Prices

May 5, 2023

US Steel Import Licenses Decline in April

Written by Laura Miller

Licenses to import steel into the US declined from March to April, with all major flat-rolled product categories showing month-on-month (MoM) declines, according to the latest figures from the Department of Commerce’s US Steel Import Monitor.

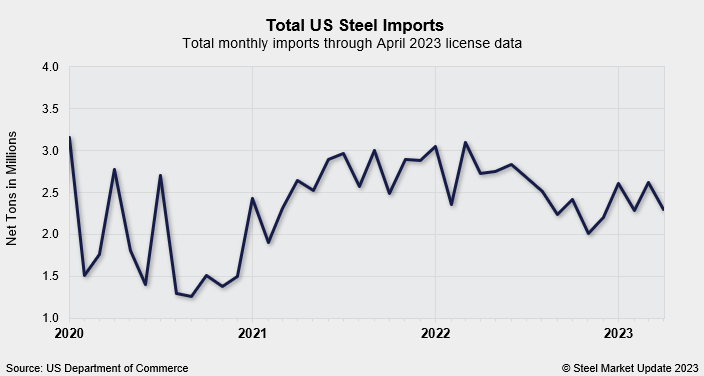

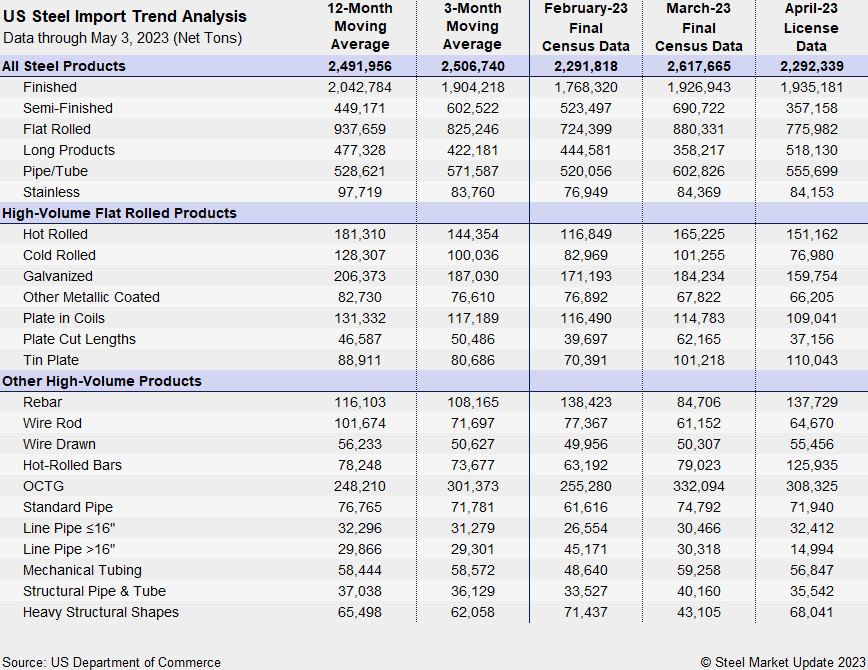

Import licenses totaled more than 2.292 million net tons in April. This was a 12% drop from March’s final import figure of almost 2.617 million tons and similar to February’s import level. April’s licenses were 16% lower than the 2.733 million tons imported in the same month of 2022.

Note that licenses provide a first look into import levels during a given month, but may differ from final figures.

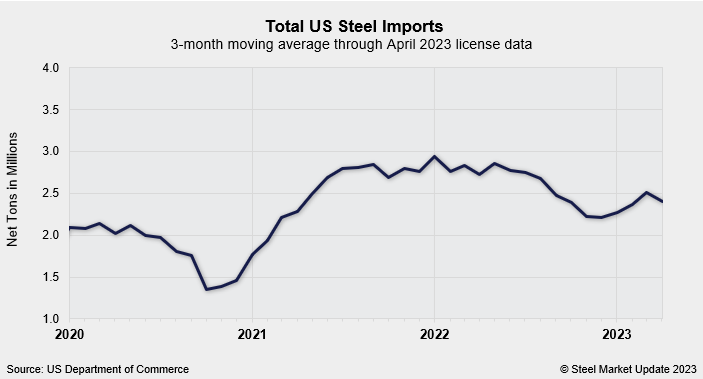

The chart below highlights total imports on a three-month moving average (3MMA) basis to more accurate display trends, as imports of semifinished steel can see large swings from month to month. The 3MMA was nearly 2.507 million tons through April license figures.

