Government/Policy

June 25, 2023

Final Thoughts

Written by Michael Cowden

Our latest survey results indicate that the round of $50/ton ($2.50/cwt) sheet price hikes have a good chance of at least stabilizing prices or increasing them modestly.

To be clear, SMU does not make formal forecasts. I’m basing this on what we’re seeing in past survey results following price hikes compared to what we’re seeing now.

SMU Survey Highlights

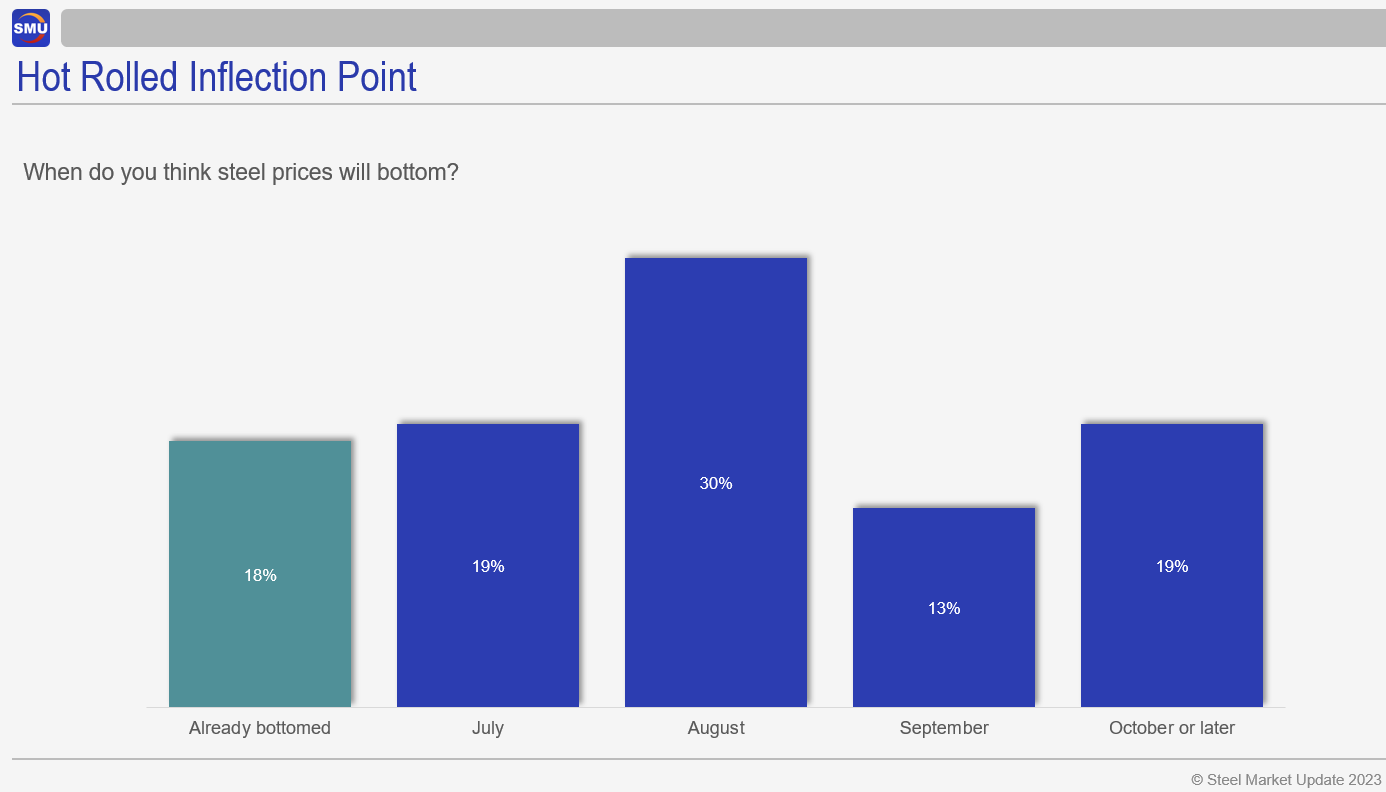

For starters, as I noted when I was going through preliminary data last week, more people now think that prices have bottomed.

