Overseas

June 23, 2023

HRC vs. Plate Price Spread Rises to Four-Month High

Written by Laura Miller

With hot-rolled coil (HRC) prices falling faster than plate pricing, the price spread between the two flat-rolled products moved this week to its highest level since February.

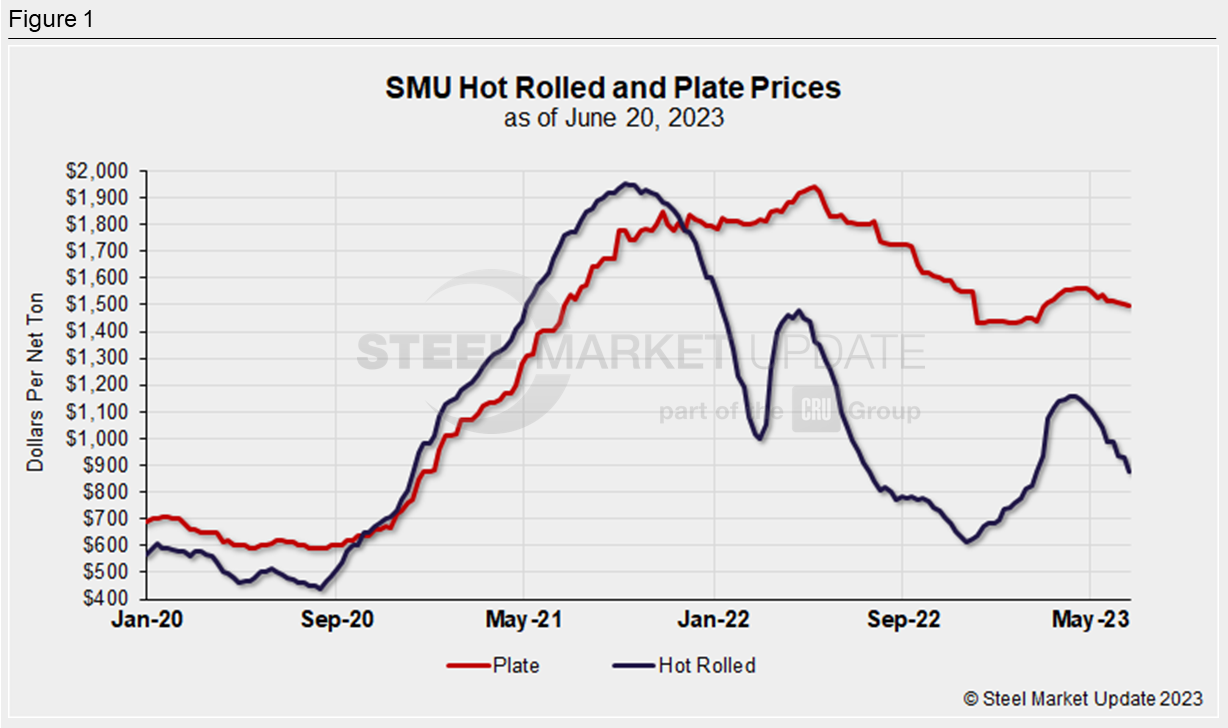

The $1,955-per-net-ton all-time high of average HRC prices was reached in September 2021. Prices then turned downward before jumping up again in March and April 2022, affected by the uncertainty surrounding Russia’s war in Ukraine. Prices then began to decline, falling to a recent low of $615 per ton during the week of Thanksgiving 2022. Pricing moved upward from there, hitting a recent peak of $1,160 per ton during the week of April 11. Since then, HRC prices have been rapidly declining, with SMU’s most recent market check putting the average price at $875 per ton as of June 20.

Average plate prices hit their all-time high of $1,940 per ton during the week of May 10, 2022. Pricing has been trending downward since then, registering a recent low of $1,430 per ton in both December and January, before bumping back up to this year’s high of $1,560 per ton in April. Prices have since been on the decline, this week slipping to $1,495 per ton.