The 3MMA reached a 42-month high of 2.94 million tons in January 2022. November 2020 was the lowest 3MMA in SMU’s recent history at 1.36 million tons.

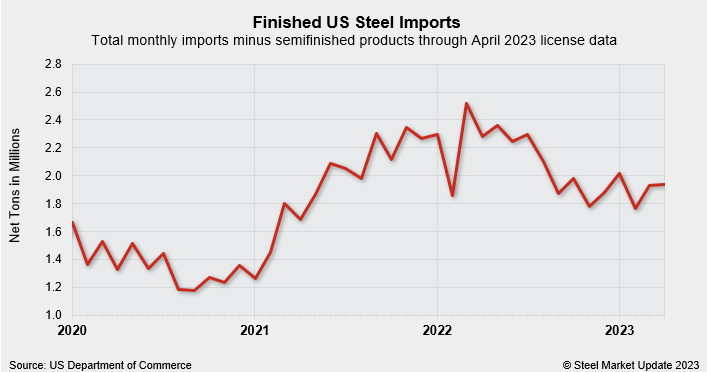

Licenses for finished steel imports, at 1.935 million tons, were flat from March and down 9% from the 2022 monthly average of 2.123 million tons.

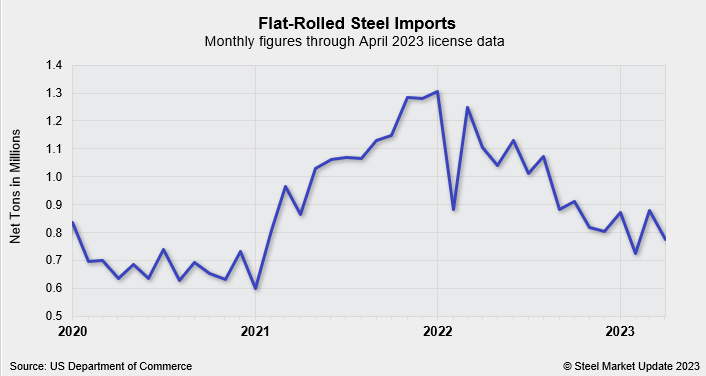

Flat-rolled steel imports hit a two-year low in February at 724,399 tons, and then rose to a five-month high of 880,331 tons in March. April import licenses were 775,982 tons – just 7% above February’s low.

While all major flat-rolled categories saw import declines from March to April, cold rolled, galvanized and cut-to-length plate all saw double-digit MoM declines.

The chart below provides further detail into imports by product and highlights high-volume steel products.

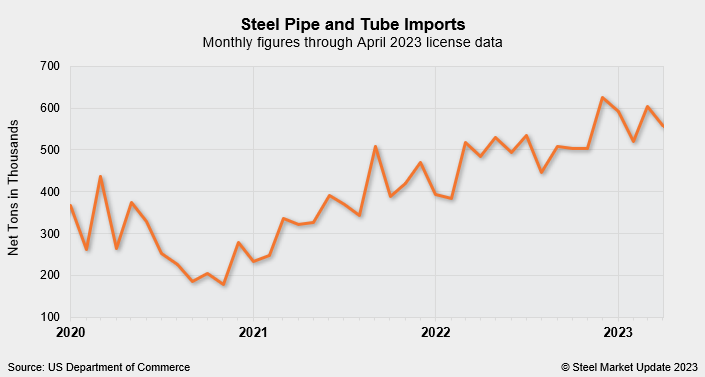

Pipe and tube import licenses, at 555,699 tons in April, were down 8% MoM but were still higher than 2022’s monthly average of 493,538 tons.

April OCTG import licenses of 308,325 tons were comparable to the monthly average of 303,111 tons so far this year and are trending significantly above 2022’s monthly average of 219,742 tons.

You can use our interactive graphing tool, available here, to explore historical import data.

By Laura Miller, laura@steelmarketupdate.com