Analysis

July 16, 2023

Final Thoughts

Written by Michael Cowden

I’ll get to the market in a minute. But first the big news, for us and we hope for you too. We crossed a big threshold this week with Steel Summit – more than 1,000 people are attending the conference on Aug. 21-23 at the Georgia International Convention Center (GICC) in Atlanta.

Join more than 1,000 of your closest friends in steel and register here! (You can find the agenda here.)

Steel Summit App and Hotels

![]() After you register, you’ll receive login information for the Steel Summit app, so you can start networking and scheduling meetings.

After you register, you’ll receive login information for the Steel Summit app, so you can start networking and scheduling meetings.

Our hotel blocks at the GICC are sold out. But don’t let that deter you from attending Steel Summit. There are still plenty of hotels available within about two miles of the event. Below are some of them.

Atlanta Airport Marriot – 1.1 miles away

The Westin Atlanta Airport – 1.1 miles away

Fairfield Inn & Suites Atlanta Airport South/Sullivan Road – 1.2 miles away

Courtyard Atlanta Airport South/Sullivan Road – 1.2 miles away

Renaissance Concourse Atlanta Airport Hotel – 2 miles away

TownePlace Suites Atlanta Airport North – 2.1 miles away

Fairfield Inn & Suites Atlanta Airport North – 2.2 miles away

Four Points by Sheraton Atlanta Airport West – 2.5 miles away

Courtyard Atlanta Airport West – 2.5 miles away

So, back to the sheet market. I’ll start with this question:

Did HRC Find a Floor?

I was a little surprised that prices were as firm as they were last week. Our average HRC price was just a little below $900 per ton ($45 per cwt). Could we meet or exceed that threshold this week? And what supports the recent stability in sheet prices after the declines we saw throughout most of Q2?

Some of you have cited companies coming back to the market after typical seasonal shutdowns around the Fourth of July, the unplanned outage at SDI Sinton, and resilient demand – despite continuing worries about the eventual impact of higher interest rates and tighter lending standards.

On a more basic level, some of you tell me that mills simply have not been willing to go below $900 per ton in recent offers. Again, that wasn’t the result that I was expecting, so I went back through some of SMU’s survey data to see what I might have missed.

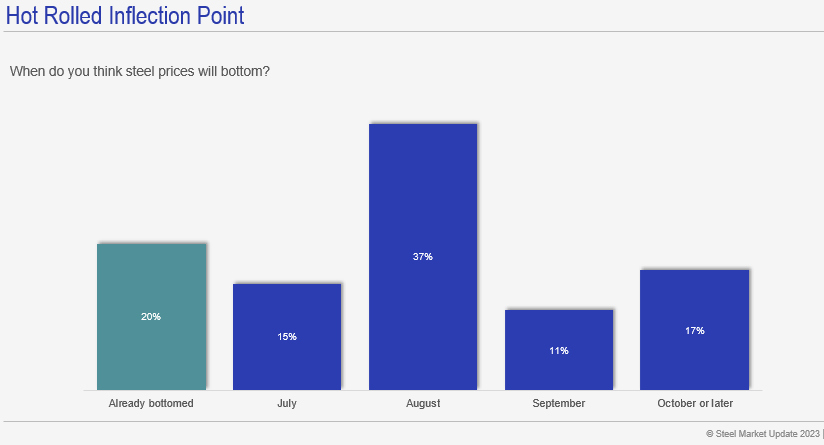

For starters, nearly 75% of respondents think that HRC prices have bottomed or will next month:

That’s a big change from prior surveys, when many people didn’t think prices would bottom until the fall. I’m not going say that perception is reality. But it can exert more influence than you might think.

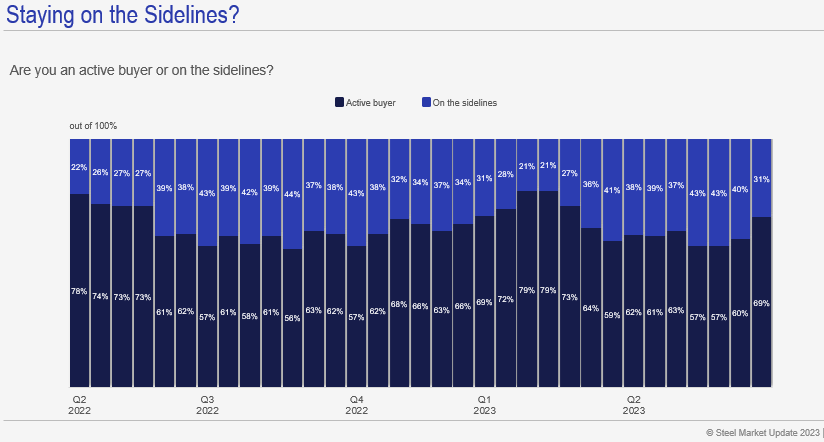

Also, nearly 70% said they were off the sidelines and active buyers, the highest reading we’ve seen since Q1, a period or rising prices:

