Prices

October 26, 2023

HRC Futures Go Vertical

Written by David Feldstein

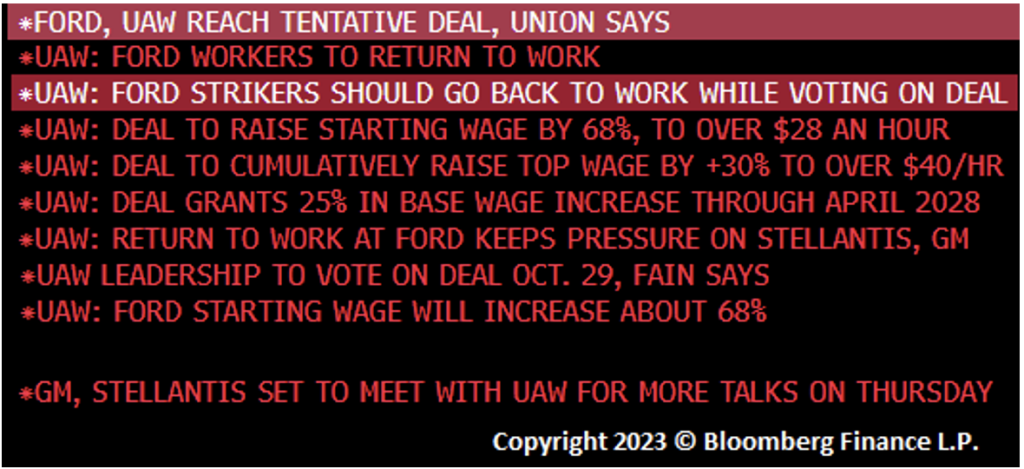

These were the headlines hot off the press Wednesday night:

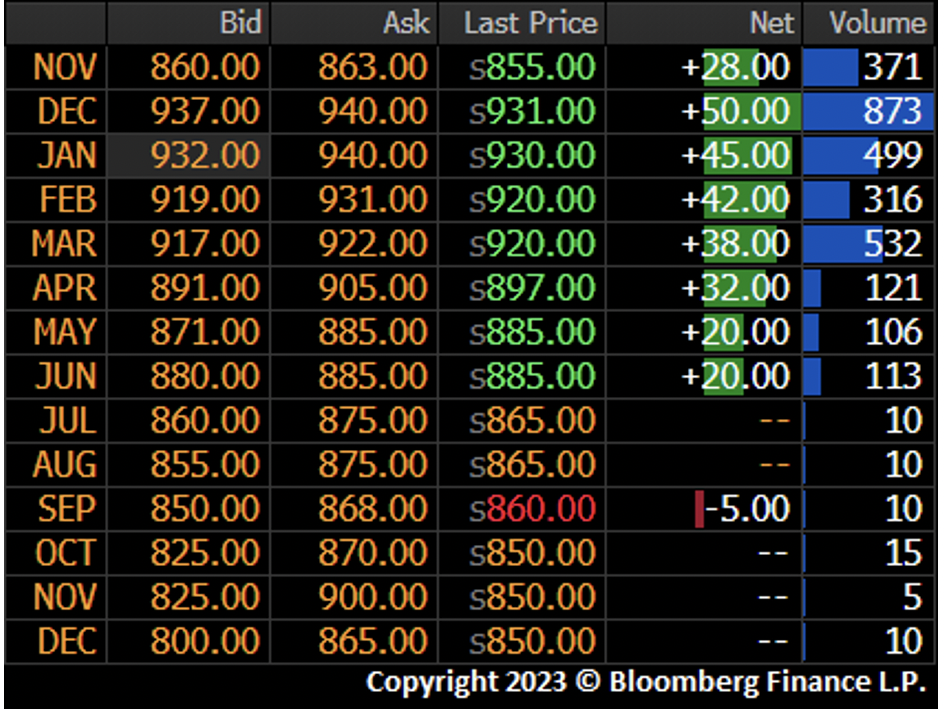

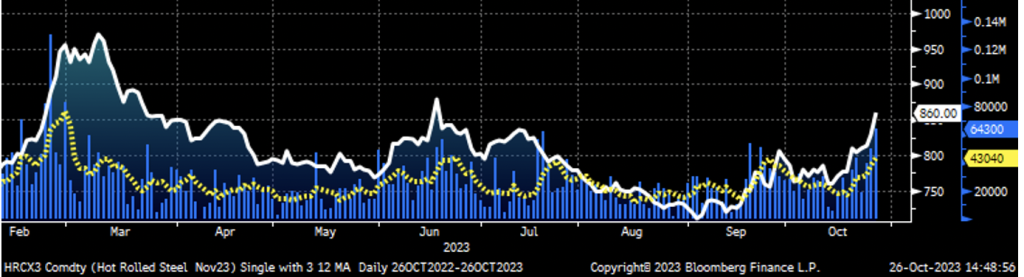

This was the response in the futures market today. It has been yet another rally of epic proportions, with rumors of another $100 price increase to $950 sending the weak shorts running for cover today. In fact, the rumors turned out to be true. U.S. Steel did announce another $100-per-ton spot price increase on sheet steel products. However, the steelmaker did not announce a new target price for hot-rolled coil. As of Thursday afternoon, it was unclear if other mills would follow.

Volume was heavy, trading 64,000 tons across the HRC futures curve today, the most since February.

Nov. CME HRC Future $/st w Aggregate Curve Volume & 5-Day Avg. (yellow)

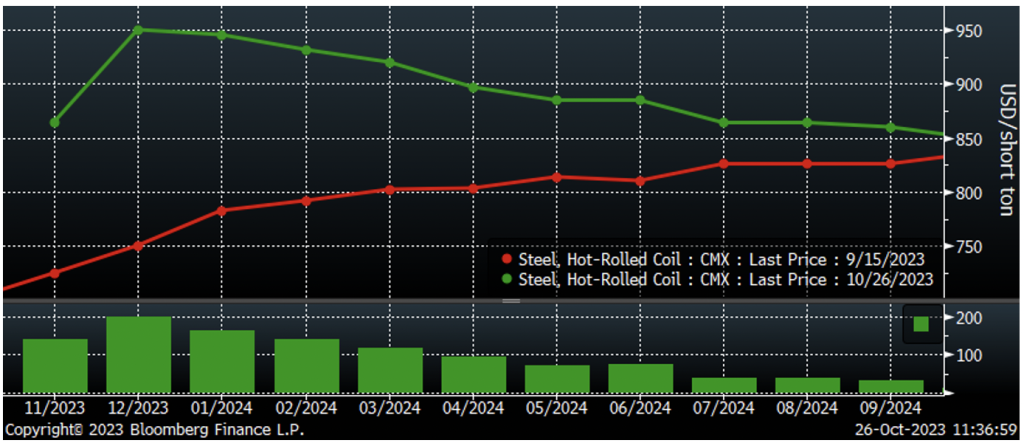

Since the start of the United Auto Workers (UAW) strike on Sept. 15, HRC futures have spiked, led by a $200 explosion higher in the December future. The $162 jump in the January future and $140 gain in the November and February futures are worthy of being mentioned as well. Over the past six weeks, the HRC futures curve has shifted from upwards sloping or contango to downwards sloping or backwardated.

CME Hot Rolled Coil Futures Curve $/st

The December future blasts through the downtrend last week having jumped $125 in just the last five trading sessions.

December CME HRC Future $/st

How far will the rally go? How long will it last? Where is the price of hot rolled steel today, tomorrow, and in the great beyond? These are the questions you need the answers to. Unfortunately, these are the questions I do not have the answers to. Tune in next week for more futures coverage…

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.