True, it’s only a minority. But it’s a bigger minority: 18% now compared to only 4% of respondents from our prior survey, which was conducted in early June before the sheet price hikes.

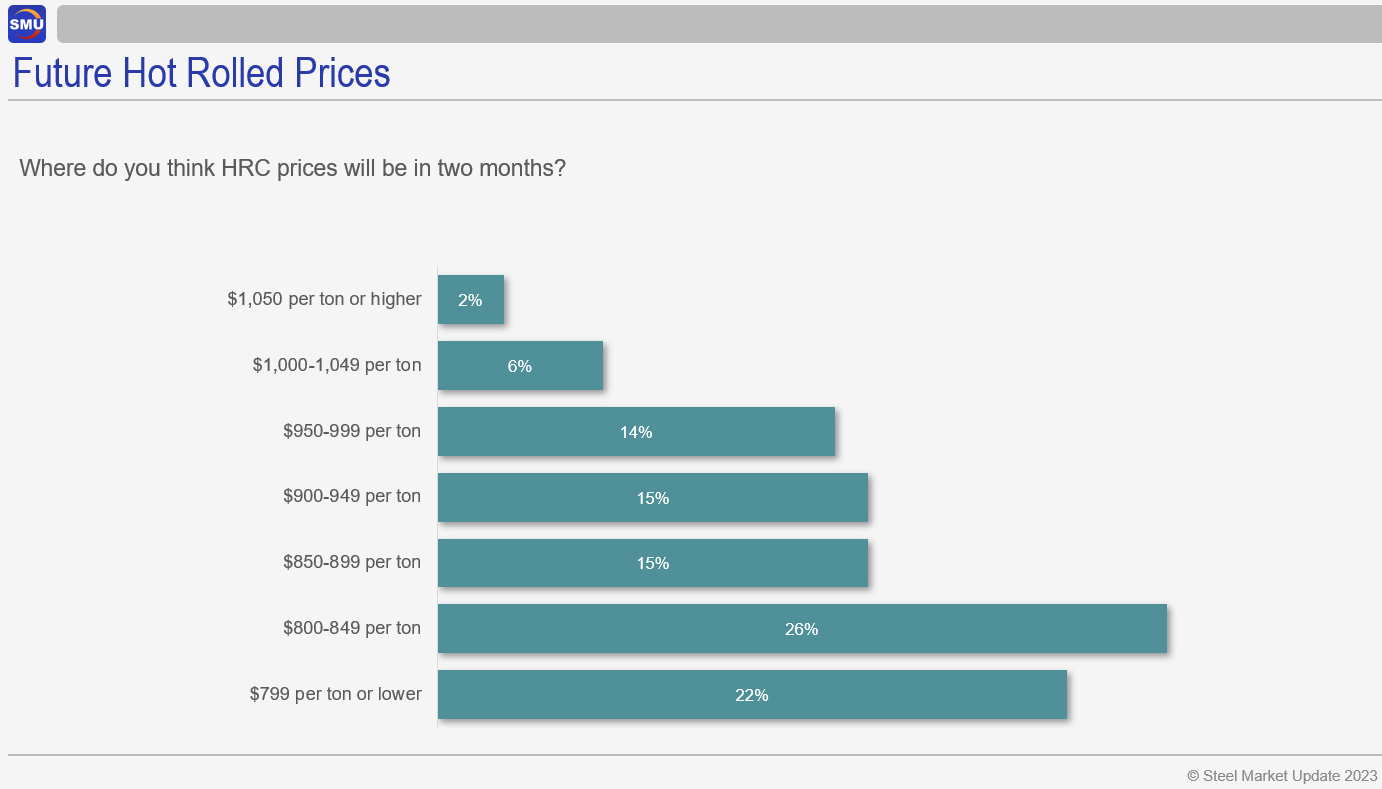

We’ve also seen a shift upward in where people think HRC prices will be two months from now:

In early June, before the increase, only 10% of survey respondents thought price would be $950 per ton (the target price now for several mills) or higher. Now that figure is 22%. That’s hardly a majority. But, again, it’s a shift away from the almost universal opinion that prices had nowhere to go but down.

