CRU

July 21, 2023

CRU: Iron Ore Speculation Confidence Shows Weakness

Written by Aaron Kearney-Keaveny

Over the last month, the iron ore price has shown more weakness as fewer participants in the market maintain a positive outlook based on more stimulus measures in China.

Simultaneously, on the supply side, Australia followed seasonal trends with a marginal y/y increase. Recovered Brazilian volumes have also begun to weigh on the market.

Supply Strong Overall, Led by Australia and Brazil

Iron ore supply from Australia has seasonally slowed after the financial year end with some companies undertaking port maintenance, but overall exports have remained stronger y/y. Exports from northern Brazil rose again m/m after moisture levels returned to manageable levels after the end of the rainy season, though this very high export level will reverse as the large stockpiles at mines get drawn down.

We have heard confirmation that this material has reached Europe and resulted in rapidly increased availability in the region as well as more Carajás material being offered in the spot market.

Chinese Consumption Holds Up Despite Sintering Restrictions

Indian export volumes were steady m/m in June as the rise in steel output was offset by high iron ore stocks at mills. The worsening conditions of monsoon season is expected to reduce iron ore exports through the rest of Q3.

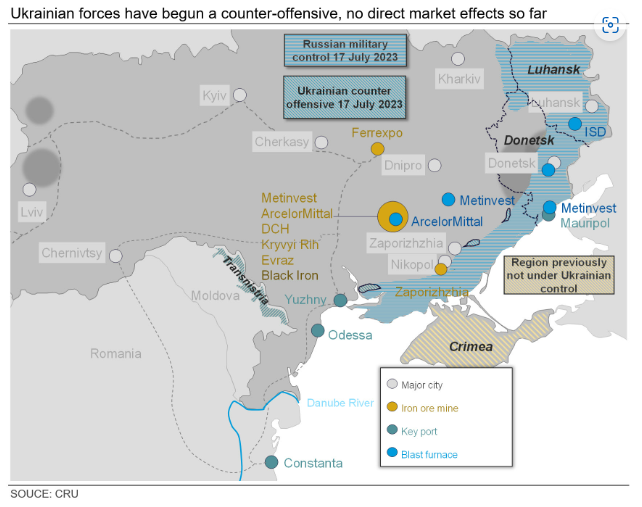

Ukrainian iron ore volumes have continued to fall, albeit very marginally by 3%, as a result of continued increases in domestic consumption as Ukrainian producers export higher levels of pig iron.

Chinese hot metal production is estimated to have increased by 1.4 Mt m/m. This was due not only to hopes that more stimulus measures would be brought in but also in preparation for government-imposed production controls following the sintering restrictions introduced in Tangshan in July.

Sites were given sintering constraints based on their emission levels, with the cuts ranging from 30–50%. This did result in higher demand for direct-charge materials, but only marginally so as affected mills were relatively well stocked on sinter.

Market contacts have expressed a high level of uncertainty about the direction of the market from here, with many waiting to hear announcements from politburo meetings at the end of July for indications. The sintering restrictions, weak end-use demand, and consequentially poor margins means that stimulus measure would have to be rather extreme for iron ore demand to stay as high as it has been so far this year.

Demand elsewhere remains slow to recover. We do expect European consumption to increase modestly, primarily led by the manufacturing sector, in Q3. However, there will be some cuts. Specifically, Voestalpine will reline a blast furnace in Austria in August-October, and a US Steel blast furnace in Kosice, Slovakia, will undergo maintenance in August 2023.

Learn more about CRU’s services at www.crugroup.com

By Aaron Kearney-Keaveny, aaron.kearney-keaveny@crugroup.com