Analysis

May 30, 2023

Final Thoughts

Written by Michael Cowden

Sheet prices were broadly flat this week mostly because of a dearth of activity around Memorial Day.

The consensus is prices will resume their downward trajectory, especially with nearly everyone we surveyed reporting that mills remain willing to negotiate lower spot prices.

So where and when might prices bottom?

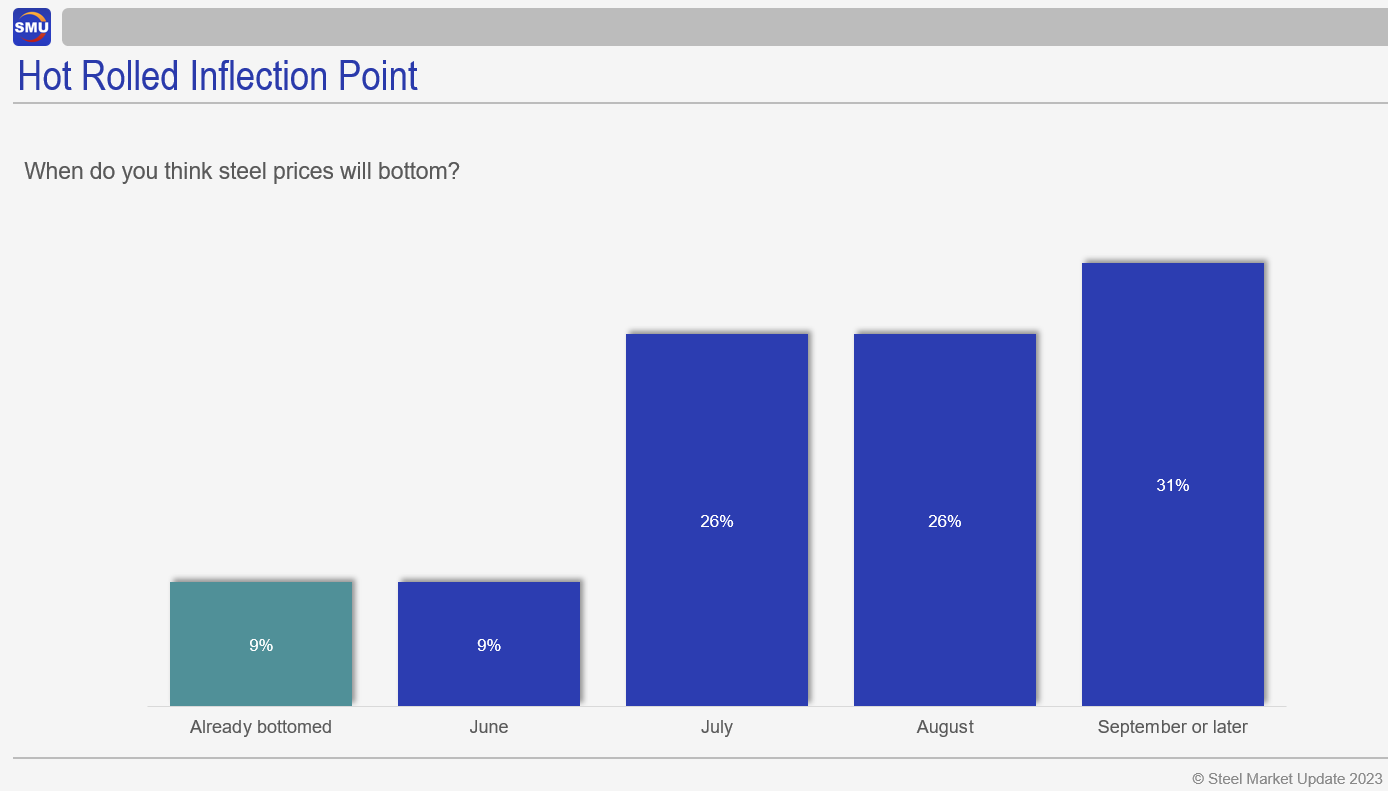

For starters, very few people think HRC prices will bottom anytime soon:

It’s a roughly even split between July, August, and September or later. Survey respondents who predicted a July or August bottom cited factors you’d expect. Namely, that mid-summer is often slow because of seasonal factors like automotive shutdowns. And that those seasonal factors have been amplified by high interest rates and tighter lending standards.

Here is what some of you had to say about when prices would bottom:

“Either June or July lead time. Buyers are waiting for the deals. Once those get done, the market will find a bottom.”

