Market Data

January 12, 2024

HRC vs. CRC price spread jumps in second week of new year

Written by Laura Miller

The spread between hot-rolled coil (HRC) and cold-rolled coil (CRC) prices jumped during the week of Jan. 9 as cold rolled tags continued to rise while hot rolled tags held steady.

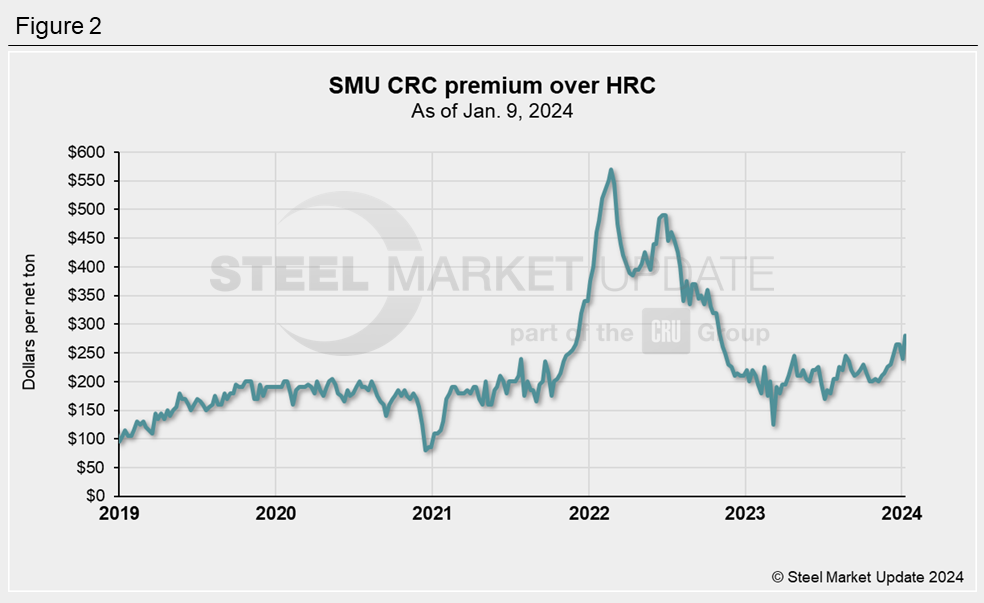

The spread declined slightly from $265 per net ton at the end of December to $240/ton in the first week of January. As of Jan. 9, CRC’s premium over HRC rose to $280/ton.

We arrived at that latest figure using the following analysis based on SMU’s weekly pricing data.

