CRU

November 16, 2023

CRU: Iron Ore High on Better Demand Outlook and Supply Concerns

Written by Aaron Kearney-Keaveny

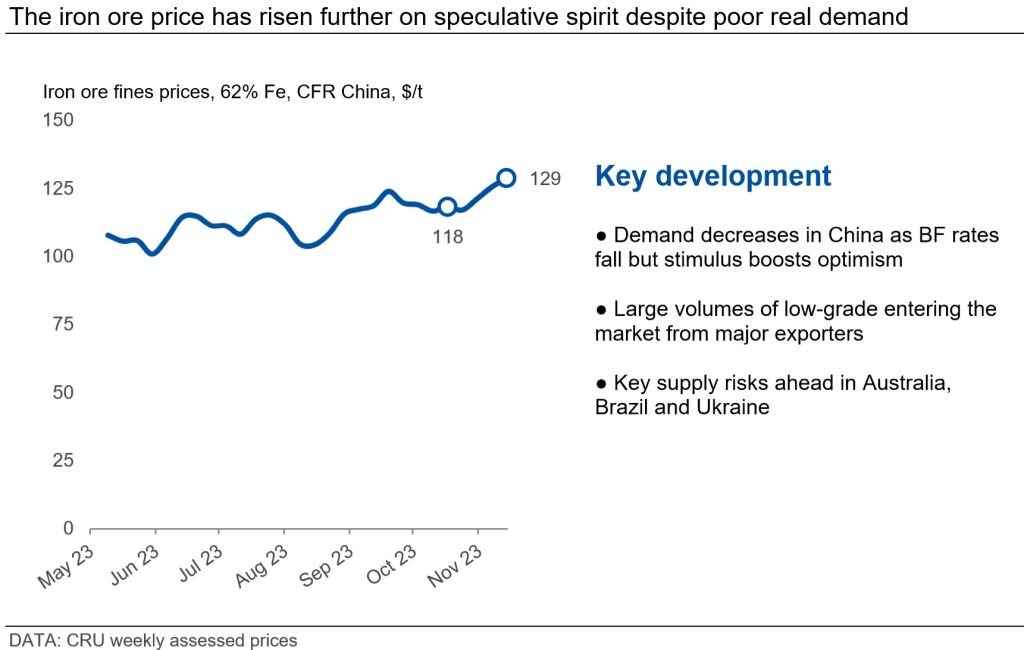

The iron ore price has been rising from the $118 /dry metric ton (DMT) level seen in the last edition, initially due to greater optimism in China after the government’s RMB 1 trillion fiscal stimulus announcement. The price has gotten some extra support from concerns over supply, though the current price level is not backed by fundamentals.