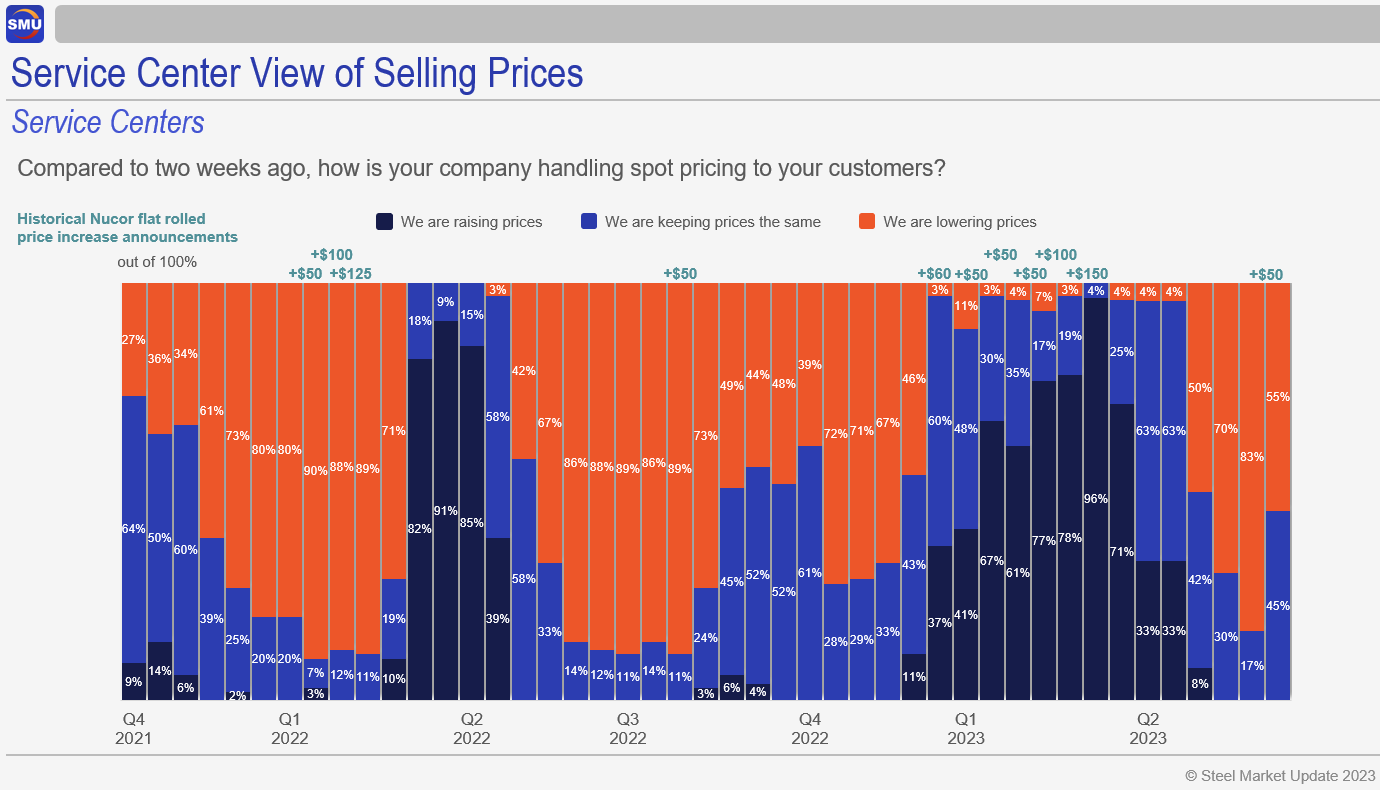

Perhaps most importantly, we’ve seen a big shift in how service centers are handling prices to their customers: 55% say they are continuing to lower prices, and 45% say they are keeping prices steady.

