Prices

January 4, 2024

HRC futures: 2024 - Off to the races

Written by David Feldstein

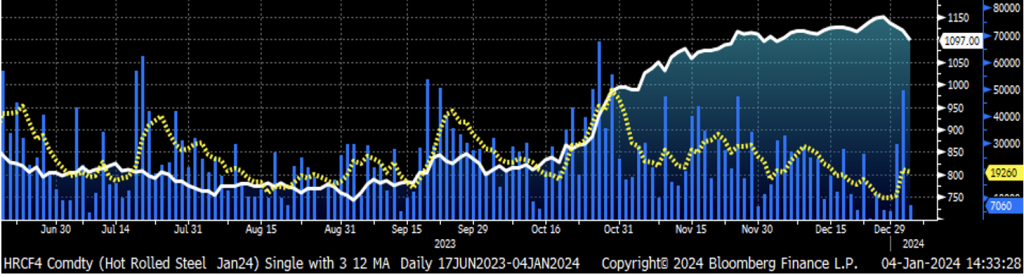

Trading slowed across the Midwest hot-rolled coil (HRC) futures curve in the final weeks of 2023, with prices drifting mostly sideways through the month of December.

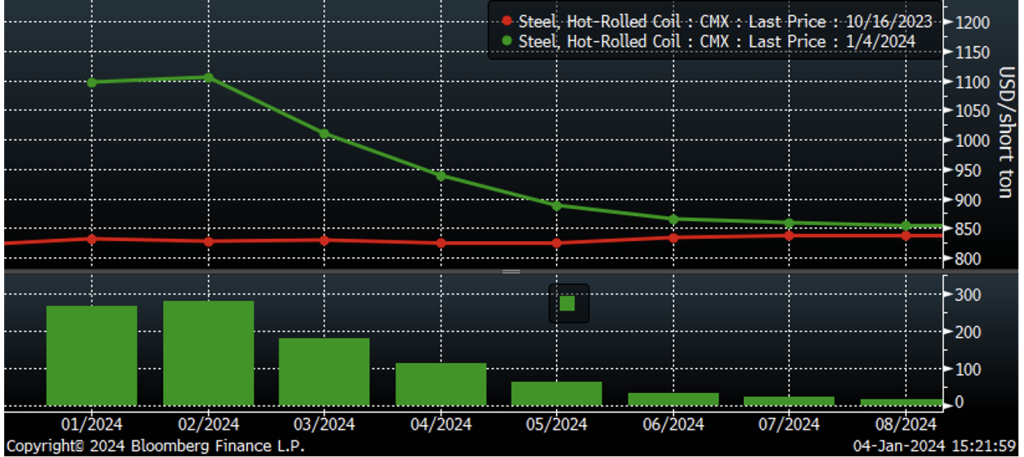

January CME HRC future $/st w aggregate curve volume and 5-day avg.

After the turn of the calendar and return to business on Tuesday, volume jumped to almost 30,000 tons, with sizeable gains in the months of February through May.

The scuttlebutt around the virtual trading pit was the buying was in response to iron ore making new highs and trading $143/t that day in Asia. Seemed a little suspect, but OK. The market has been anticipating mills would announce another price increase. Did somebody know something the market didn’t?