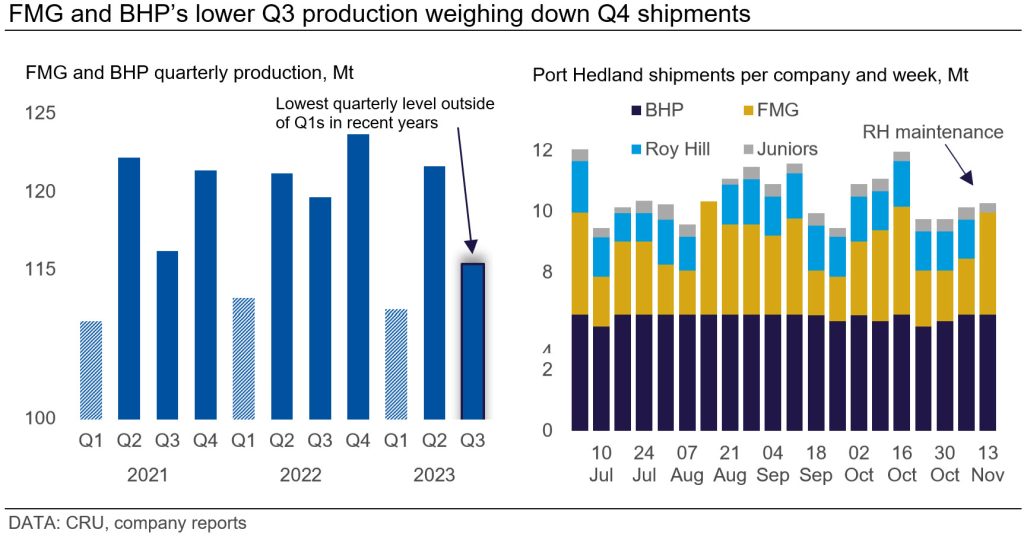

Overall, Australian majors announced both lower output and quality in their Q3 reports, with the reduced production resulting in lower shipment levels over recent weeks compared to last year. Specifically, BHP and FMG had lower production, while Rio Tinto’s rose slightly. This, in combination with Roy Hill’s maintenance, lowered Port Hedland volumes substantially. Also, the large producers reported higher sales than production, indicating that they entered Q4 with low stocks, which is likely to have impacted shipments in October.

The reduced quality is not as problematic for these producers, as low-grade ore is still in high demand. There are potential supply shocks in the near term, with BHP rail workers and CITIC Limited employees threatening industrial action. Our sources have also mentioned that many Australian producers are behind on maintenance, which may continue to hurt exports here towards the end of the year.

In Brazil, shipments from Vales’ Northern System have held at expected levels while volumes from southern Brazil are still holding strong. The high price and weak low-grade discount are keeping additional low-grade volumes profitable. Vale reported that one of their trains caught fire in its Northen System in early November, but there does not seem to be a notable impact on supply. The early onset of higher rainfall levels in Brazil, which started in October compared with the usual occurrence in January, is yet to noticeably impact operations. Three of Vale’s tailings dams have been condemned and nearby locals have been evacuated from 13 November. At the time of writing, it is too early to tell this development’s impact on operations.

South Africa underwent rail and port maintenance in October, with exports being constrained until this was finished around the end of the month. Equipment breakages meant that maintenance at Saldanha Bay took longer than usual, while outflow from other ports fell far more due to the impacts on railways from maintenance.