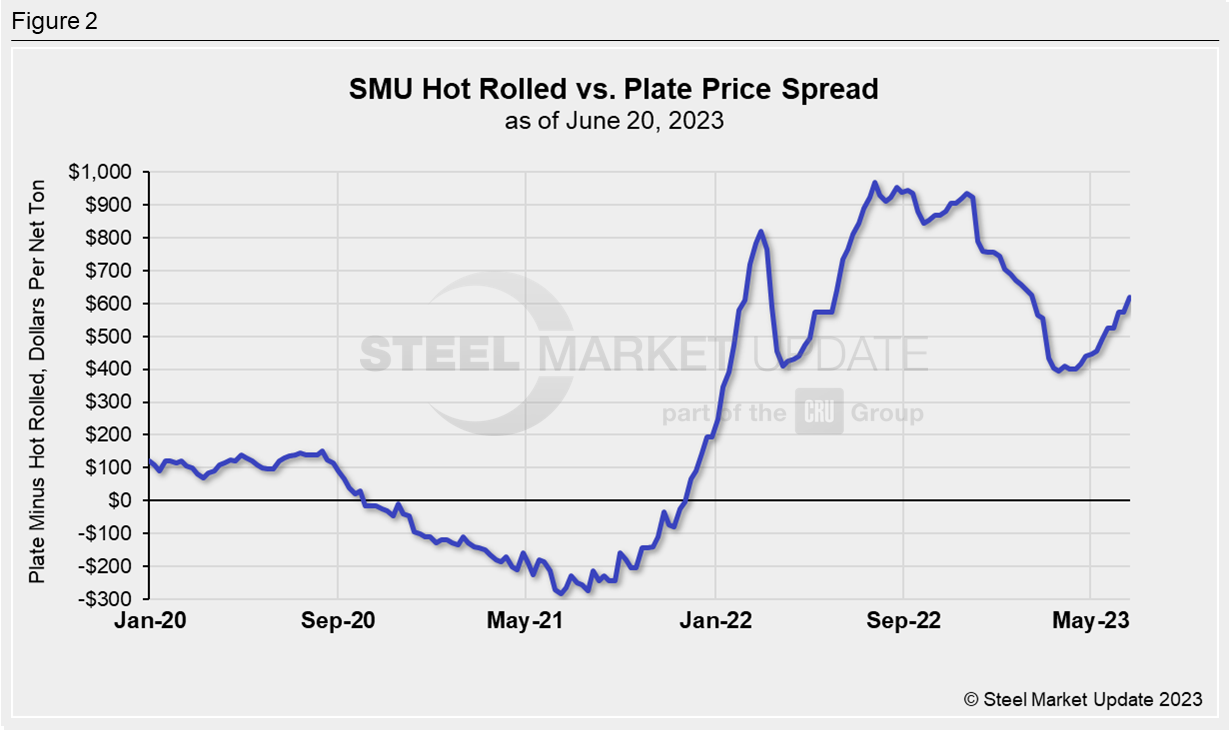

HRC prices rose above plate prices in October 2020, pushing the spread between HRC and plate negative, where it remained through the middle of November 2021. The spread then spiked, with plate holding a significant premium over HRC for all of 2022. A high of $935 per ton was reached during the week of November 22, 2022, before the spread plummeted to $395 per ton during the week of March 21. Since then, the differential has been climbing, rising from $525 per ton a month ago to $620 per ton in the latest check of the market.

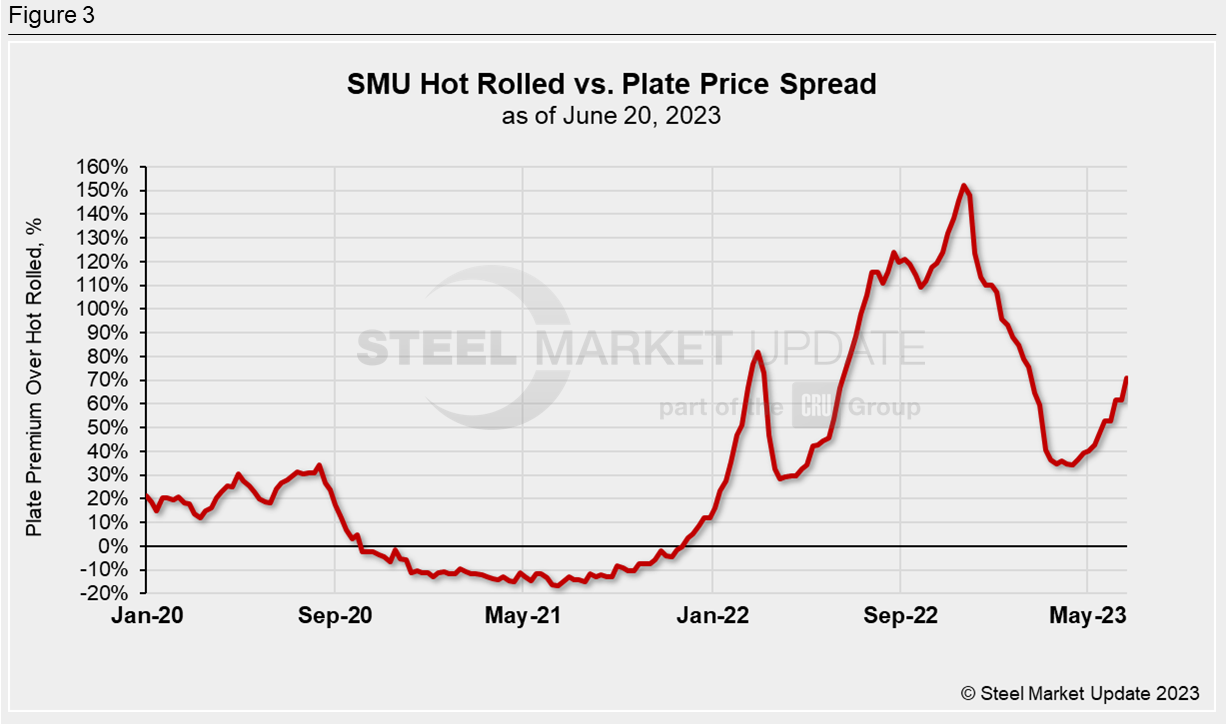

Looking at the spread as plate’s premium over HRC as a percentage of the HR price, we can see the spread shrinking from 107% at the start of this year to 34% as of April 11. However, the spread has since been increasing. A month ago, it stood at 53% but moved up to 71% in the most recent market check.

You can graph the relationship between HRC and plate prices, as well as the other steel prices SMU tracks, using the interactive pricing tool on our website.

By Laura Miller, laura@steelmarketupdate.com