Rolling 2nd month SGX iron ore future $/mt

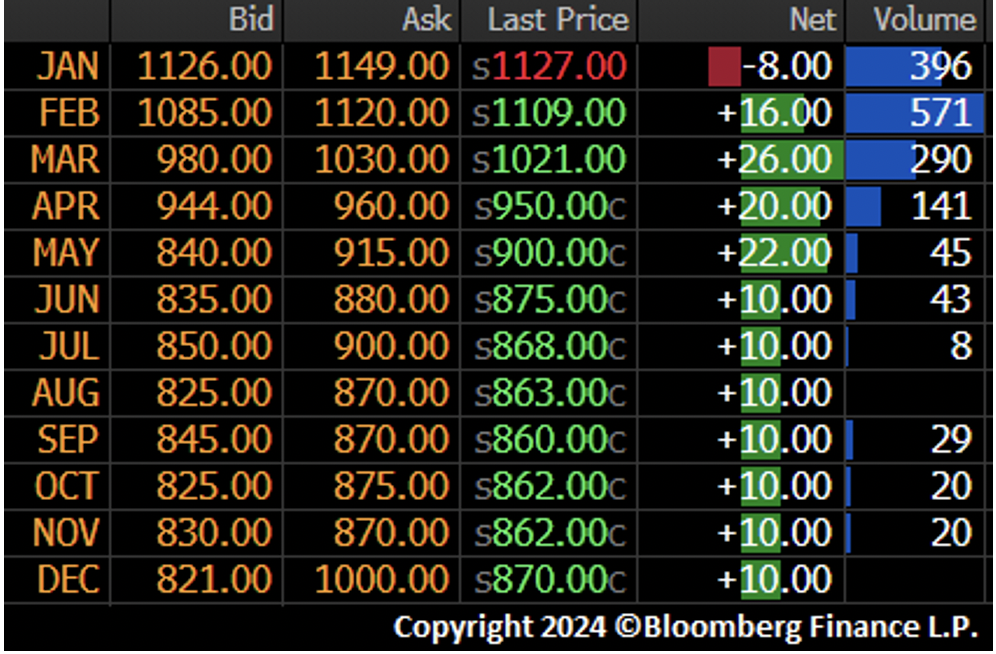

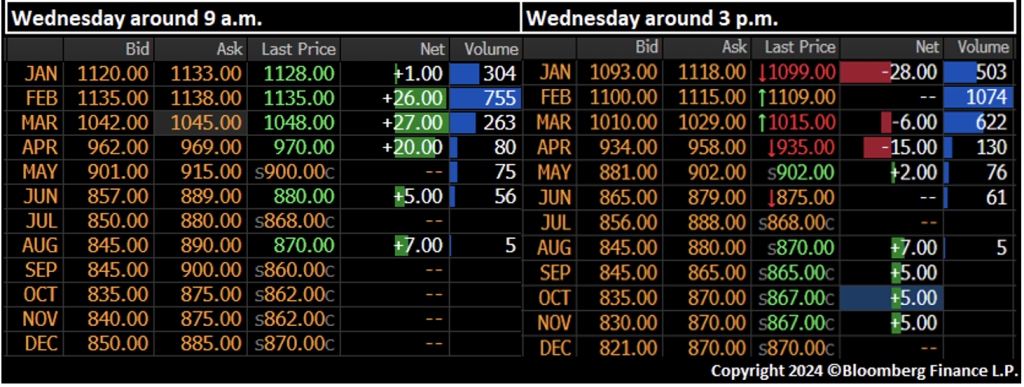

Wednesday morning brought the weekly CRU monitor followed shortly by said price increase with Cliffs announcing a $50 flat rolled price increase.

By 9:00 a.m. the market was adding to Tuesday’s gains, pushing the February future to a new recent intraday high of $1,140, with the market trading 49,420 tons all day. However, as the day continued, the market softened, giving up the mornings gains and then turning red in some months as shown by the market on the right side below. The virtual trading pit rumor mill explained the late-day selling was in response to a report out of Platts that a service center bought 150 tons from a Canadian producer at $1,010.

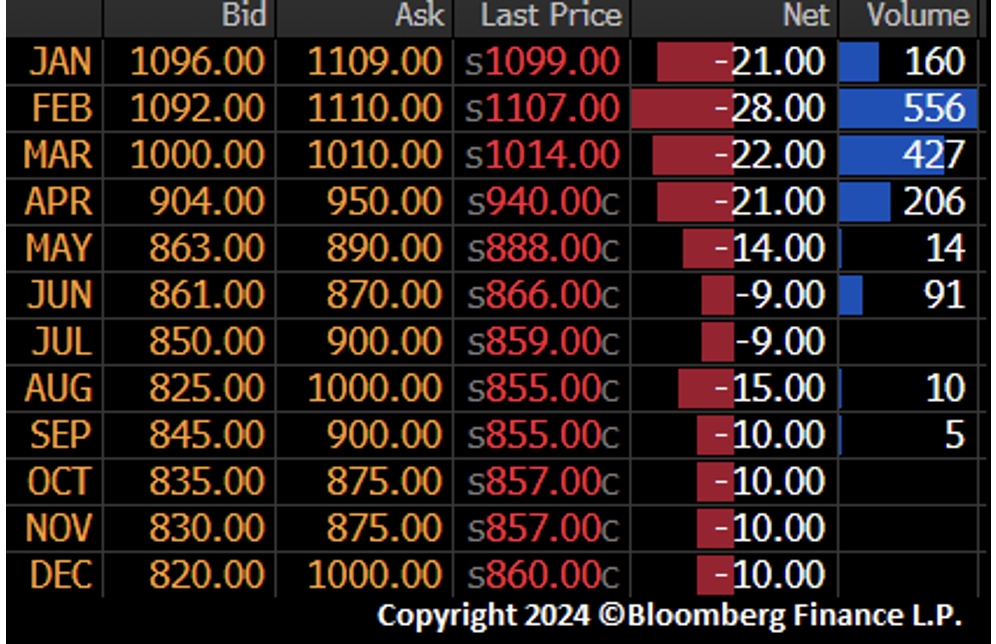

However, the futures continued to be under pressure again on Thursday with almost 30,000 tons traded all day. However, I ain’t buying that explanation. All of this scuttlebutt has me confused. This reminds me of the time I went to the fancy seafood restaurant in downtown Chicago. I made a reservation and when I showed up, the manager said to me, “Do you mind waiting a bit?” I said, “Sure.” He said, “Thanks, can you please take these two martinis to table nine?” As if I don’t get enough confusion at my day job.

Rumors and excuses aside, the first week’s moves are concerning, especially in light of Cliffs’ price increase announcement. Will another mill or mills join Cliffs? Are the EAFs waiting for next week’s scrap settlement before raising their prices, and will we see a price increase to $1,200? It has been quite a move since mid-October, with the January and February futures gaining almost $300, even with today’s declines.

CME hot-rolled coil futures curve $/st

Open interest (the number of outstanding futures contracts, or tons in this case, across a product’s curve) stood at a paltry 376,000 tons as of Wednesday night’s close. Where are all the tons? Are they being held in OTC or off-exchange accounts at a bank or banks? There has been a 16,000 ton increase in open interest over the first two trading days of this week, but still open interest is suspiciously low.

Rolling 2nd month CME HRC future $/st & open interest (red) (22-day M.A. ylw)

Perhaps the selling of the past day-and-a-half was service centers and/or importers simply rushing in to capture the big gains of Q4, with their focus on quickly getting a position on rather than trying to get a better price? Could it be financial players anticipating the service centers and importers’ need to hedge and getting ahead of them? Maybe it has been financial players that had been sidelined by the year-end now able to establish their 2024 positions? So far this week, there has been a risk-off tone across financial markets, with sell-offs in products, including base metals and equities, so possibly the move in HRC is part of a larger trading strategy?

Regardless, 2024 is not even 96 hours old and it is likely too soon to tell how things will unfold in January. Will these sellers get squeezed in the days and weeks ahead by another round of price increases or moves higher in the HRC indices? Or has the market peaked and thus sitting on the precipice of a correction? One thing that is certain is that 2024 is going to be another wild ride, so buckle your chinstrap and get those feet choppin’!

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.