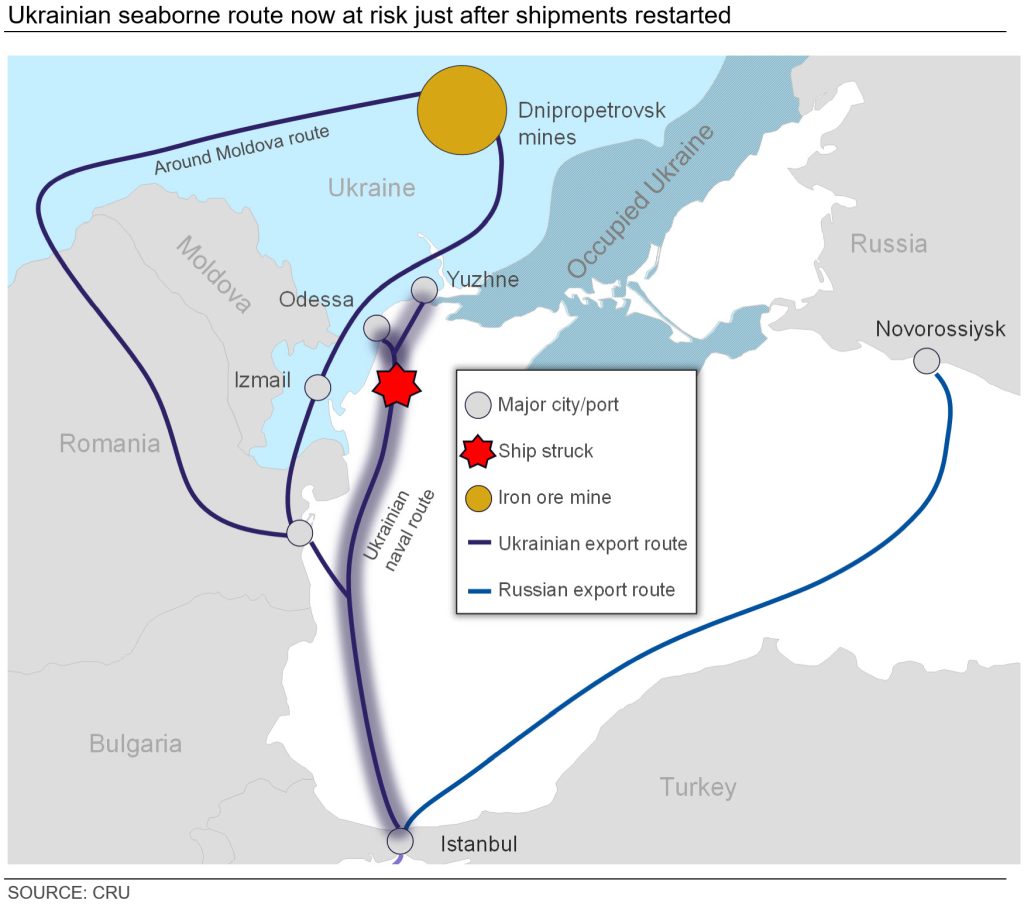

Ukraine shipments continued to leave from domestic ports after the Russian navy’s blockade seemed to have weakened. However, an iron ore carrying ship was recently struck by a missile, tragically resulting in one fatality and four cases of injury among the crew members. This could reverse the minor return in shipments from Ukrainian ports, due to the higher perception of risk and the likely increase in insurance premia.

In China, iron ore consumption fell by ~3.3 million metric tons month-over-month (m/m) since mid-October. Mills’ restocking slowed, given lower iron ore consumption and bearish sentiment, but it picked up after the stimulus announcement. Mills still prefer lower grade materials, except for some extra pellet demand amid some regional sintering restrictions. Slower port outflow, higher shipment arrivals and faster ship-offloading process resulted in iron ore port inventories rising by more than 3 million metric tons m/m.

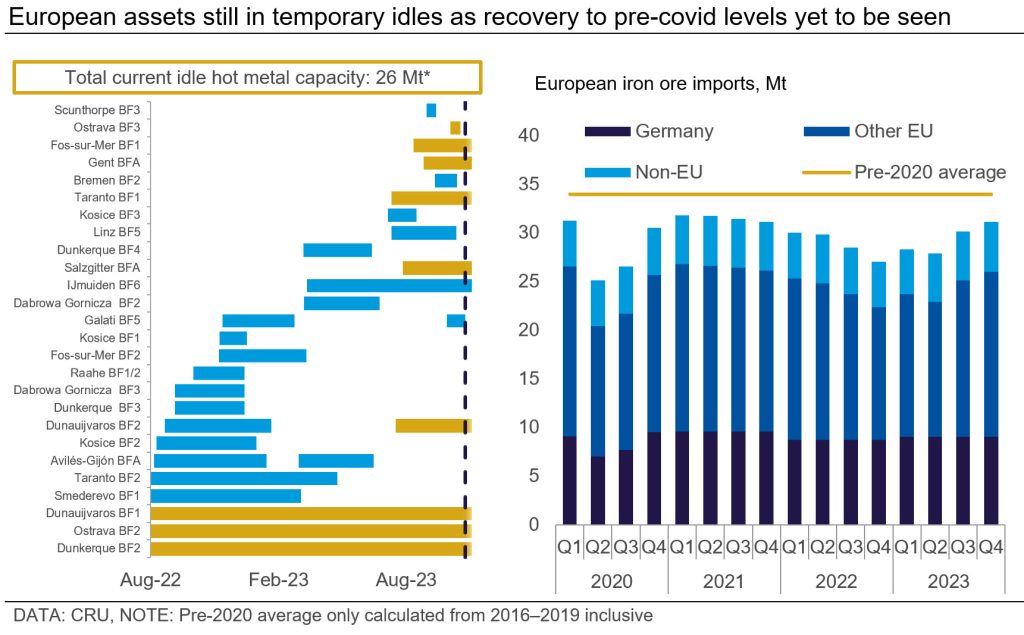

In Europe, demand remains weak with mills maintaining low stocks. The idle at Bremen (Germany) has finished as maintenance was completed, while Ghent (Belgium) is expected to restart at the end of the month. Fos-Sur-Mur (France) will remain offline until ArcelorMittal determines the market to be strong enough. There has been an additional idling, Liberty’s Ostrava, which occurred due to weak demand though it is only planned to be offline for two weeks as they go about maintenance.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com.