Market Data

October 12, 2023

SMU Survey: Lead Times Extend Across the Board

Written by Laura Miller

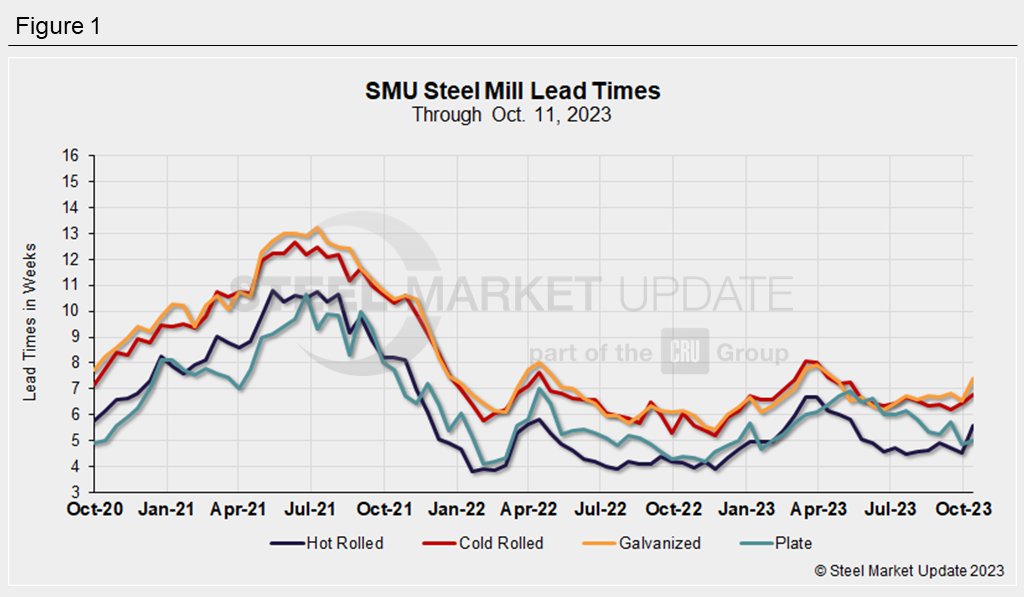

This week’s survey showed steel mill lead times extending across all product lines tracked by SMU.

This makes sense, given planned and unplanned mill outages, rising sheet prices, and the uncertainty surrounding demand and the ongoing UAW strike.

Delivery dates are now into early November through early December for hot-rolled sheet, mid-November to mid-December for cold-rolled sheet, mid-November to late December for galvanized sheet, December for Galvalume, and November for plate.

Steel Mill Lead Times This Week

Lead times for hot rolled were reported by buyers in this week’s survey to be between 4 and 8 weeks, with an average of 5.59 weeks. That’s an extension of a week from our survey results two weeks ago and the longest lead time for hot-rolled coil since mid-May.

Cold rolled lead times were said to be between 5 and 9 weeks this week. The average CR lead time of 6.79 weeks increased by 0.32 from two weeks ago. Like hot rolled, this is CRC’s most extended lead time since mid-May.

Surveyed buyers reported lead times for galvanized sheet ranging from 5 to 10 weeks. SMU’s average galvanized lead time increased by 0.88 weeks from the last week of September to an average of 7.41 weeks this week. Galvanized lead times were last reported this long in April.

Galvalume lead times were reported by buyers this week to be between 7 and 9 weeks, with an average of 8.17 weeks. Lead times for this sheet product extended by 0.84 weeks from two weeks prior. We have to go back to mid-March to see a longer lead time for Galvalume.

Note that our data for Galvalume is more volatile due to the smaller sample and market size. If you are a buyer of Galvalume and would like to share your lead time and pricing data with SMU, please contact david@steelmarketupdate.com.

Lead times for plate increased more modestly, rising by 0.14 weeks from two weeks ago to an average of 5.0 weeks this week. Buyers reported plate lead times to be between 4 and 6 weeks. The 4.86-week average lead time for plate registered in the survey during the last week of September was the shortest since January.

This Week’s Survey Says

Of service centers and manufacturers responding to this week’s survey question about how they would categorize current mill lead times, 45% said they are ‘normal’ while 32.5% said they are ‘shorter than normal.’ Still, 17.5% categorized them as ‘slightly longer than normal,’ and 5% said they are ‘highly extended.’

One service center source said most mills are full and are not offering spot tons right now.

Another service center buyer noted that they think the market has bottomed. With current mill lead times and low inventories, they believe there is enough support for another price increase.

That same buyer commented: “I think the worst happens in the next few weeks, and then buying starts to decline, impacting lead times, [which] are inflated because of the [mill] outages.”

Although “intrigued by the recent subtle spike in lead times,” one manufacturer noted their “worry about imports coming back in the first quarter.”

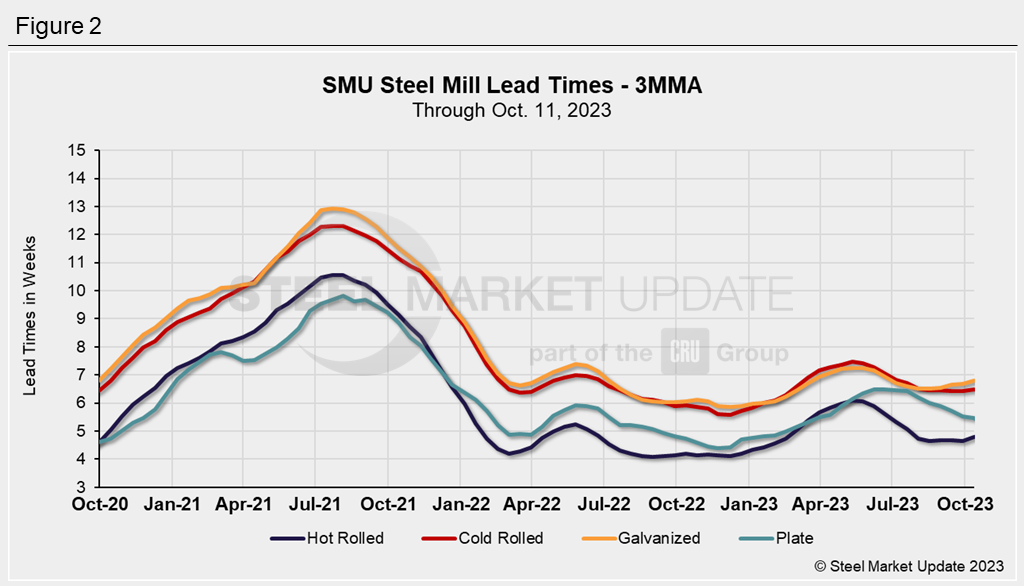

3MMA Lead Times

To smooth out the variability in SMU’s weekly readings, we can look at lead times on a three-month moving average (3MMA) basis.

The 3MMA of hot rolled lead times increased slightly to 4.8 weeks in this week’s survey. The hot rolled 3MMA has been steady, averaging between 4.6 and 4.8 weeks since early August.

Cold-rolled sheet’s 3MMA lead time stood at 6.5 weeks this week. This has also been steady since the start of the summer.

The 3MMA of galvanized lead times inched up to 6.8 weeks. Galv’s 3MMA hit a recent bottom of 6.5 weeks throughout August.

Galvalume’s 3MMA lead time rose for a third consecutive market check to 7.2 weeks this week, comparable to that at summer’s start.

Meanwhile, the 3MMA plate lead time held steady at 5.2 weeks this week. That’s the shortest the product’s 3MMA has been since March.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website here.