Market Segment

June 22, 2023

Lead Times Contract to Shortest Levels Seen in Months

Written by Laura Miller

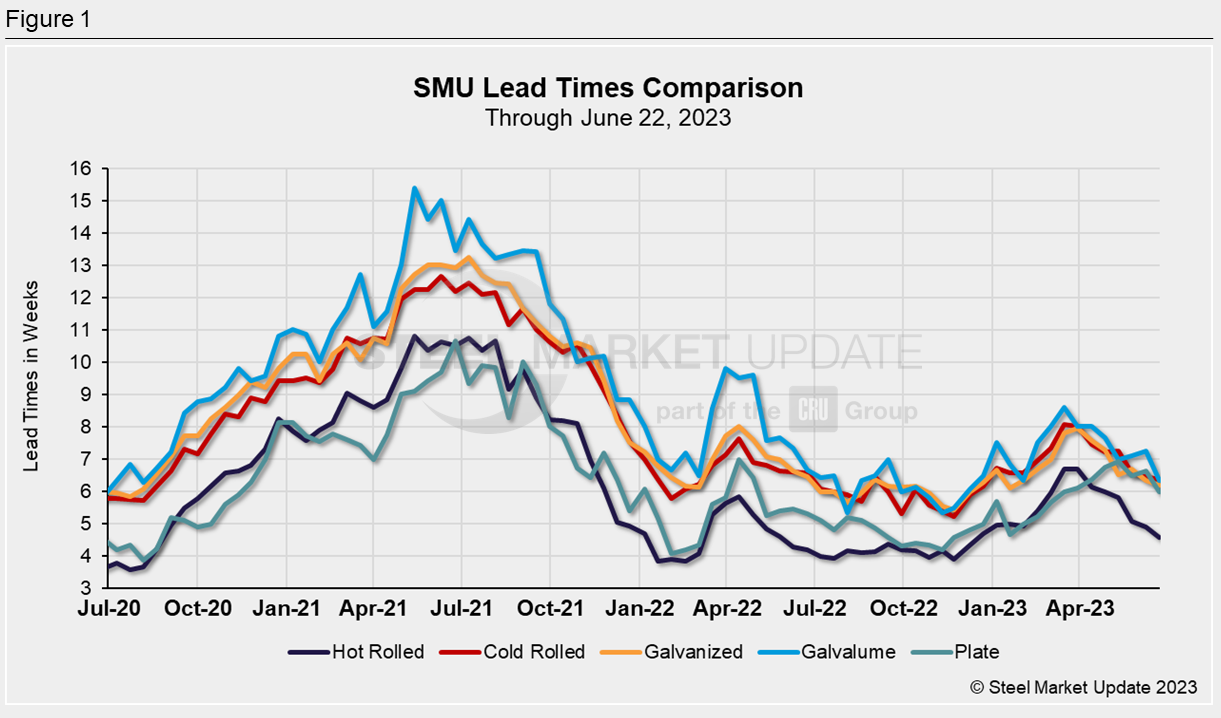

In SMU’s market check this week, lead times for sheet and plate pulled back to some of the shortest times seen in several months. To see lead times this short, we have to go back to March for plate, January for galvanized sheet, and December for hot-rolled, cold-rolled, and Galvalume sheet.

With mills pushing for a price increase on the sheet side, it remains to be seen whether the contraction in lead times will continue. If buyers come off the sidelines and the increases stick, SMU expects lead times to move out. If buyers remain on the sidelines, however, lead times should remain flat or shrink even further. Stay tuned to SMU for our next market check two weeks from now.

In the meantime, we’d love to hear what you’re seeing in the marketplace. Contact david@steelmarketupdate.com to share your thoughts and/or to take part in our weekly steel buyers survey.

Steel buyers this week reported lead times ranging from 3 to 6 weeks for hot rolled, 5 to 8 for cold rolled and galvanized, 5 to 7 for Galvalume, and 4 to 8 weeks for plate.

SMU’s average lead time for hot-rolled sheet contracted by 0.34 weeks from the market check two weeks ago to 4.56 weeks this week. This is the shortest HR lead time seen since the week of Dec. 8 and down from 5.06 weeks just a month ago. Recall that the longest lead time for HR sheet so far this year was 6.69 weeks during the week of March 16.

Lead times for cold-rolled sheet fell back by 0.10 weeks to sit at an average of 6.36 weeks. We have to go back to the week of Christmas to see a shorter CR lead time. A month ago average CR lead times were 6.57 weeks.

The average galvanized lead time came in at 6.19 weeks this week, down by 0.15 weeks from the check two weeks ago and down by 0.5 weeks from a month ago. January was the last time galvanized lead times were this short.

Lead times for Galvalume sheet averaged 6.33 weeks this week, a drop of 0.92 weeks from two weeks ago, and the shortest lead time since December. A month earlier Galvalume lead times were averaging 7.25 weeks.

On the plate side, after extending slightly in our last market check, lead times fell back again, declining by 0.64 weeks to sit at 6.0 weeks this week. That’s down from 6.5 weeks one month ago. The last time plate lead times hit 6.0 weeks was during the week of March 16.

A majority of steel buyers still think lead times will be flat two months from now (64% this week vs. 66% two weeks ago), according to SMU’s survey this week. Only 16% think lead times will be extended, while 20% believe they will be shorter.

Here are comments from a few of this week’s survey respondents when asked, “Two months from now, will lead times be extending, flat, or contracting?”

“The initial [price] increase will extend lead times, so higher than we sit right now.” – Buyer predicting flat lead times

“Good responsibility in the market by the producers.” – Buyer predicting flat lead times

“We believe imports will continue to be a factor and that more domestic supply will be back online.” – Buyer predicting flat lead times

“Lead times will start to extend in the coming weeks and remain extended.” – Buyer predicting extended lead times

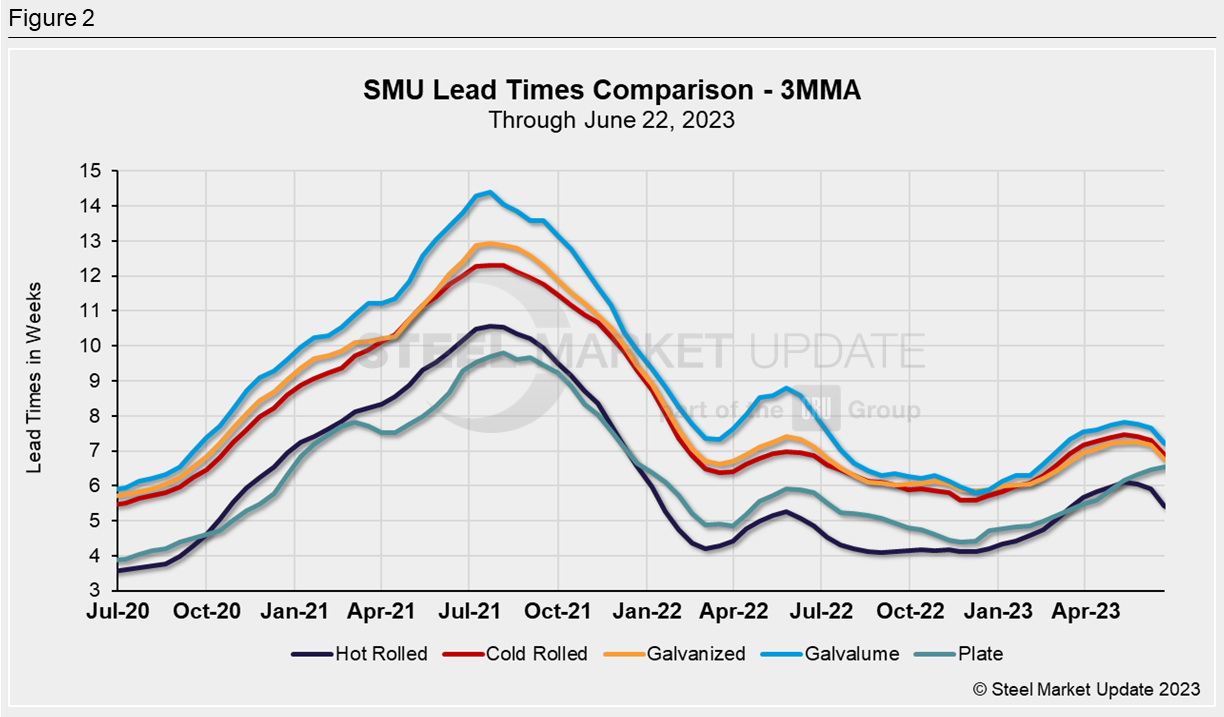

To smooth out the variability in the biweekly readings, let’s chart lead times on a three-month moving average (3MMA) basis. As a 3MMA, sheet lead times have shrunk from those a month ago to levels comparable to those seen in March. The 3MMA lead time for plate, after rising in nine consecutive market checks, remained flat this week at 6.5 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website.

By Laura Miller, laura@steelmarketupdate.com