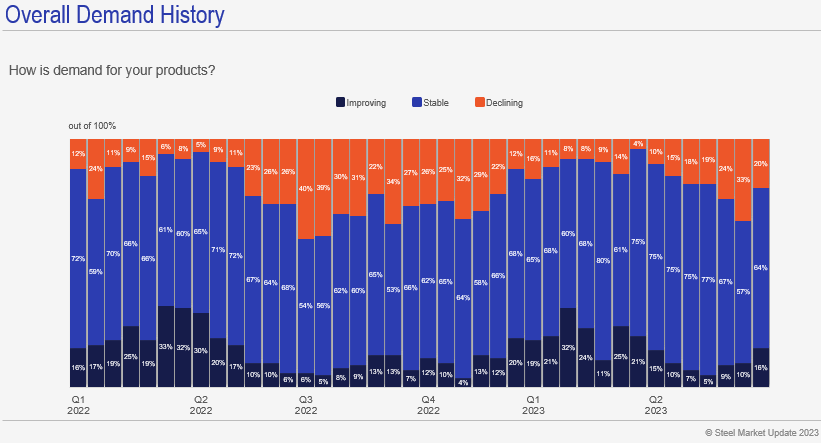

We’ve in addition seen an increase in the number of people reporting stable (light-blue bars) or increasing demand (dark-blue bars):

There, too, it’s the best reading we’ve seen since Q1. I don’t want to read too much into one survey result. But it’s worth watching to see whether these trends continue.

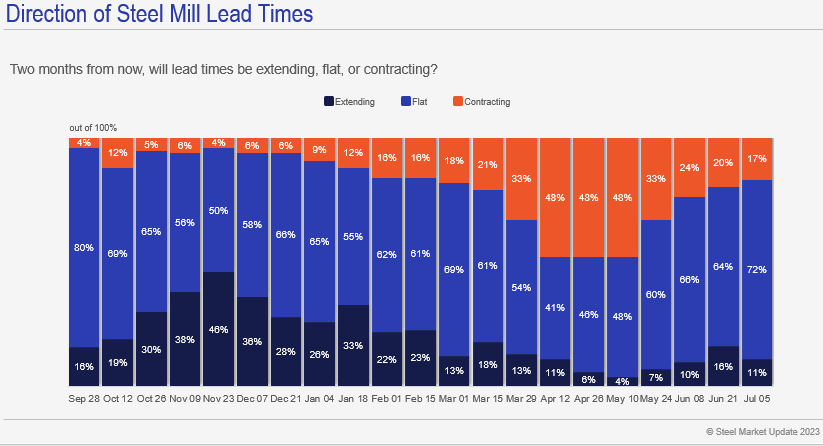

Finally, I know lead times are widely seen as a leading indicator of price moves. (I know not all of you agree with that, but I digress.)

We haven’t seen lead times improve yet. We’re still roughly 4-5 weeks on average for HRC. However, expectations around lead times have improved.

More people expected lead times to be falling in early/mid-March than they do now. That’s notable because HRC prices were still rising in March. Are expectations of stable lead times now a potential precursor to stable prices just as expectations of lower lead times in March/April preceded falling prices?

Fun aside: ChatGPT, which I tinkered around with in early June, predicted sideways prices when that was hardly the consensus view. Was that a surprisingly accurate forecast, or just an AI hallucination that got lucky?

Or Do Prices Take Another Leg Down?

BUT I know some of you don’t buy into any notion of stable or rising prices. You might make the logical case that prices should decline on increased domestic capacity, higher import volumes, and stable/weaker demand.

Here’s one potential red flag: Some of you have told me that your mill reps, after initially offering HRC at $900 per ton, have come back and asked if another look might be needed to get your order. That’s not something mills typically do if business is strong. (Also of note, we’re not talking huge tons here.)

Why might some mills be holding the line on $900 per ton and trying to get $950 per ton even as others seem willing to cut deals?

Among the potential reasons are wide variations in lead times. I know that certain mills are in mid/late August for HR lead times and getting close to closing out September on coated products. I also know that other mills have HRC lead times in late July/early August – so approximately three weeks in some instances.

That is not anything on its own to write home about. EAFs and slab re-rollers often have shorter lead times than integrated mills. That said, it’s hard to enforce target prices of $900-950/ton for HRC if you’re still trying to close out July or are only in early August.

Again, many of our readers expect lead times to improve, or at least stabilize, over the next two months. I’ll be curious to see where not only where prices land on Tuesday but also where lead times land when we update them on Thursday.

PS – Don’t just read the data, see your company’s experience reflected in it. Contact us at info@steelmarektupdate.com if you’d like to participate in our surveys.

By Michael Cowden, michael@steelmarketupdate.com