Market Data

August 15, 2023

Service Center Shipments and Inventories Report for July

Written by Estelle Tran

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Lindsey Fox at lindsey@steelmarketupdate.com.

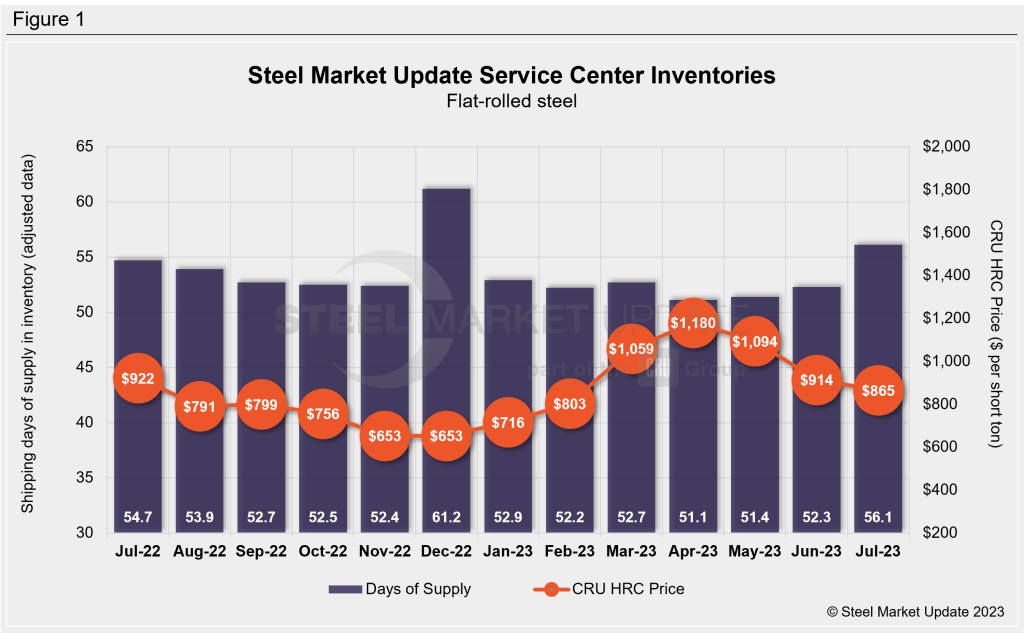

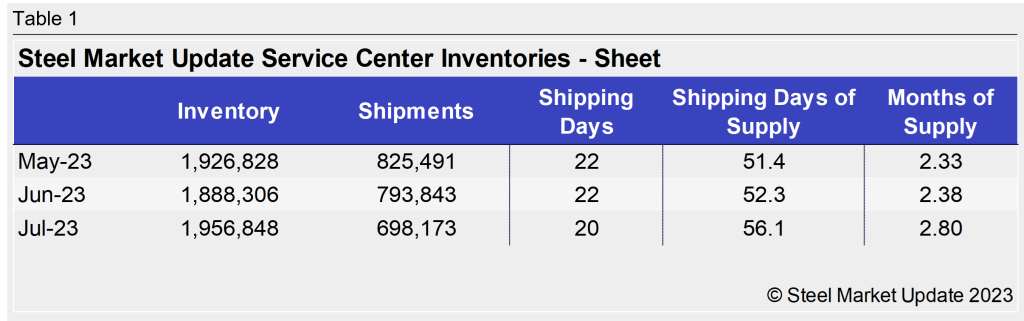

Flat Rolled = 56.1 Shipping Days of Supply

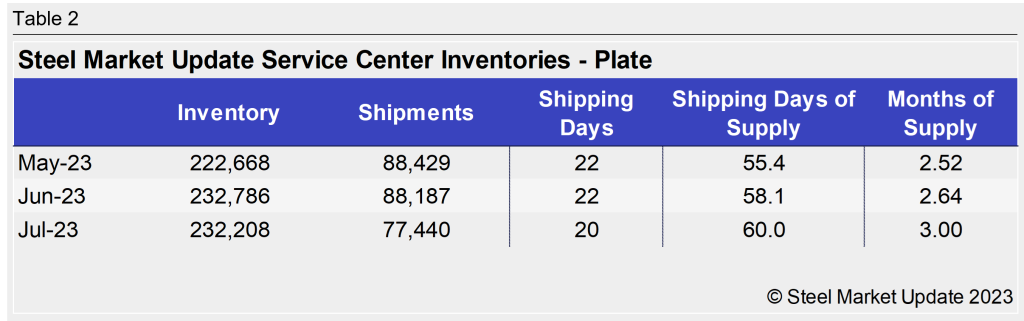

Plate = 60.0 Shipping Days of Supply

Flat Rolled

US service center flat-rolled steel inventories spiked in July with a slowdown in shipments. At the end of July, service centers carried 56.1 shipping days of flat roll supply, according to adjusted SMU data. This is up from 52.3 shipping days of supply in June. In terms of months of supply, flat-rolled steel on hand represented 2.8 months of supply, up from 2.38 months in June.

July had 20 shipping days, compared to June’s 22 shipping days. While there is typically a seasonal drop-off in shipments in July with the Independence Day holiday, the daily shipping rate was the lowest since December 2022. Inventories increased in total volume, and with the lower daily shipping rate, the amount of flat-rolled steel on hand represented a significant growth in supply.

In the latest SMU survey published August 2nd, 44% of service centers said they were releasing the same amount of steel as a year ago, 37% said they were releasing less and 19% said they were releasing more.

At the same time, the amount of material on order expanded in July to the highest level seen since April. This can be attributed in part to some opportunistic deals at lower pricing levels as well as some restocking preparing for fall. Service centers shipping days of flat roll supply on order at the end of July was up vs. June. The amount of inventory on order was up as well month-on-month (MoM) in July.

In the latest survey, 77% of service centers said they were maintaining inventory, while 19% said they were reducing inventory and 4% said they were building inventory. These results are less bearish than they were a year ago, when 52% of service centers said they were reducing inventory, 45% said they were maintaining inventory and 3% said they were building inventory.

