Market Data

November 18, 2023

Galvanized Sheet's Premium Over Hot Rolled Hovering Around $200/Ton

Written by Laura Miller

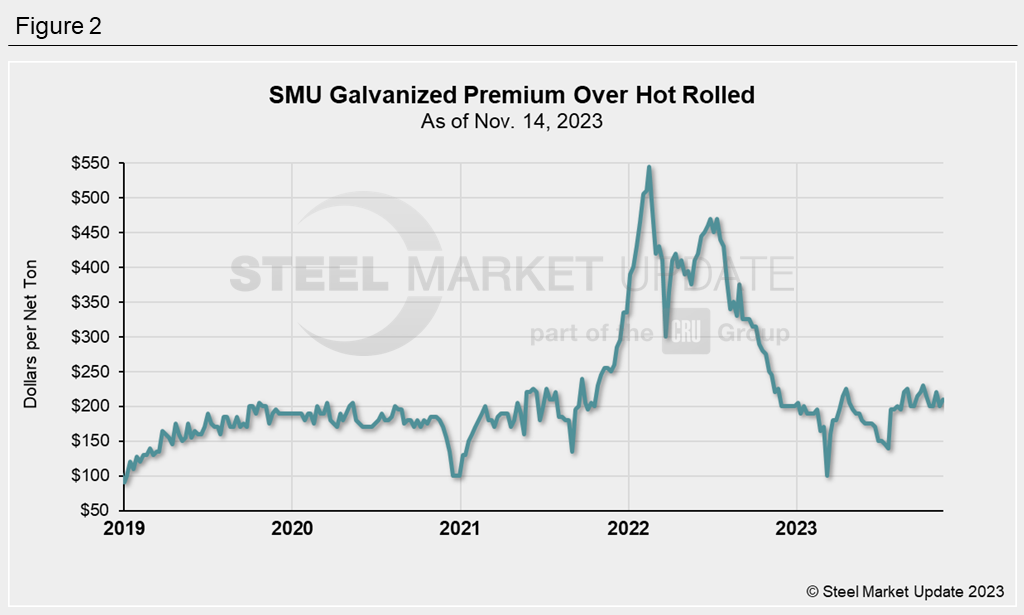

The spread between hot-rolled coil (HRC) and galvanized sheet base prices has been hovering near $200 per net ton since late July, according to SMU’s latest analysis.

So far in 2023, the hot rolled vs. galvanized spread has averaged $190 per ton. It was lowest during the week of March 7 when HRC held just a $100-per-ton premium over galvanized sheet. The spread widened to as much as $230 per ton during the week of Oct. 3. As of Nov. 14, galvanized sheet held a $210-per-ton premium over hot rolled.

The 2023 year-to-date (YTD) average spread of $190 per ton is down considerably from 2022’s average of $365 per ton and down slightly from 2021’s average of $205 per ton.

We arrived at these latest figures using the following analysis based on SMU’s weekly pricing data.