“Hard drop between now and the end of June, then prices bounce slightly higher as demand remains good.”

“No doubt a slide has started. I expect mills to go down as slowly as they can. If fundamentals dictate a quicker pace, then maybe August as a bottom. If not, I anticipate after September.”

“We will hit the bottom mid-year in 2024. I think the prices will continue to decline until then.”

“Inventories are low. Customers cannot hold off buying much longer. Maybe another month, then they will re-engage.”

“Inventories appear to be running tight, while everyone continues to expect collapse. Underlying demand has been resilient and should lead to a brief period of restocking.”

It surprised me to see more than 30% predicting that prices might not bottom until September or later. I write that because I’d been thinking we might see something roughly similar to what we saw last year. Namely, declines through the summer – barring no big, unplanned outages – and then mills announcing price hikes as lead time get closer to Labor Day.

Would that raise prices? Not necessarily. But it might at least put a floor under them. Those of you saying prices might not bottom until September or later are taking a decidedly darker view of 2H than I am. And I’m usually a little dark!

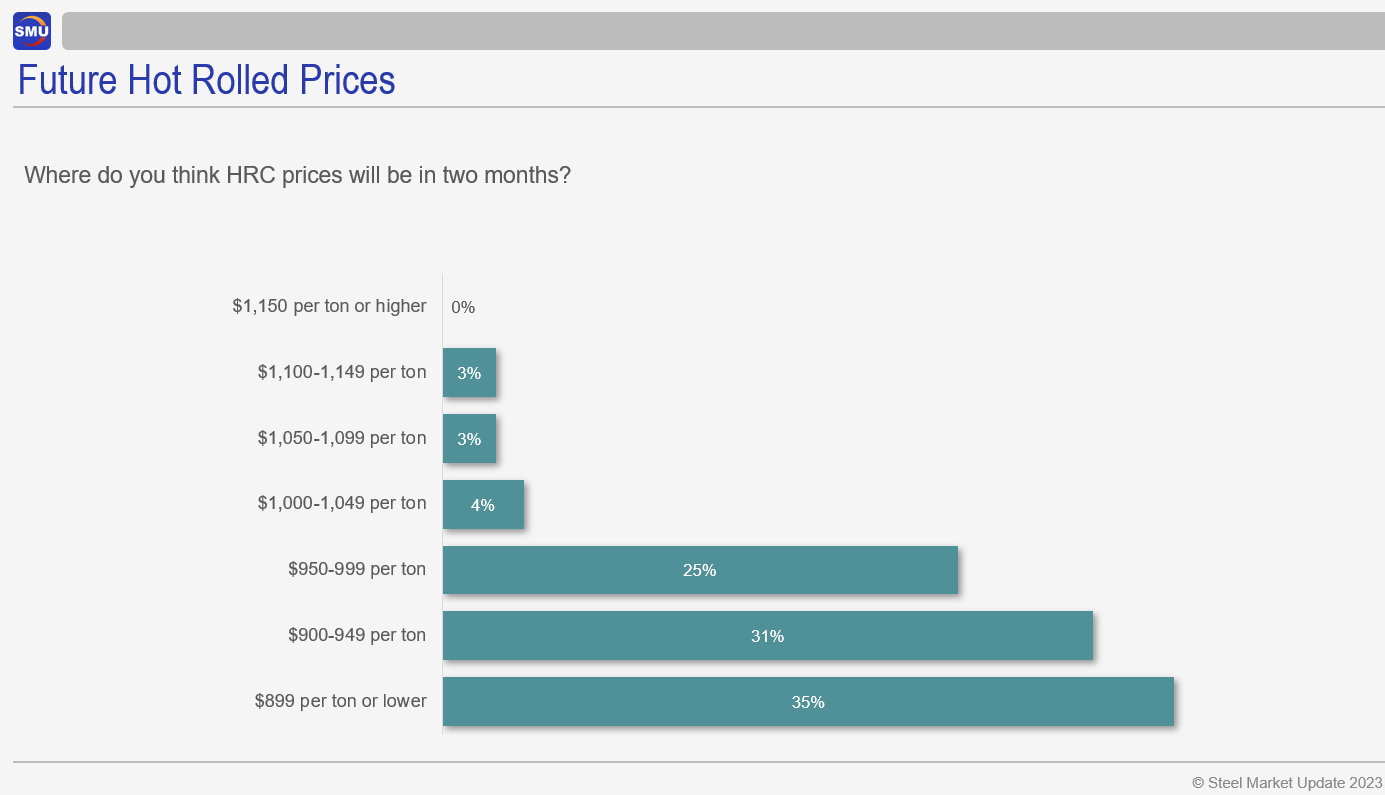

Another area of near consensus is that prices will bottom well below where they are now:

We’re clearly going to have to lower our range in our next survey given how many of you predicted a bottom below $900 per ton.