Despite the opportunistic deals and rise in the amount of material on order in July, mill lead times have been mostly steady around 4.5 weeks for HRC for the last two months, according to SMU data.

The amount of inventory at the end of July combined with relatively short lead times indicates an oversupply. August has 23 shipping days and demand typically recovers compared to July, but a greater pickup in demand will be needed to absorb the excess inventory and material in the pipeline to keep new orders from falling off.

Plate

US service center plate inventories rose again in July with the daily shipping rate falling to the lowest level since December. At the end of July, service centers had 60 shipping days of plate supply on an adjusted basis. This is up from 58.1 shipping days of supply in June. In terms of months on hand, plate inventories at the end of July represented 3 months of supply, up from 2.64 months in June.

Shipments fell MoM with seasonal trends and two fewer shipping days in July, though market contacts said there has been a slowdown in contract business. One service center contact said demand is flat and will remain the same for the rest of the year.

SMU surveys have pegged plate lead times at around 6 weeks for the last two months, though the latest survey dropped to 5.81 weeks. In reality, mills continue to ship material early though. Nucor’s gradual ramp up at Brandenburg has helped to keep lead times steady.

Without a significant uptick in demand expected, service centers remain satisfied with maintaining inventories and filling gaps as needed. Service centers are having issues with falling resale values, which is causing them to liquidate their highest priced material.

At the end of July, service centers cut back on new orders, and the amount of plate on order fell to the lowest level since February 2022. The amount of plate on order in July slipped when compared to June.

Considering the lower amount of material on order and seasonally slower July, plate inventories appear to be mostly balanced, or slightly high. Steady inventories have helped to keep prices flat, though the ongoing balance will depend on how much shipments recover in August.