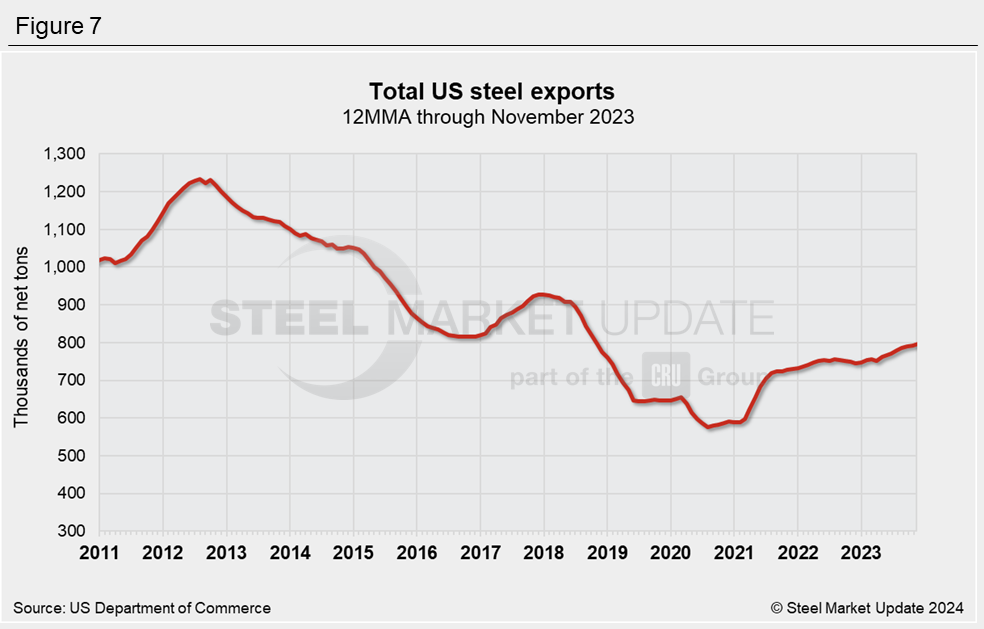

Looking at exports on a 12-month moving average basis to smooth out the month-to-month fluctuations, we can see shipments rising from a recent low in August 2020. From mid-2021 through November 2023, exports steadily increased.

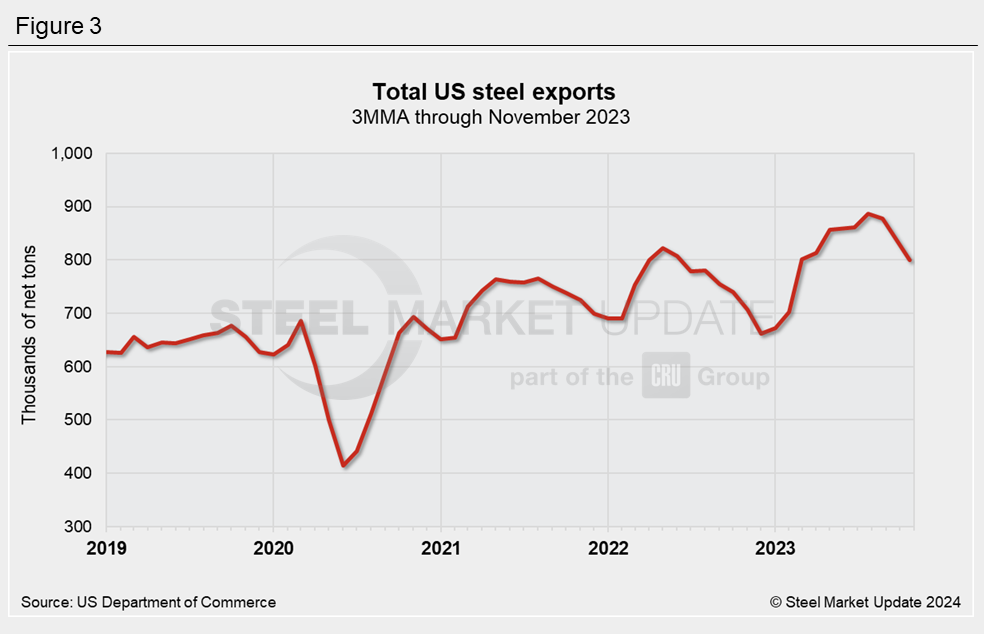

On a three-month moving average basis, however, we can see exports falling from a recent high of 886,666 tons in July 2023 to 745,013 tons in November.

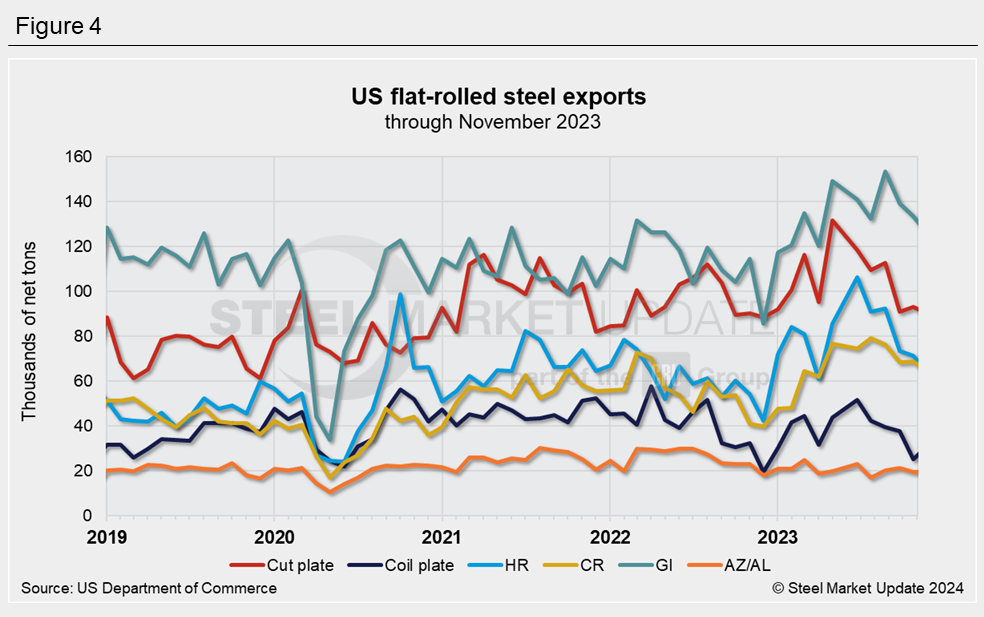

Exports of all major flat-rolled steel products showed month-on-month (m/m) declines in November, except for coiled plate, which saw a 22% m/m jump. Note that shipments of coiled plate to foreign destinations were at a 10-month low in October.

Notable year-on-year (y/y) increases were seen in exports of cold-rolled, hot-rolled, and galvanized sheet. 2023 was a strong year for exports of those products.

Galvanized, hot rolled, and cold rolled exports, on a 12MMA basis, were at recent highs in November at 129,367 tons, 77,026 tons, and 64,206 tons, respectively.

Steel exports have generally been trending upwards since mid-2020, but if we look at historical export levels, they are down significantly from the years 2011 through 2018.

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico.