Market Segment

August 29, 2023

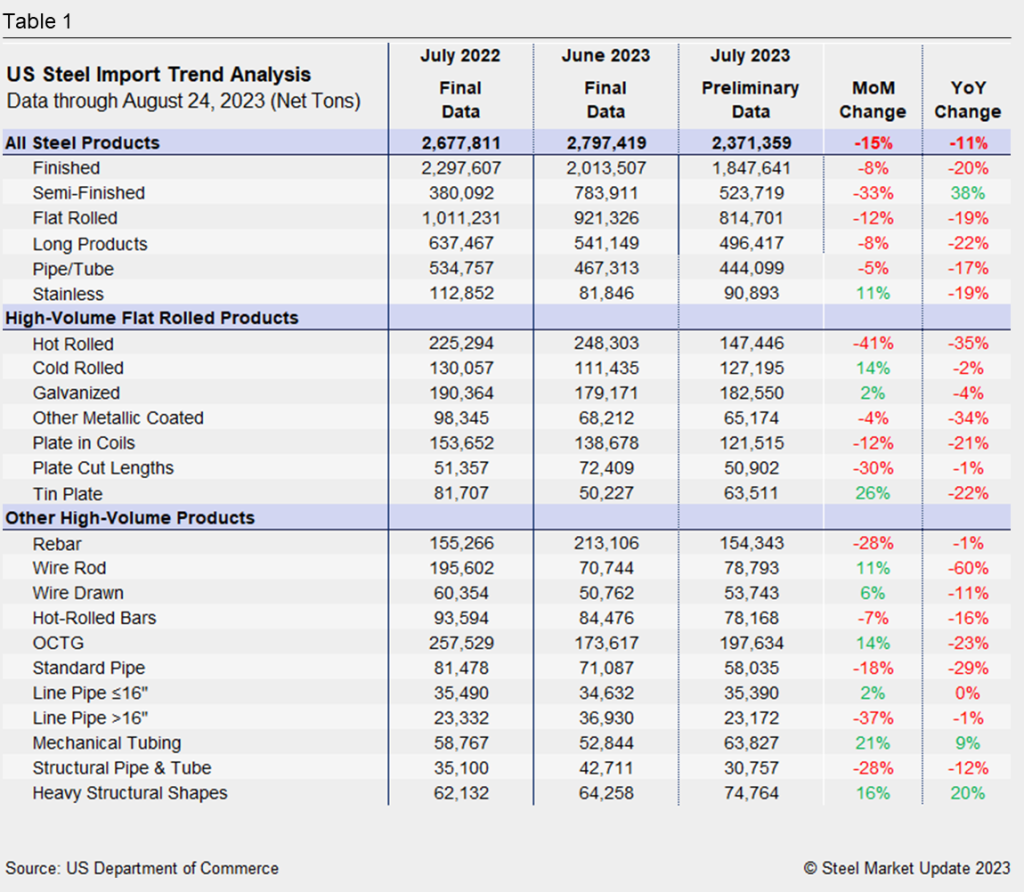

July Imports Fall Back 15% From June’s 12-Month High

Written by Laura Miller

The drop in imports from June to July was not as steep as license applications had suggested, but imports were still down both month on month (MoM) and year on year (YoY).

