Market Data

November 15, 2023

Service Center Shipments and Inventories Report for October

Written by Estelle Tran

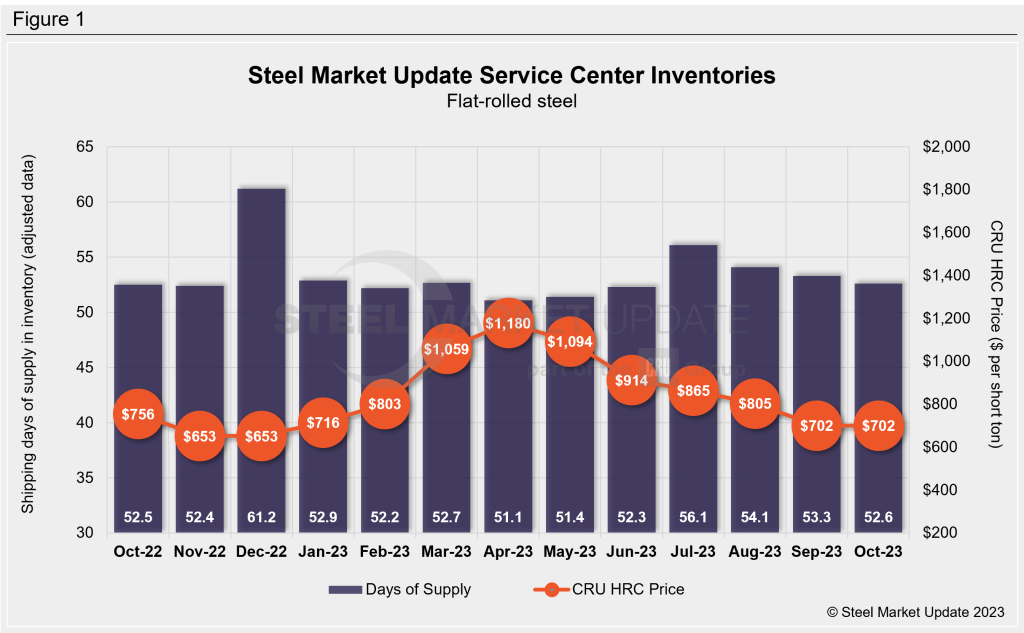

Flat Rolled = 52.6 Shipping Days of Supply

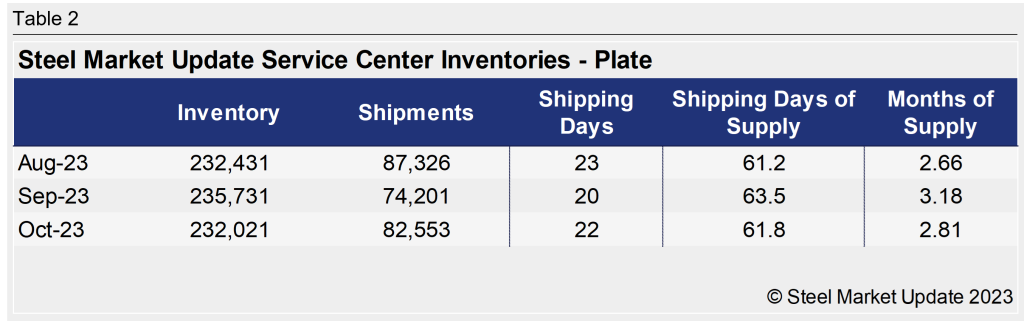

Plate = 61.8 Shipping Days of Supply

Flat Rolled

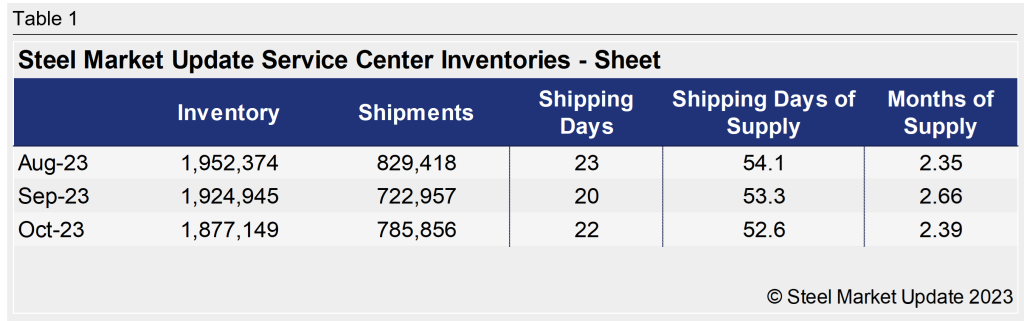

US service center flat-rolled steel inventories decreased for a third consecutive month in October. At the end of October, service centers carried 52.6 shipping days of supply, according to adjusted SMU data. This is down from 53.3 shipping days of supply in September.

In terms of months on hand, flat-rolled steel inventories represented 2.39 months of supply in October, down from 2.66 months in September. The lower months of supply figure in October was because October had 22 shipping days compared to September’s 20.

Shipments increased in October month on month (MoM), but intake was still higher than shipments for the third consecutive month. Mill outages likely drove this imbalance and allowed inventories to fall MoM. With shipping days of supply declining for a third month in October, inventories were nearly balanced with shipments.

The amount of material on order in October built upon the gains in September. Service centers sought to maximize purchases at the bottom of the market, and prices have been rising since reaching a low of $663 per ton on October 4th, according to CRU data.

The amount of flat-rolled steel on order surged in October when compared to September. The material on order in October moved higher compared to September as a result. With this spike, the amount of sheet on order reached the highest level since Russia invaded Ukraine.

The elevated amount of material on order can also be seen in lead times. The latest SMU lead time data published on Nov. 9 showed HRC lead times at 6.9 weeks, up from 5.59 weeks the month before. The large-volume sales at the bottom of the market have allowed mills to announce four rounds of price increases since late September.

Heading into the slower months of November and December though, the high level of inbound material will be more than enough to cover requirements.

Plate

US service center plate inventories eased back in October after climbing for the last six months. At the end of October, service centers carried 61.8 shipping days of plate supply, down from 63.5 days on an adjusted basis in September.

Plate supply in October represented 2.81 months of supply, down from 3.18 months in September. The months-of-supply metric is skewed slightly because October had two more shipping days than September.

The plate market has been under pressure from low demand and more attractive import offers. At the end of October, Nucor dropped plate prices by $140 per ton. Service centers in recent months were struggling to reduce inventories to match demand. Inventories still appear to be high, considering slowing demand in November and December.

The amount of material on order remains restrained though. At the end of October, service centers shipping days of plate on order were down from September. The amount of plate on order also fell in October vs. September figures.

Plate lead times reported by SMU were at 5.57 weeks in the latest survey, up from 5 weeks the month before. Service center contacts said that they were not concerned about supply based on lead times.

Looking ahead to January, inventories along with material on order could be on the lower side for the seasonal pickup in demand. There has been some debate about how much of a seasonal boost the market will see, and the extent of destocking as the end of the year approaches will determine when service centers need to restock in Q1.