Market Segment

August 4, 2023

HRC vs. Galvanized Price Spread Widens

Written by Laura Miller

The spread between hot-rolled coil (HRC) and galvanized coil base prices widened over the last month as hot rolled prices declined faster than prices for galvanized product.

At the end of June, galvanized coil’s premium over HRC averaged $150 per net ton ($7.50 per cwt). That premium increased to $195 per ton in our last check of the market.

Let’s take a deeper look at how we arrived at those figures.

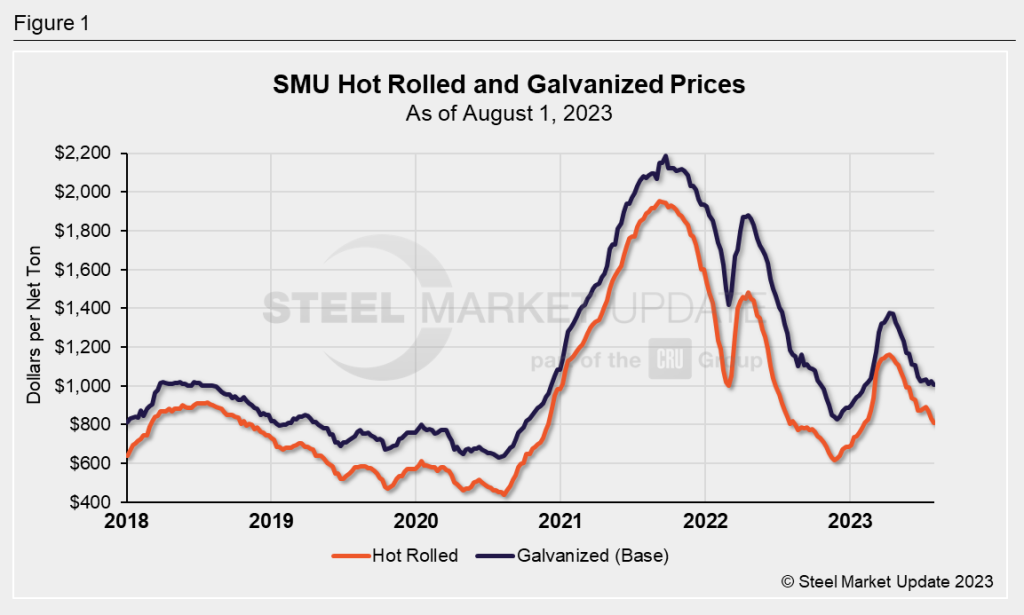

Figure 1 below shows SMU’s HRC and galvanized base prices as of Aug. 1.

The average HRC price slipped for a third consecutive week to $810 per ton. That’s now down $70 per ton from the beginning of July and down 30% from 2023’s peak of $1,160 per ton during the week of April 11.

Galvanized sheet base prices averaged $1,005 per ton this week, down by $25 per ton from a month ago and down $300 per ton from this year’s peak of $1,350 per ton mid-April.

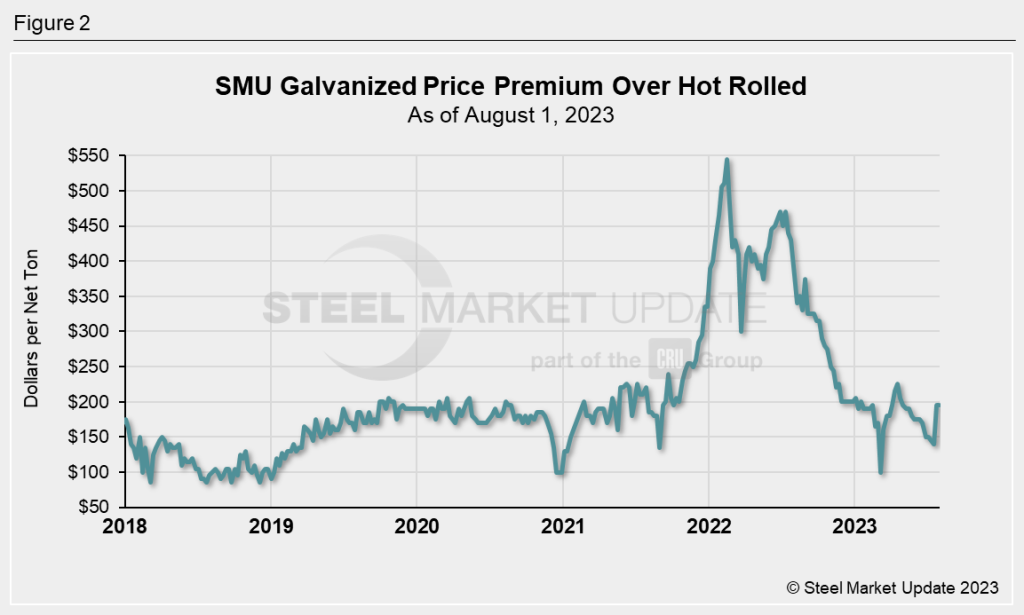

The result: The average galvanized price premium over hot rolled, shown in Figure 2, rose to $195 per ton. That’s up from $150 per ton at the beginning of July and from $175 per ton at the beginning of June.

The premium had fallen as low as $140 per ton during the week of July 18, before jumping to $195 per ton the next week and then remaining at that point.

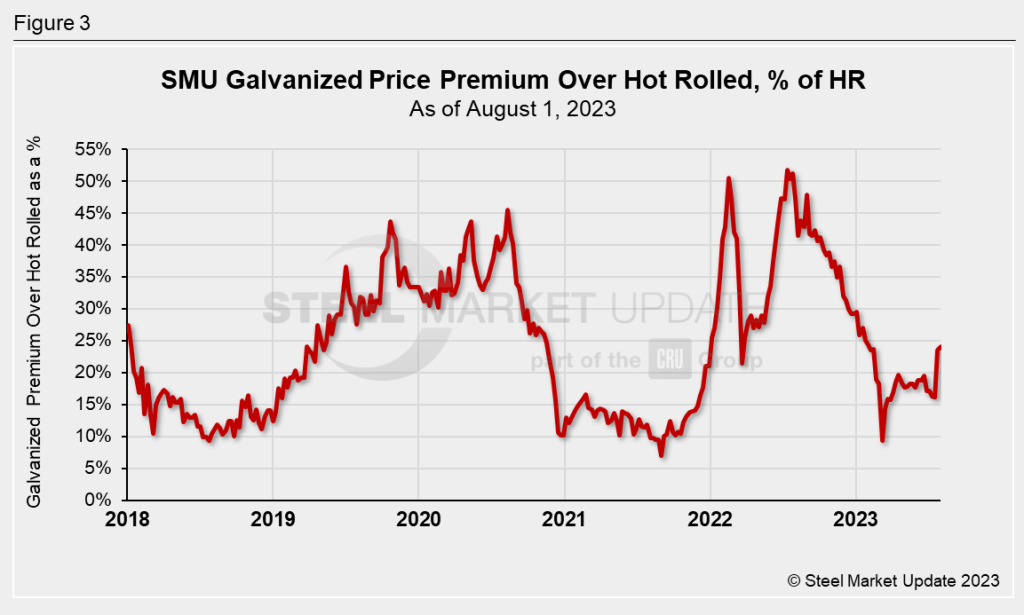

Figure 3 shows the galvanized premium over hot rolled as a percentage of the HRC price.

The premium rose to 24% as of Aug. 1, up from 17% one month earlier. It had fallen to 16% during the weeks of July 11 and July 18.

The last time the percentage of the premium was this high was in February.

You can chart historical HRC and galv prices using SMU’s interactive pricing tool found here.