That’s a big change from two weeks ago, prior to the hike, when 83% said they were slashing prices and only 17% were trying to hold the line.

We saw a similar in result in reaction to initial price hikes in 2022 following the war in Ukraine, last August/September, and again in late November.

The question now: Will the June increases prove to be more like those announced last August/September? Those resulted in fewer service centers cutting prices and helped stabilize pricing at the mill level for a month or so. But few service centers in August/September tried to raise prices in tandem with mills. The result: There were no additional mill price hikes to try to shore up the initial ones or to keep the upward momentum going, and so prices at the mill level resumed their downward trend in October-November.

In other words, the lack of dark blue bars – of service centers increasing prices in tandem with mills – in the chart above during that August/September period is what you see if an increase succeeds only in ”slowing the bleeding.”

When an increase succeeds, as we saw after the outbreak of war in Ukraine in early 2022 and, more recently, in late Q4/Q1, you’ll see fewer service centers lowering prices. And then you’ll see a big increase in the dark blue bars, the number of respondents reporting that service centers are raising prices. That’s what to look for in our next survey.

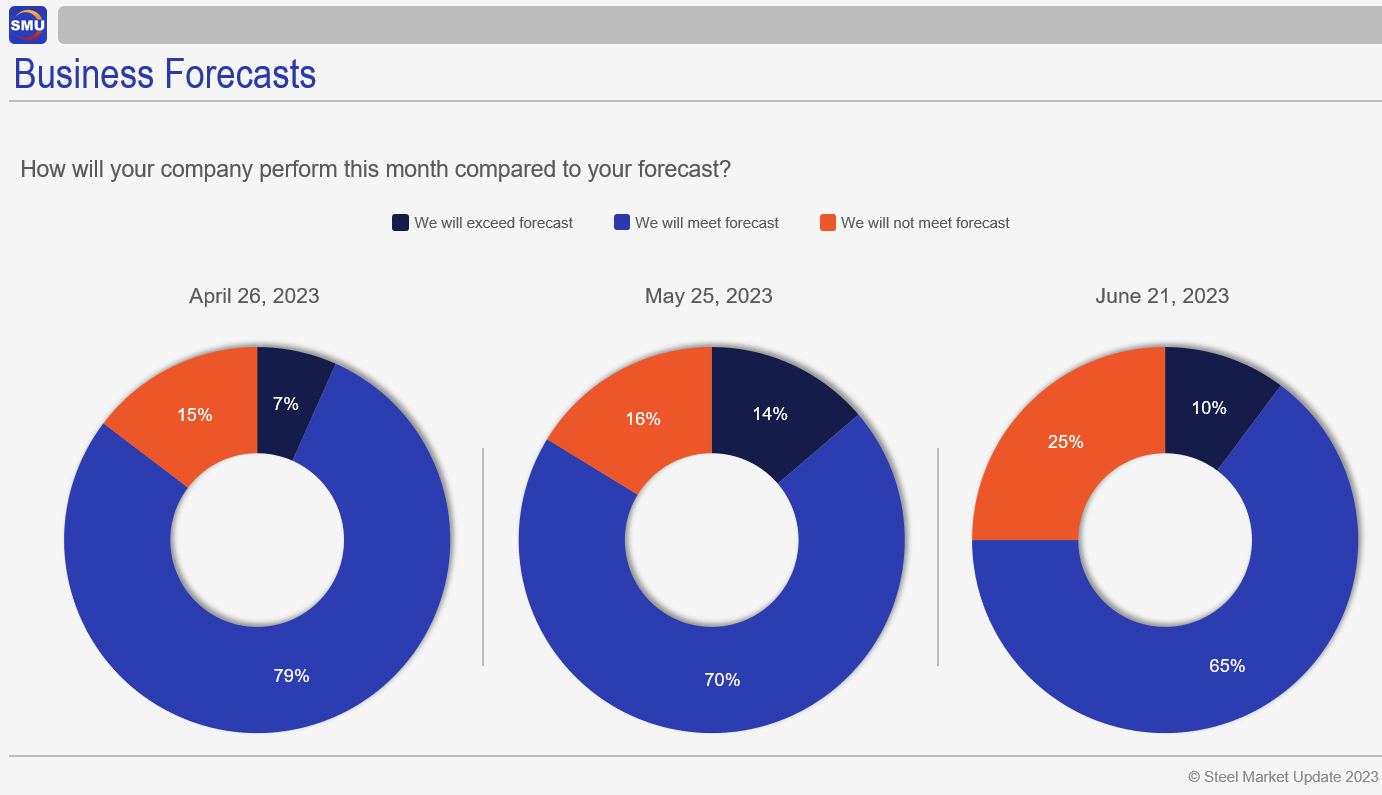

There are some clouds on the horizon that we didn’t see in Q1, when price increases were largely successful. For most of this year people have been telling us that they expected to meet or exceed forecast.

That’s not so much the case now:

Approximately 75% of respondents said they expect to meet or exceed forecast this month, which is hardly a bad result. That said, we have seen an increase in the number of people who don’t think they’ll meet forecast – up to 25% from ~15% in prior months. (Also, some of you have told us that your forecasts are lower now than they were a year ago.)

Does this mean the increase will fail? Of course not. For that to happen, it would have to be hated. And that’s not what we’re seeing. It has some early support.

Also, as I’ve noted in prior Final Thoughts, service center sheet inventories in May weren’t high. Could we see a restock catalyzed by the price hikes?