Here is what some of you had to say about where prices would bottom:

“Mills are very profitable at this point and should not start to feel any type of squeeze until prices are sub-$900.”

“Demand is low, offshore volume is arriving, and supply levels are increasing.”

“Looking at where international will be, the US guys have to drop levels.”

“A few months ago, I thought we’d see sub-$1,000/ton in June and sub-$900/ton in July. I’m sticking with that.”

“Lower demand and added supply are leading to lack of pricing discipline among mills and service centers.”

“Buyers will drive inventory down more than they should. That will lower prices as mills fight for orders.”

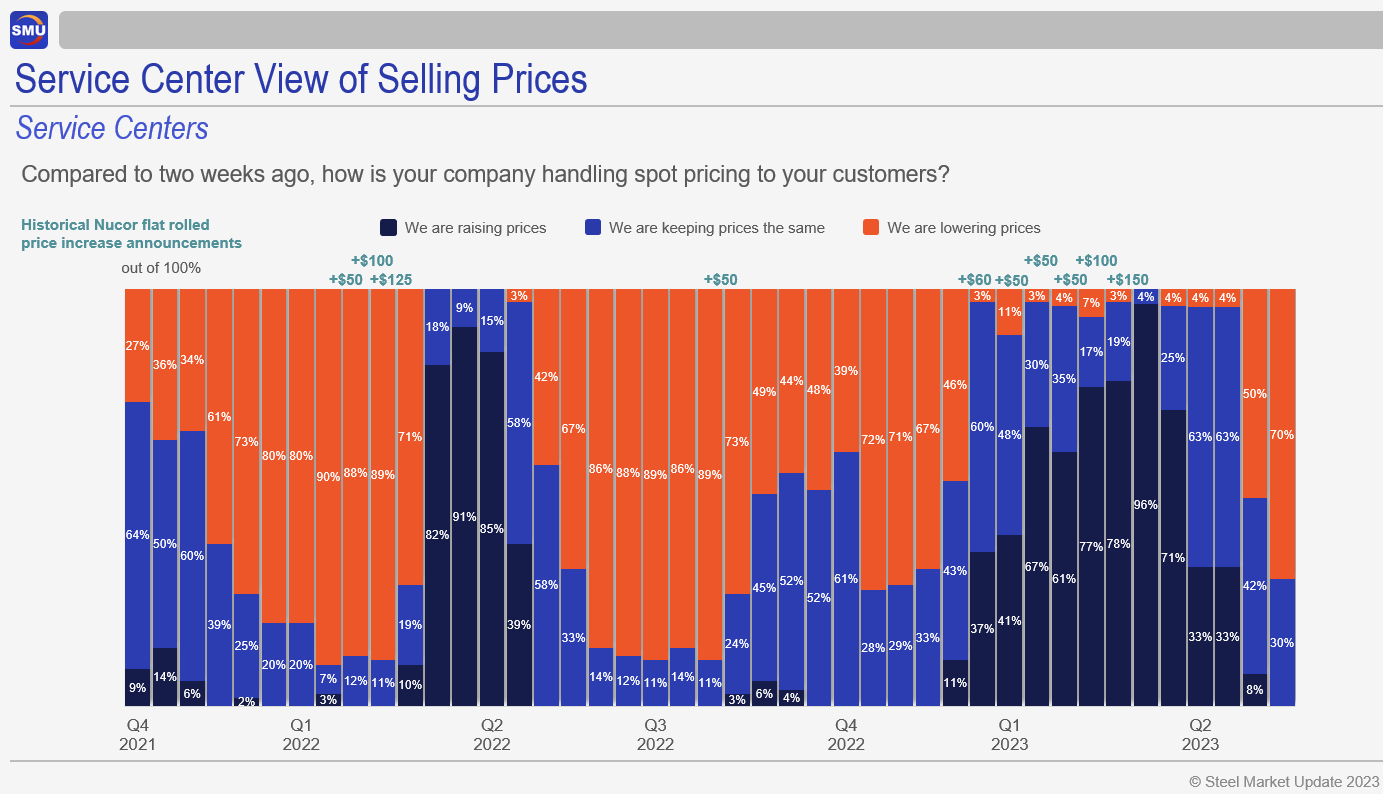

Looking downstream, a trend that continues to stand out is the sharp reversal in how service centers are handling prices:

Nearly 70% tell us they are lowering prices, up from 50% in mid-May, and up from a mere 4% as recently as late April.