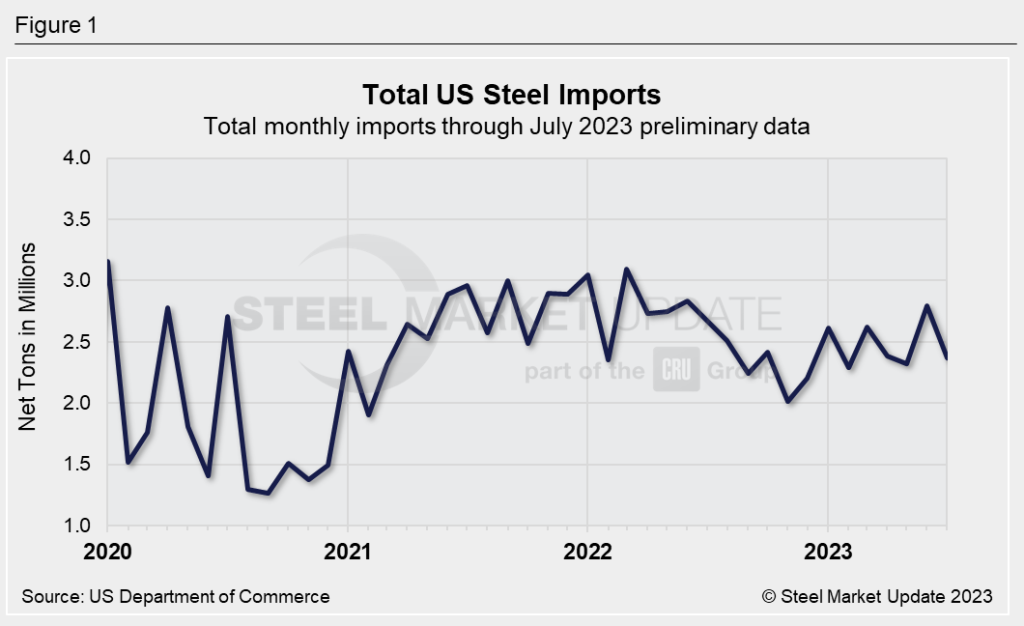

The US imported 2,371,359 net tons of steel products in July, according to a preliminary count by the US Department of Commerce. This was a 15% decline from June’s recent high of 2,797,419 tons. Recall that June’s imports were at a 12-month high.

Compared to year-ago levels, July’s imports were down 11%.

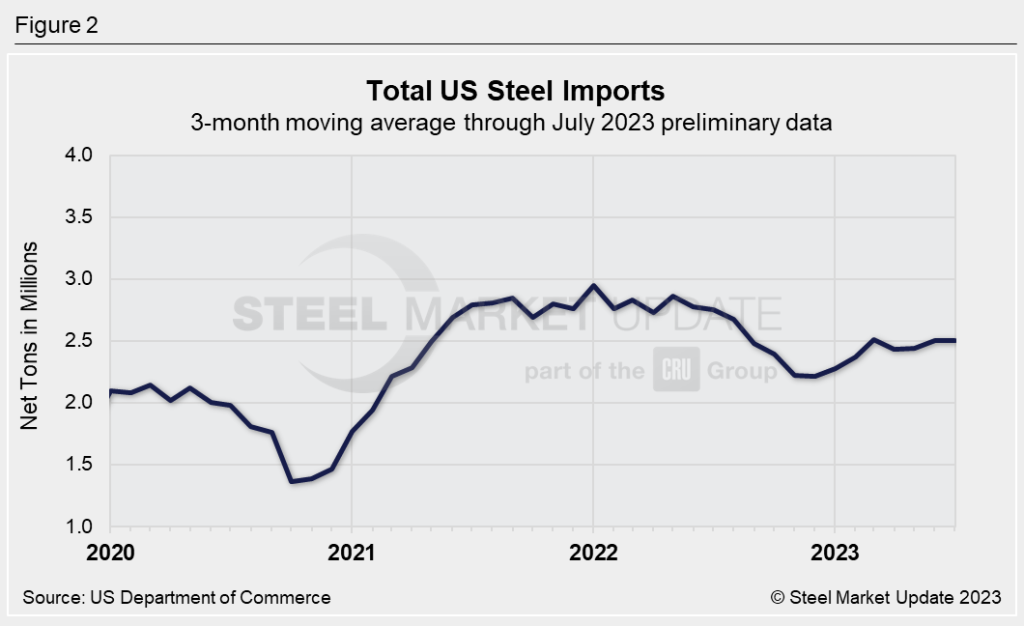

Looking at imports on a three-month moving average basis to smooth out the month-to-month fluctuations, we can see that imports have been fairly steady for most of this year but are still down from the elevated levels seen mid-2021 through mid-2022.

While imports of semifinished steel dropped by a third from June to 523,719 tons in July, they were more than a third above year-ago levels.

Finished steel imports, meanwhile, were 8% lower MoM and 20% lower YoY at 1,847,641 tons in July.

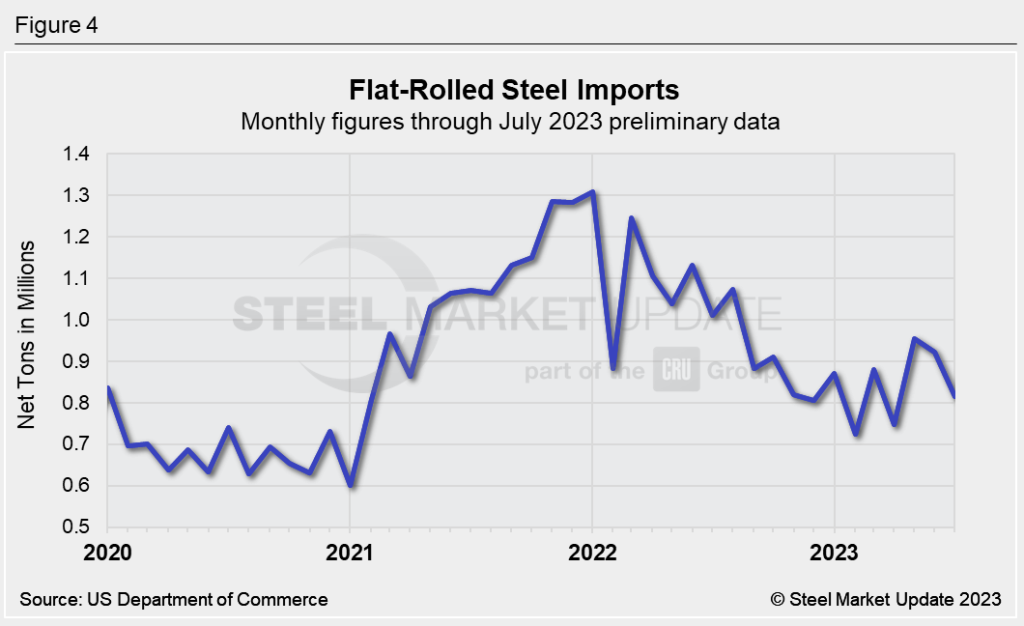

Flat-rolled steel imports declined for a second consecutive month, coming in at 814,701 tons in July. This was a 12% MoM decline and a 19% YoY fall.

While overall flat rolled imports were down MoM, cold-rolled sheet and galvanized sheet and strip imports registered rises of 14% and 2%, respectively. Tin plate imports shot up 26%.

Imports of hot-rolled sheet saw a huge MoM drop, falling 41% from June to 147,446 tons in July.

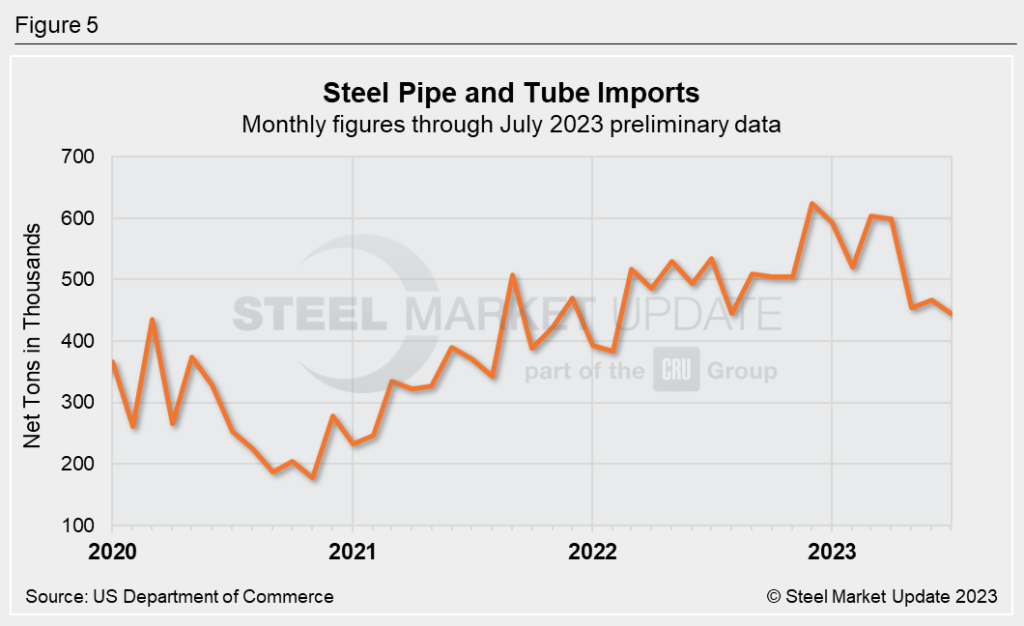

Pipe and tube imports fell to a 17-month low of 444,099 tons in July.

OCTG imports were down markedly in May, June, and July after having been elevated for the prior six months.

Imports of structural pipe and tube, at 30,757 tons in July, were at a two-year low, and standard pipe imports of 58,035 tons were at a 20-month low.

Mechanical tubing imports, meanwhile, were at almost a two-year high at 63,827 tons in July.

The chart below provides further detail into imports by product, highlighting high-volume steel products.