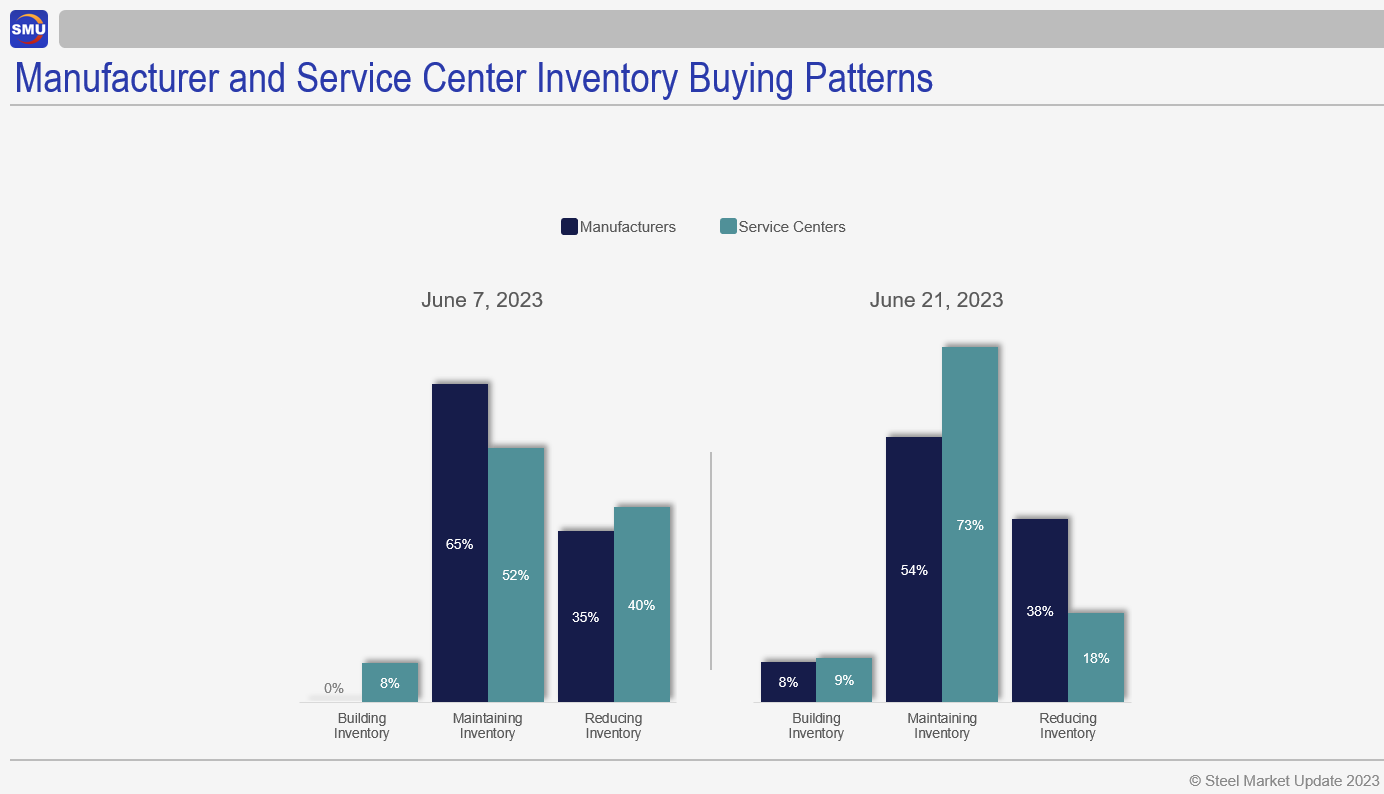

We won’t have June inventory data available until mid-July. But a preliminary check of consumer buying patterns shows that there are fewer service centers destocking (18% now compared to 40% in early June).

What Comes Next?

As I said above, SMU doesn’t do forecasts. What I can offer is my opinion based on what I know now.

Could this price increase stop the bleeding and perhaps even raise prices modestly over the next month or so – analogous to what we saw in August/September of last year? Yes, I think that’s a reasonable conclusion.

Could we see a big spike in prices analogous to what we saw in Q1? True, AHMSA doesn’t look like it will be coming back online as soon as some had expected. The increase has some early support. And mills are more consolidated and, at times, more “disciplined” than they’ve been in the past.

But new capacity or expanded capacity – think SDI Sinton, Nucor Gallatin, and North Star BlueScope – continues to ramp up. There could be more import competition over the next couple of months given how high US prices have been compared to those in the rest of the world. And – perhaps most obviously – we’re going into July, which is typically among the slowest times of the year because of typical seasonal events like automakers shutting down for model year changeovers.

In short, I don’t see a big July/August price spike in the cards. But I’m probably not seeing all the cards. If you think prices will go significantly higher, drop me a line and let me know what I’m missing!

SMU Steel Summit Hotels

Registrations for Steel Summit are going up sharply week over week. It’s what we often see when we’re less than two months from the conference, which runs from Aug. 21-23 at the Georgia International Convention Center (GICC) in Atlanta. (You can learn more and register here.)

Most of the hotels at the GICC – the ones within walking distance of the event – are sold out. But there are still plenty of hotels available near Atlanta Hartsfield-Jackson airport at affordable prices and within about a mile of the GICC. Just a few examples: the Atlanta Airport Marriot, the Westin Atlanta Airport, and the Courtyard Atlanta South/Sullivan Road.

Also, there are plenty of options if you’d rather stay downtown. Among them are the Glenn Hotel (Autograph Collection), the AC Hotel Atlanta Downtown, and Residence Inn Atlanta Downtown.

I hope that helps. And thanks to all of you from all of us at SMU for your business!

By Michael Cowden, michael@steelmarketupdate.com