Prices

January 9, 2024

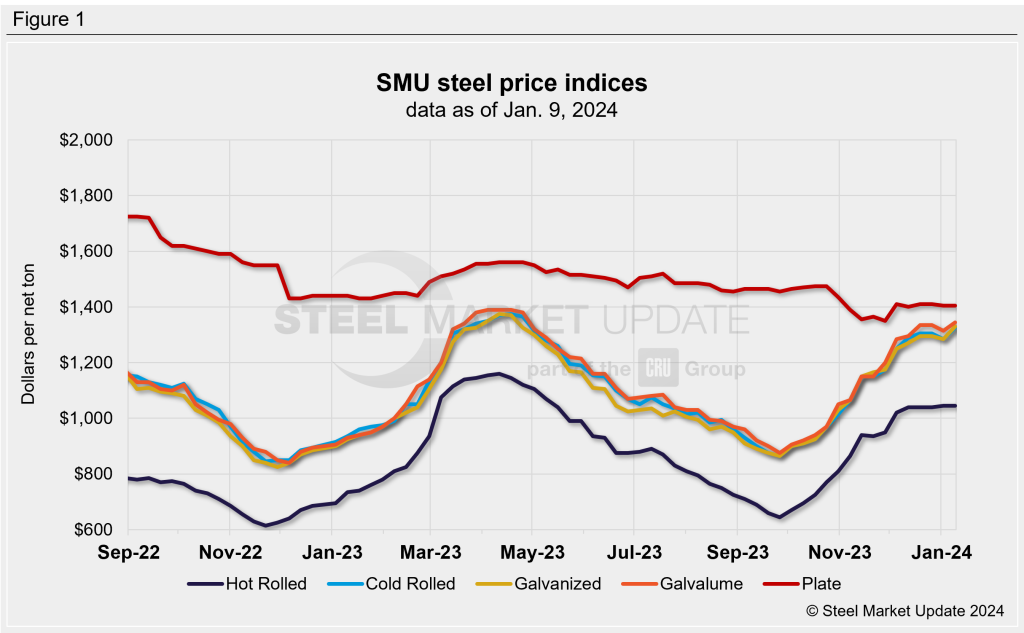

SMU Price Ranges: HR unchanged, peak or pause?

Written by David Schollaert & Michael Cowden

Hot-rolled (HR) coil prices remain in the holding pattern they’ve been in since mid-December, according to SMU pricing archives.

SMU’s HR price stands at $1,045 per ton on average, unchanged from a week ago.

Flat HR prices might result in part from a still unsettled January scrap market, some sources said. That uncertainty could make it difficult for mills to enforce (or even to follow) a price hike announced by Cleveland-Cliffs last week, they said.

Recall that price increase was aimed at lifting spot HR prices to at least $1,150 per ton.

But it was a different story on the cold-rolled and coated side. SMU’s cold-rolled (CR) coil price stands at $1,325 per ton on average, up $40 per ton from last week. Following a similar trend, galvanized was at $1,330 per ton (up $45 per ton) and Galvalume at $1,345 (up $30 per ton).

It was not immediately clear why CR and coated prices would continue to move upward even as HR appears to have plateaued. The divergent trends have at least temporarily created an unusually wide spread between prices HR and those for tandem products.

Some sources said unexpected issues at certain mills might be to blame. Others said they weren’t aware of any production problems. They said supplies of tandem products were simply tighter than those for HR.

SMU’s plate price, meanwhile, was unchanged at $1,405 per on average.

With price trends mixed, our sheet and plate momentum indicators remain at neutral. They will remain so until a clear market direction emerges.

Hot-rolled coil

The SMU price range is $990–1,100 per net ton, with an average of $1,045 per ton FOB mill, east of the Rockies. The bottom end and the top end of our range were unchanged vs. one week ago. Our overall average is, as a result, sideways week on week (WoW). Our price momentum indicator for HRC remains neutral, meaning SMU is unsure of the direction prices will move over the next 30 days.

Hot rolled lead times: 6–8 weeks

Cold-rolled coil

The SMU price range is $1,300–1,350 per net ton, with an average of $1,325 per ton FOB mill, east of the Rockies. The lower end of our range was up $60 per ton vs. the prior week, while the top end of our range was up $20 per ton. Our overall average is up $40 per ton vs. the week prior. Our price momentum indicator for CRC remains neutral, meaning SMU is unsure of the direction prices will move over the next 30 days.

Cold rolled lead times: 6–12 weeks

Galvanized coil

The SMU price range is $1,300-1,360 per ton, with an average of $1,330 per ton FOB mill, east of the Rockies. The lower end of our range was up $60 per ton vs. the prior week, while the top end of our range was $30 per ton higher WoW. Our overall average is up $45 per ton vs. the week prior. Our price momentum indicator for galvanized remains neutral, meaning SMU is unsure of the direction prices will move over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,397–1,457 per ton with an average of $1,427 per ton FOB mill, east of the Rockies.

Galvanized lead times: 6-11 weeks

Galvalume coil

The SMU price range is $1,300–1,390 per net ton, with an average of $1,345 per ton FOB mill, east of the Rockies. The lower end of our range was up $20 per ton vs. the prior week, while the top end of our range was also up $40 per ton. Thus our overall average is up $30 per ton vs. the week prior. Our price momentum indicator for Galvalume remains at neutral, meaning SMU is unsure of the direction prices will move over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,594–1,684 per ton with an average of $1,639 per ton FOB mill, east of the Rockies.

Galvalume lead times: 6-15 weeks

Plate

The SMU price range is $1,380–1,430 per net ton, with an average of $1,405 per ton FOB mill. The lower end of our range was up $10 per ton WoW, while the top end of our range was $10 per ton lower vs. the prior week. Our overall average is unchanged vs. one week ago. Our price momentum indicator for plate remains neutral, meaning SMU is unsure of the direction prices will move over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert