Market Data

December 7, 2023

SMU survey: Mills more willing to talk price on sheet, less on plate

Written by Ethan Bernard

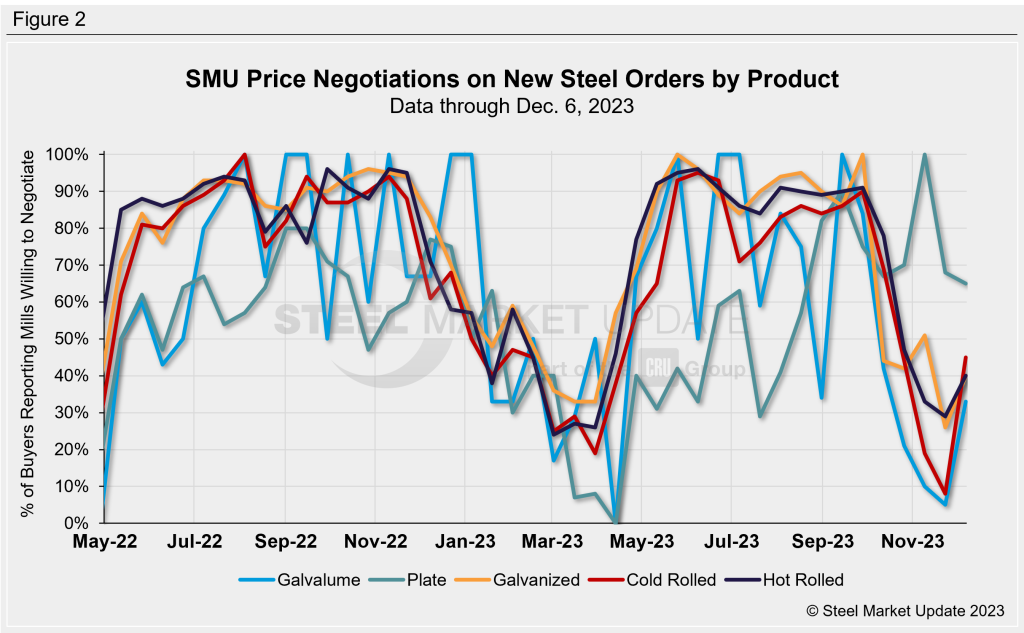

The percentage of steel buyers saying mills were willing to budge on spot pricing has risen for all sheet products SMU surveys, according to our most recent survey data.

The negotiation rate for hot rolled jumped 11 percentage points to 40% vs. two weeks earlier. However, steel plate’s negotiation rate edged down three percentage points to 65% in the same comparison.

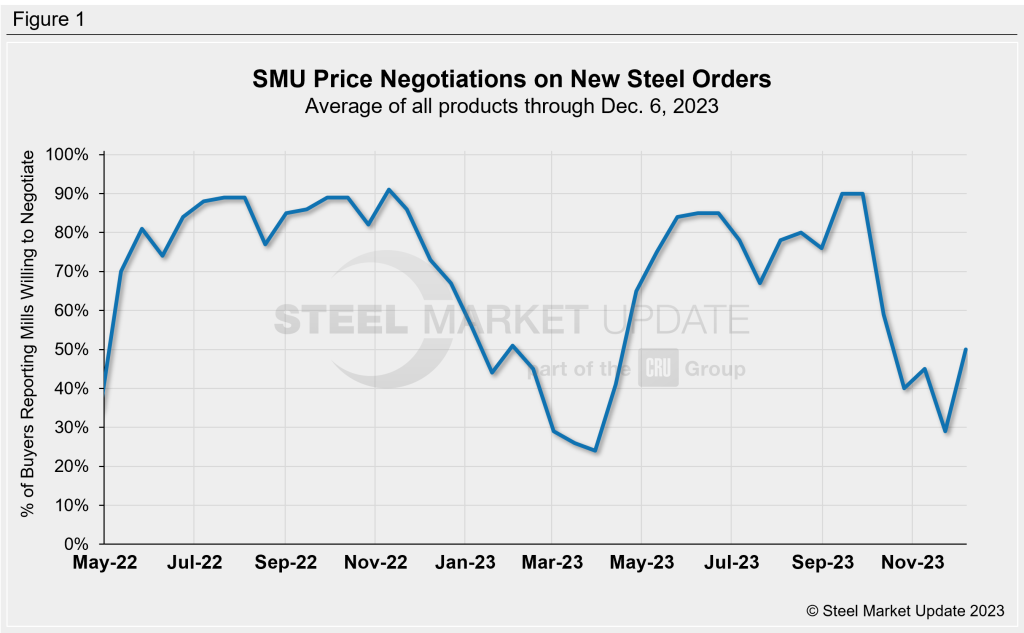

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 50% of participants surveyed by SMU reported mills were willing to negotiate prices on new orders, up from 29% from two weeks prior (Figure 1). This is the first time the reading has hit 50% since the middle of October.

Figure 2 below shows negotiation rates by product. Cold rolled’s rate soared to 45% of buyers saying mills were willing to talk price vs. 8% at the previous market check; galvanized rose 14 percentage points to 40%; and Galvalume increased 28 percentage points to 33%. We have averaged Galvalume with the previous market check because of fewer market participants and to reduce volatility.

Here’s what some survey respondents had to say:

“Mills are happy with their current spot order books (on galvanized) as their contract order books have been very strong.”

“More about negotiating the increase announcements (on plate).”

“I think there is minimal room to negotiate (on hot rolled), just depends on mill and size of buy.”

“I think there is some negotiation to be had here (on galvanized), based on HRC and CRC substrate differences and the mill.”

“Galvalume spot is still in extremely tight supply.”

“I believe that pricing (on plate) is negotiable, if determined mutually beneficial for the buyer and seller, and perhaps a third party.”

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website.