CRU

October 15, 2023

CRU: Ore-Based Metallics Prices Mixed as Demand Weakens

Written by Brett Reed

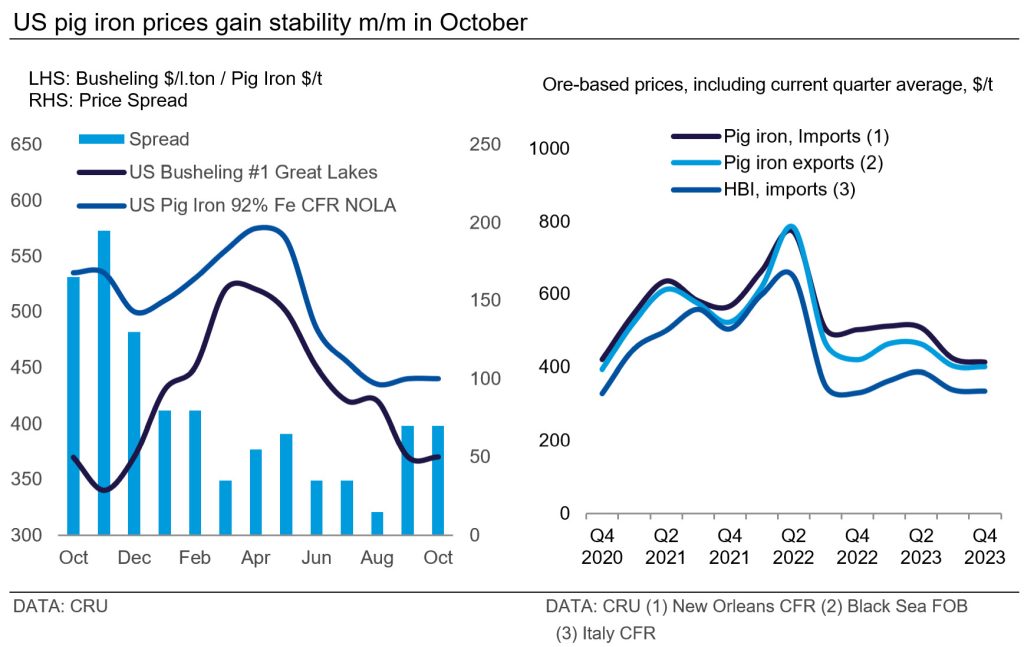

Prices for ore-based metallics were mixed month-on-month (MoM) as lower finished steel production weighs on pig iron demand. Supply out of the Brazilian market continues to tighten as producers look to raise prices in the near term.

In the CIS, pig iron prices increased $10 per metric ton MoM to $365 per metric ton FOB Black Sea. Local mills continue to focus on crude steel production, causing output and exports of merchant pig iron to decline substantially. The primary export locations for Ukrainian material remain Poland and Romania as exporters continue to face logistical issues, with the port of Danube sustaining an attack in September.

After reducing in July, Russian merchant pig iron shipments increased in August and September as logistical constraints in the Black Sea eased for Russian exports. The primary destination is the Asian market as demand from European buyers remains low because buyers are unwilling to take on the reputational risk of buying Russian material. Meanwhile, demand in Turkey remains soft due to sluggish demand for finished steel.

In Europe, pig iron prices declined $10 per metric ton to $385 per metric ton CFR Italy based on deals concluded in the last two weeks. Buying activity is limited as recent steel production cuts have softened demand in Europe.

Brazilian pig iron prices fell slightly, declining $5 per metric ton to $435 per metric ton and $405 per metric ton FOB for North and South respectively. Market participants report that there is limited buying activity as traders wait to see where US scrap prices move in the near term. Margins for Brazilian producers remain squeezed, causing producers to tighten supply and support prices over the coming months.

Despite softening demand caused by multiple planned outages, US pig iron prices remain unchanged at $440 per metric ton CFR NOLA as supply availability has become limited. Traders report that Brazilian producers were able to hold prices firm despite efforts from buyers to push prices downwards in recent weeks. With the recent price stability in the scrap market, producers increased offer prices this month as supply is expected to remain tight till profitability improves.