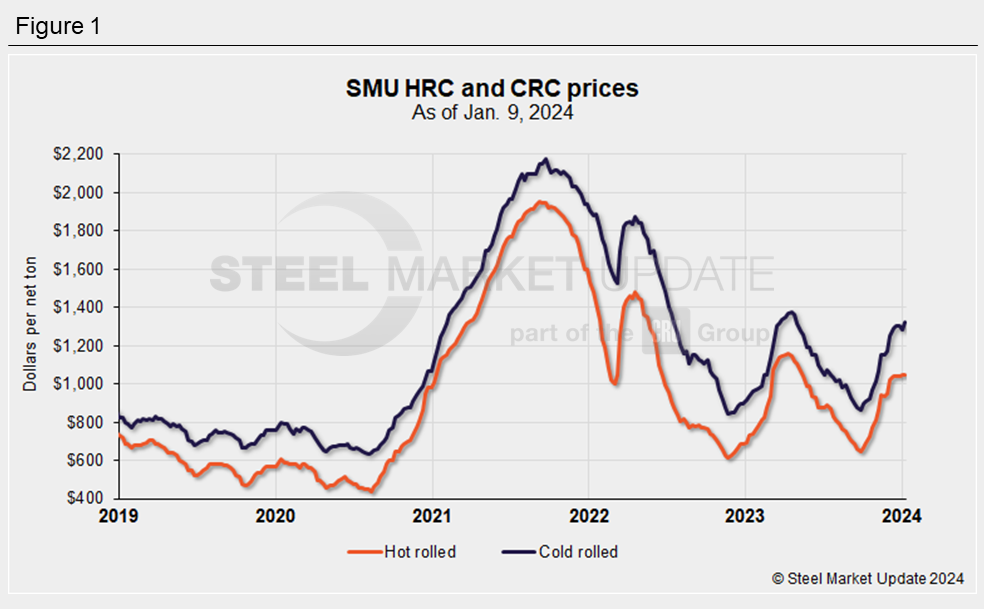

Figure 1 below shows SMU’s average HRC and CRC base prices as of Jan. 9.

The average HRC price was $1,045 per net ton in the second week of 2024. That was unchanged from the prior week. HRC prices have risen, on average, just $25/ton, or 2.5%, since the beginning of December.

CRC prices, meanwhile, rose by $40/ton week on week to $1,325/ton on average during the week of Jan. 9. The average cold rolled price has risen 6% from the start of December.

That puts the spread between HRC and CRC prices at $280/ton as of Jan. 9. The spread rose by $40/ton from the previous week and is $50/ton higher than at December’s start.

As Figure 2 shows, the HRC vs. CRC price spread soared in 2022 and then rapidly declined at year’s end. In 2023, the spread fluctuated while generally trending upwards and then rose quickly to end the year.

The price spread as of Jan. 9 is the highest it’s been since the beginning of November 2022.

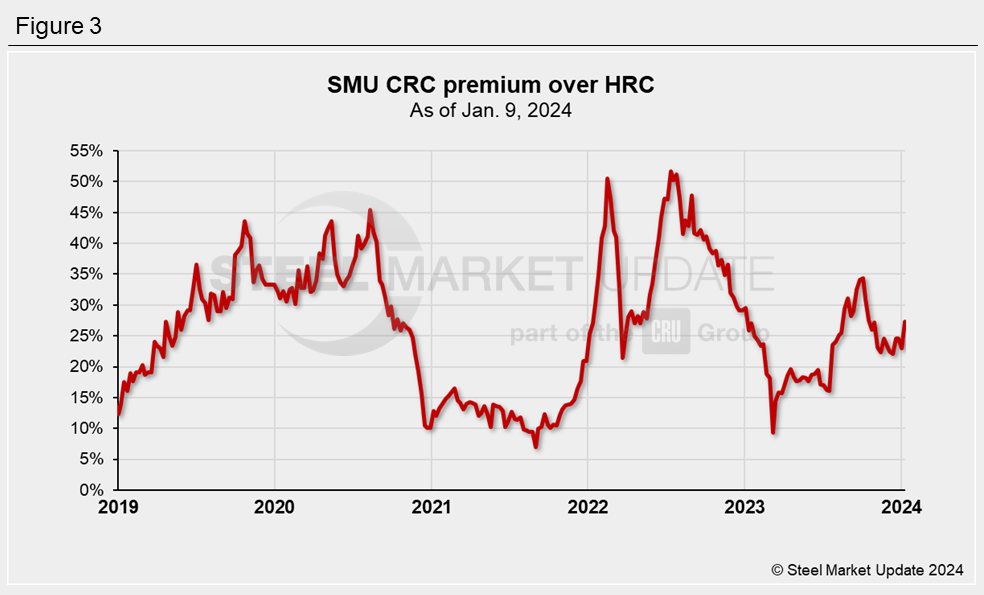

Figure 3 shows the CRC premium over HRC as a percentage of the HRC price.

While cold rolled’s percentage premium over hot rolled took a dive to start 2023, the premium was on the rise during the second week of 2024.

The premium was 123% at both the start of December and during the first week of January. It increased to 127% as of Jan. 9.

You can chart historical HRC and CRC prices using SMU’s interactive pricing tool on our website.