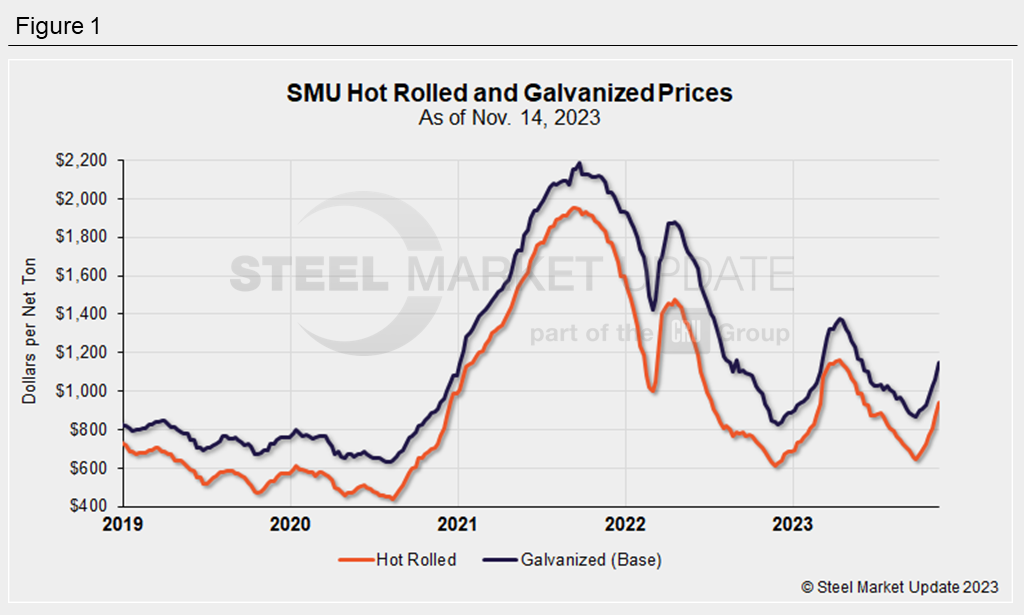

Figure 1 below shows SMU’s HRC and galvanized base prices as of Nov. 14.

Sheet prices bottomed this year in the last week of September, with HRC averaging $645 per ton and galvanized averaging $865 per ton. Those were down 44% and 37%, respectively, from this year’s peaks of $1,160 per ton and $1,375 per ton during the week of April 11.

As of Nov. 14, the average HRC price was $940 per ton, and galv’s was $1,150 per ton.

In Figure 2 below, we can see the price differential between the two sheet products.

In SMU’s last hot rolled vs. galvanized price analysis two months ago, the price spread between HRC and galvanized sheet was $200 per ton. The spread has stayed at or above this level since then, rising as high as $230 per ton during the week of Oct. 3.

As of Nov. 14, galvanized had a $210-per-ton premium over hot rolled.

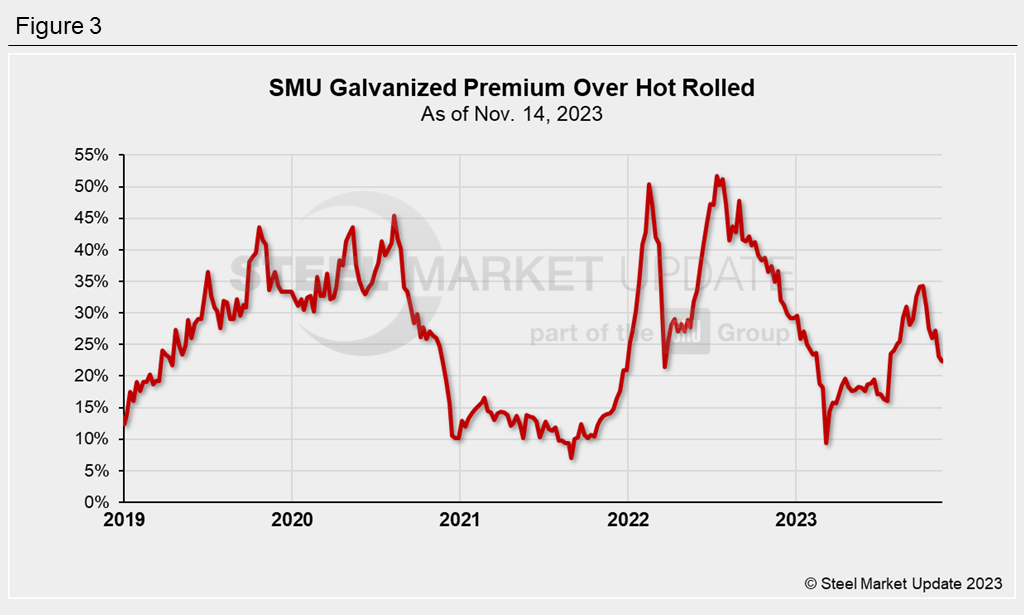

Figure 3 shows the galvanized premium over hot rolled as a percentage of the HRC price.

The premium was as low as 9% in early March and rose to as high as 34% in the weeks of Sept. 26 and Oct. 3. It’s since been declining, falling to 22% as of Nov. 14.

DId you know you can chart historical HRC and galv prices using SMU’s interactive pricing tool on our website?