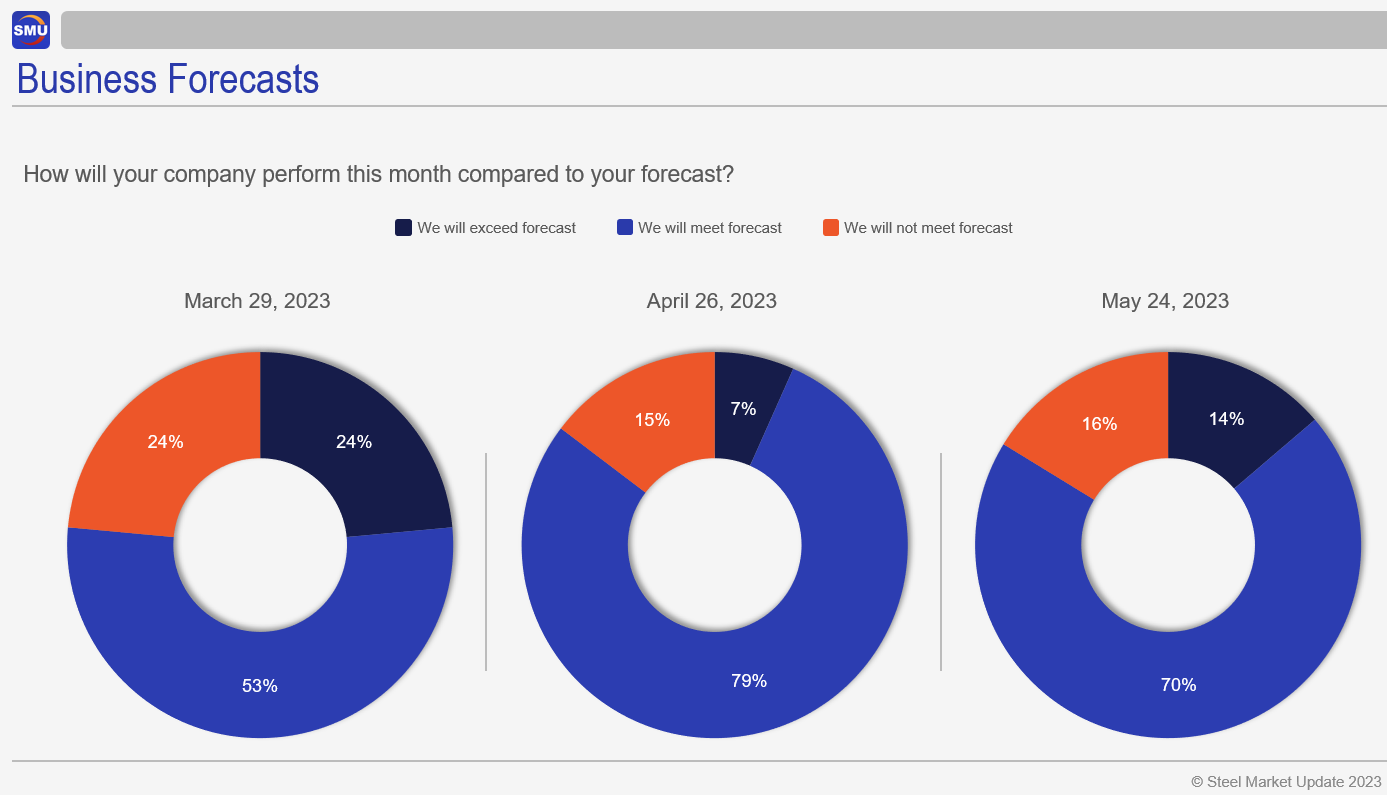

While it’s clear that prices are falling, one thing that remains surprisingly robust is demand, according to our survey results.

Most of you continue to meet or exceed forecast, which is great. Let’s hope that trend is durable.

SMU Steel Market Survey

Don’t just read our data, see your company’s experience reflected in it.

Many thanks to those of you who participate in our steel market surveys. Please contact us at info@steelmarketupdate.com if you’d like to participate or learning more about participating.

By Michael Cowden, michael@steelmarketupdate.com