Prices

August 1, 2023

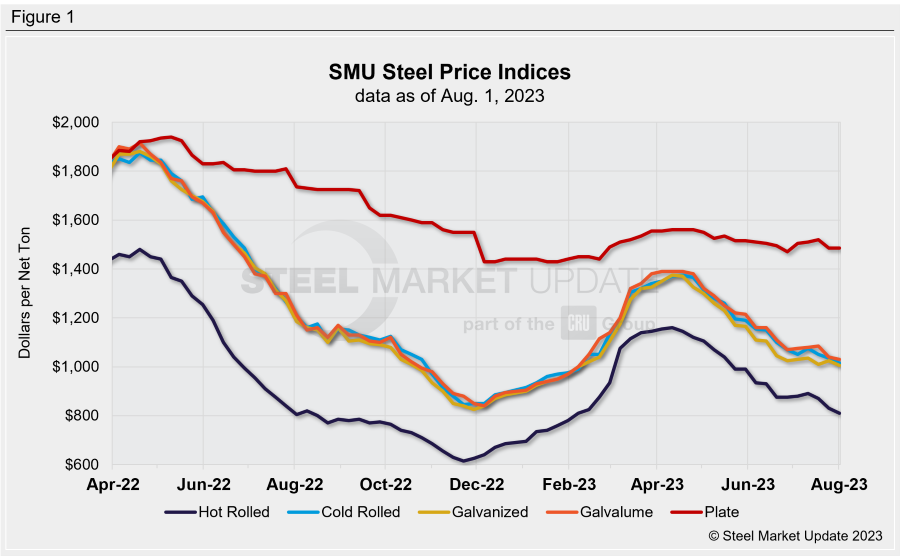

SMU Price Ranges: Sheet Price Slide Again as Volume Discounts Continue

Written by David Schollaert & Michael Cowden

Sheet prices slipped for the third consecutive week on continued discounts from certain mills for larger buyers.

While some sources raised questions about demand, others said they expect prices and activity to firm as lead times move into the typically busier period after Labor Day.

SMU’s average hot-rolled coil prices stood at $810 per ton, down $20 per ton from last week and off $350 per ton from a 2023 peak, recorded in early April, of $1,160 per ton.

Prices are now at their lowest point since early February, before a wave of price increases sent them sharply higher.

A few market participants speculated that a round of price hikes could be in the works. But a more common refrain was that deep discounts – in the mid- to low-$700s per ton for HRC – continued to be available for big buyers.

Cold-rolled and coated prices saw declines like those in hot-rolled. Plate prices were unchanged. The result: Our sheet momentum indicators continue to point lower. Our plate momentum indicator remains at neutral.

Hot-Rolled Coil

The SMU price range is $770–850 per net ton ($38.50–42.50 per cwt), with an average of $810 per ton ($40.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range was down $10 per ton vs. one week ago, while the top end was $30 per ton lower week on week (WoW). Our overall average is down $20 per ton WoW. Our price momentum indicator for hot-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil

The SMU price range is $970–1,060 per net ton ($48.50–53.00 per cwt), with an average of $1,015 per ton ($50.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged WoW, while the top end was down $40 per ton compared to a week ago. Our overall average is down $20 per ton WoW. Our price momentum indicator on cold-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil

The SMU price range is $960–1,050 per net ton ($48.000–52.50 per cwt), with an average of $1,005 per ton ($50.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $40 per ton vs. last week, while the top end of our range was unchanged vs. one week ago. Our overall average is $20 per ton lower vs. the prior week. Our price momentum indicator on galvanized steel is pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,057–1,147 per ton with an average of $1,102 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks

Galvalume Coil

The SMU price range is $1,000–1,060 per net ton ($50.00–53.00 per cwt), with an average of $1,030 per ton ($51.50 per cwt) FOB mill, east of the Rockies. The lower end of the range moved lower by $20 per ton vs. last week, while the top end was sideways WoW. Our overall average decreased by $10 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,354 per ton with an average of $1,324 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate

The SMU price range is $1,400–1,570 per net ton ($70.00–78.50 per cwt), with an average of $1,485 per ton ($74.25 per cwt) FOB mill. The lower end and the top end of our range were unchanged compared to the prior week. Our overall average was sideways vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert